IBM 2013 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

146

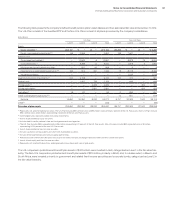

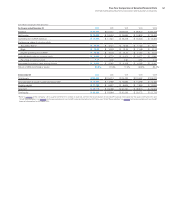

Revenue by Classes of

Similar Products or Services

The following table presents external revenue for similar classes of

products or services within the company’s reportable segments.

Within Global Technology Services and Global Business Services,

client solutions often include IBM software and systems and other

suppliers’ products if the client solution requires it. Within Software,

product license charges and ongoing subscription and support are

reported as Software, and software as a service, consulting, educa-

tion, training and other product-related services are reported as

Services. Within Systems and Technology, Microelectronics original

equipment manufacturer (OEM) revenue is primarily from the sale

of semiconductors. Microelectronics Services revenue includes

circuit and component design services and technology and manu-

facturing consulting services. See “Description of the Business,”

beginning on page 28 for additional information.

($ in millions)

For the year ended December 31: 2013 2012 2011

Global Technology Services

Services $29,953 $31,161 $31,746

Maintenance 7,111 7,343 7,515

Systems 1,322 1,574 1,478

Software 164 159 140

Global Business Services

Services $18,065 $18,216 $18,956

Software 221 208 211

Systems 109 142 118

Software

Software $23,420 $23,144 $22,921

Services 2,512 2,304 2,022

Systems and Technology

Servers $ 9,646 $11,980 $12,362

Storage 3,041 3,411 3,619

Microelectronics OEM 1,463 1,572 1,975

Retail Store Solutions 6357 753

Microelectronics Services 215 346 277

Global Financing

Financing $ 1,493 $ 1,471 $ 1,612

Used equipment sales 529 542 490

NOTE U.

SUBSEQUENT EVENTS

On January 23, 2014, the company and Lenovo Group Limited

(Lenovo) announced a definitive agreement in which Lenovo will

acquire the company’s x86 server portfolio. See the caption, “Dives-

titures,” on page 98 for additional information.

On January 28, 2014, the company announced that the Board

of Directors approved a quarterly dividend of $0.95 per common

share. The dividend is payable March 10, 2014 to shareholders of

record on February 10, 2014.

On January 31, 2014, the company completed the initial closing

of the sale of its customer care business process outsourcing ser-

vices business to SYNNEX. See the caption, “Divestitures” on page

98 for additional information.

On February 6, 2014, the company issued $4.5 billion in bonds

as follows: $1 billion of 2-year floating-rate bonds priced at 3-month

LIBOR plus 7 basis points; $750 million of 5-year floating-rate bonds

priced at 3-month LIBOR plus 37 basis points; $750 million of 5-year

fixed-rate bonds with a 1.95 percent coupon; and $2 billion of

10-year fixed-rate bonds with a 3.625 percent coupon.