IBM 2013 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

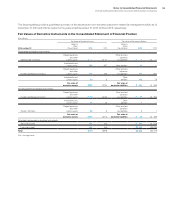

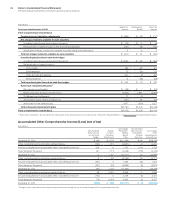

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

114

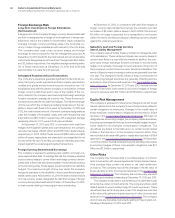

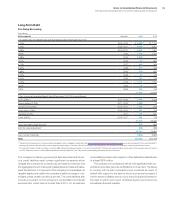

Pre-swap annual contractual maturities of long-term debt outstanding

at December 31, 2013, are as follows:

($ in millions)

To t a l

2014 $ 3,854

2015 4,566

2016 4,114

2017 5,386

2018 2,662

2019 and beyond 16,453

To t a l $37,036

Interest on Debt

($ in millions)

For the year ended December 31: 2013 2012 2011

Cost of financing $ 587 $ 545 $553

Interest expense 405 470 402

Net investment derivative activity (3)(11) 9

Interest capitalized 22 18 9

Total interest paid and accrued $1,011 $1,022 $973

Refer to the related discussion on page 143 in note T, “Seg ment

Infor mation,” for total interest expense of the Global Financing

segment. See note D, “Financial Instruments,” on pages 102 through

106 for a discussion of the use of currency and interest rate swaps

in the company’s debt risk management program.

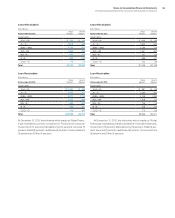

Lines of Credit

In 2013, the company extended the term of its five-year, $10 billion

Credit Agreement (the “Credit Agreement”) by one year to Novem-

ber 10, 2018. The total expense recorded by the company related

to this global credit facility was $5.4 million in 2013, $5.3 million in

2012 and $5.0 million in 2011. The Credit Agreement permits the

company and its Subsidiary Borrowers to borrow up to $10 billion

on a revolving basis. Borrowings of the Subsidiary Borrowers will

be unconditionally backed by the company. The company may also,

upon the agreement of either existing lenders, or of the additional

banks not currently party to the Credit Agreement, increase the

commitments under the Credit Agreement up to an additional

$2.0 billion. Subject to certain terms of the Credit Agreement, the

company and Subsidiary Borrowers may borrow, prepay and rebor

-

row amounts under the Credit Agreement at any time during the

Credit Agreement. Interest rates on borrowings under the Credit

Agreement will be based on prevailing market interest rates, as further

described in the Credit Agreement. The Credit Agreement contains

customary representations and warranties, covenants, events of

default, and indemnification provisions. The company believes that

circumstances that might give rise to breach of these covenants or

an event of default, as specified in the Credit Agreement, are remote.

As of December 31, 2013, there were no borrowings by the company,

or its subsidiaries, under the Credit Agreement.

The company also has other committed lines of credit in some

of the geographies which are not significant in the aggregate.

Interest rates and other terms of borrowing under these lines of

credit vary from country to country, depending on local market

conditions.

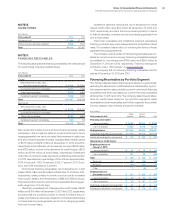

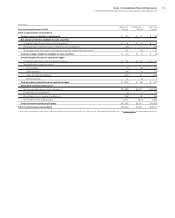

NOTE K.

OTHER LIABILITIES

($ in millions)

At December 31: 2013 2012*

Income tax reserves $3,189 $2,527

Excess 401(k) Plus Plan 1,673 1,501

Disability benefits 699 890

Derivative liabilities 126 78

Special restructuring actions 440 430

Workforce reductions 500 473

Deferred taxes 1,741 448

Other taxes payable 186 24

Environmental accruals 231 216

Warranty accruals 171 167

Asset retirement obligations 129 127

Acquisition-related accruals 205 35

Other 644 691

To t a l $9,934 $7,607

* Reclassified to conform with 2013 presentation.

Post-Swap Borrowing (Long-Term Debt, Including Current Portion)

(in millions)

2013 2012

For the year ended December 31: Amount Average Rate Amount Average Rate

Fixed-rate debt $30,123 3.07% $24,049 3.43%

Floating-rate debt* 6,587 0.87% 5,631 1.91%

To t a l $36,710 $29,680

* Includes $3,106 million in 2013 and $4,252 million in 2012 of notional interest rate swaps that effectively convert the fixed-rate long-term debt into floating-rate debt. (See note D,

“Financial Instruments,” on pages 102 through 106.)