IBM 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 Management Discussion

International Business Machines Corporation and Subsidiary Companies

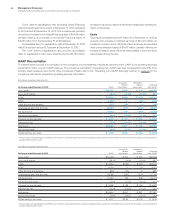

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent

Change

Earnings per share of common stock

Assuming dilution $14.94 $14.37 4.0%

Basic $15.06 $14.53 3.6%

Diluted operating (non-GAAP) $16.28 $15.25 6.8%

Weighted-average shares

outstanding (in millions)

Assuming dilution 1,103.0 1,155.4 (4.5)%

Basic 1,094.5 1,142.5 (4.2)%

Actual shares outstanding at December 31, 2013 and 2012 were

1,054.4 million and 1,117.4 million, respectively. The average number

of common shares outstanding assuming dilution was 52.4 million

shares lower in 2013 versus 2012. The decrease was primarily the

result of the common stock repurchase program. See note L,

“Equity Activity,” on page 116 for additional information regarding

common stock activities. Also see note P, “Earnings Per Share of

Common Stock,” on pages 124 and 125.

Financial Position

Dynamics

At December 31, 2013, the company continues to have a high degree

of financial flexibility with a strong balance sheet to support the busi-

ness over the long term. Cash and marketable securities at year end

were $11,066 million, consistent with the prior year-end balance.

During the year, the company continued to manage the investment

portfolio to meet its capital preservation and liquidity objectives.

Total debt of $39,718 million increased $6,449 million from prior

year-end levels. The commercial paper balance at December 31,

2013, was $2,458 million, an increase of $658 million from the prior

year. Within total debt, $27,504 million is in support of the Global

Financing business which is leveraged at a 7.2 to 1 ratio. The com-

pany continues to have substantial flexibility in the market. During

2013, the company completed bond issuances totaling $10,956

million, with terms ranging from 2 to 12 years, and priced from 0.22

to 3.38 percent depending on maturity. The company has consis-

tently generated strong cash flow from operations and continues

to have access to additional sources of liquidity through the capital

markets and its $10 billion global credit facility, with 100 percent of

the facility available on a same day basis.

Consistent with accounting standards, the company remeasures

the funded status of its retirement and postretirement plans at

December 31. At December 31, 2013, the overall net underfunded

position was $11,434 million, a decrease of $8,756 million from

December 31, 2012 driven by the increase in discount rates, primarily

in the U.S. At year end, the company’s qualified defined benefit plans

were well funded and the cash requirements related to these plans

remain stable going forward at less than $700 million per year

through 2015. In 2013, the return on the U.S. Personal Pension Plan

assets was 7.1 percent and the plan was 109 percent funded. Overall,

global asset returns were 7.1 percent and the qualified defined benefit

plans worldwide were 102 percent funded. See note S, “Retirement-

Related Benefits,” on pages 127 to 141 for additional information.

During 2013, the company generated $17,485 million in cash from

operations, a decrease of $2,102 million compared to 2012. In addi-

tion, the company generated $15,021 million in free cash flow, a

decrease of $3,164 million versus the prior year. See pages 65 to 67

for additional information on free cash flow. The company returned

$17,917 million to shareholders in 2013, with $13,859 million in gross

share repurchases and $4,058 million in dividends. In 2013 the com-

pany repurchased approximately 73 million shares and had

approximately $14.7 billion remaining in share repurchase authoriza-

tion at year end. The company’s cash generation permits the

company to invest and deploy capital to areas with the most attrac-

tive long-term opportunities.

The assets and debt associated with the Global Financing

business are a significant part of the company’s financial position.

The financial position amounts appearing on page 80 are the con-

solidated amounts including Global Financing. The amounts

appearing in the separate Global Financing section, beginning

on page 72, are supplementary data presented to facilitate an

understanding of the Global Financing business.

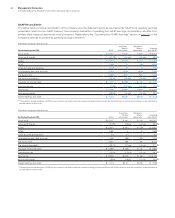

Working Capital

($ in millions)

At December 31: 2013 2012

Current assets $51,350 $49,433

Current liabilities 40,154 43,625

Working capital $11,196 $ 5,807

Current ratio 1.28:1 1.13:1

Working capital increased $5,388 million from the year-end 2012

position. The key changes are described below:

Current assets increased $1,917 million ($2,815 million adjusted

for currency), due to:

• An increase of $1,258 million ($1,886 million adjusted for

currency) in short-term receivables primarily due to higher

volumes related to inventory financing; and

• An increase of $463 million ($630 million adjusted for

currency) in prepaid expenses and other assets,

primarily driven by prepaid income taxes ($407 million).

Current liabilities decreased $3,471 million ($2,562 million adjusted

for currency), as a result of:

• A decrease in short-term debt of $2,319 million ($2,096 million

adjusted for currency) (see debt analysis on pages 45 and 46);

• A decrease of $853 million ($770 million adjusted for currency)

in compensation and benefits reflecting lower accruals for

performance-related compensation; and

• A decrease in accounts payable of $490 million ($409 million

adjusted for currency) reflecting payment of higher 2012 year-

end volumes; partially offset by

• An increase in deferred income of $605 million ($861 million

adjusted for currency) primarily driven by Software.