IBM 2013 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

125

Stock Options

Stock options are awards which allow the employee to purchase

shares of the company’s stock at a fixed price. Stock options are

granted at an exercise price equal to the company’s average high

and low stock price on the date of grant. These awards, which

generally vest 25 percent per year, are fully vested four years from

the date of grant and have a contractual term of 10 years.

The company estimates the fair value of stock options at the date

of grant using the Black-Scholes valuation model. Key inputs and

assumptions used to estimate the fair value of stock options include

the grant price of the award, the expected option term, volatility of

the company’s stock, the risk-free rate and the company’s dividend

yield. Estimates of fair value are not intended to predict actual

future events or the value ultimately realized by employees who

receive equity awards, and subsequent events are not indicative

of the reasonableness of the original estimates of fair value made

by the company.

During the years ended December 31, 2013, 2012 and 2011, the

company did not grant stock options.

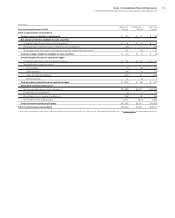

The following table summarizes option activity under the Plans during the years ended December 31, 2013, 2012 and 2011.

2013 2012 2011

Weighted-

Average

Exercise Price

Number of

Shares

Under Option

Weighted-

Average

Exercise Price

Number of

Shares

Under Option

Weighted-

Average

Exercise Price

Number of

Shares

Under Option

Balance at January 1 $94 11,389,721 $90 20,662,322 $ 94 39,197,728

Options exercised 90 (5,585,127) 86 (9,080,170)98 (18,144,309)

Options canceled/expired 86 (181,643) 75 (192,431)107 (391,097)

Balance at December 31 $97 5,622,951 $94 11,389,721 $ 90 20,662,322

Exercisable at December 31 $97 5,622,951 $94 11,389,721 $ 90 20,662,322

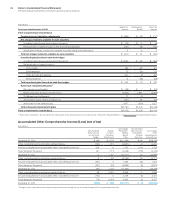

The shares under option at December 31, 2013 were in the following exercise price ranges:

Options Outstanding and Exercisable

Exercise Price Range

Weighted-

Average

Exercise Price

Number of

Shares

Under Option

Aggregate

Intrinsic

Value

Weighted-Average

Remaining

Contractual Life

(in Years)

$85 and under $ 82 468,427 $ 49,244,658 2.1

$86 – $105 98 4,908,689 440,012,196 1.1

$106 and over 106 245,835 20,055,475 0.2

$ 97 5,622,951 $509,312,330 1.1

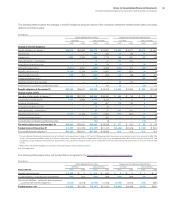

In connection with various acquisition transactions, there was an

additional 0.6 million stock-based awards, consisting of stock

options and restricted stock units, outstanding at December 31,

2013, as a result of the company’s assumption of stock-based

awards previously granted by the acquired entities. The weighted-

average exercise price of these awards was $67 per share.

Exercises of Employee Stock Options

The total intrinsic value of options exercised during the years ended

December 31, 2013, 2012 and 2011 was $614 million, $1,005 million

and $1,269 million, respectively. The total cash received from

employees as a result of employee stock option exercises for the

years ended December 31, 2013, 2012 and 2011 was approximately

$505 million, $785 million and $1,786 million, respectively. In con-

nection with these exercises, the tax benefits realized by the

company for the years ended December 31, 2013, 2012 and 2011

were $199 million, $341 million and $412 million, respectively.

The company settles employee stock option exercises primarily

with newly issued common shares and, occasionally, with treasury

shares. Total treasury shares held at December 31, 2013 and 2012 were

approximately 1,153 million and 1,080 million shares, respectively.

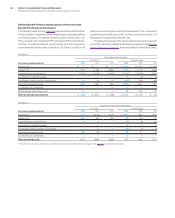

Stock Awards

In lieu of stock options, the company currently grants its employees

stock awards. These awards are made in the form of Restricted

Stock Units (RSUs), including Retention Restricted Stock Units

(RRSUs), or Performance Share Units (PSUs).