IBM 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 Management Discussion

International Business Machines Corporation and Subsidiary Companies

Other software revenue increased 7.0 percent (9 percent adjusted

for currency) driven by growth in software-related services.

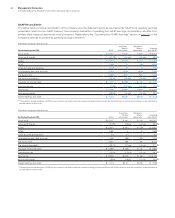

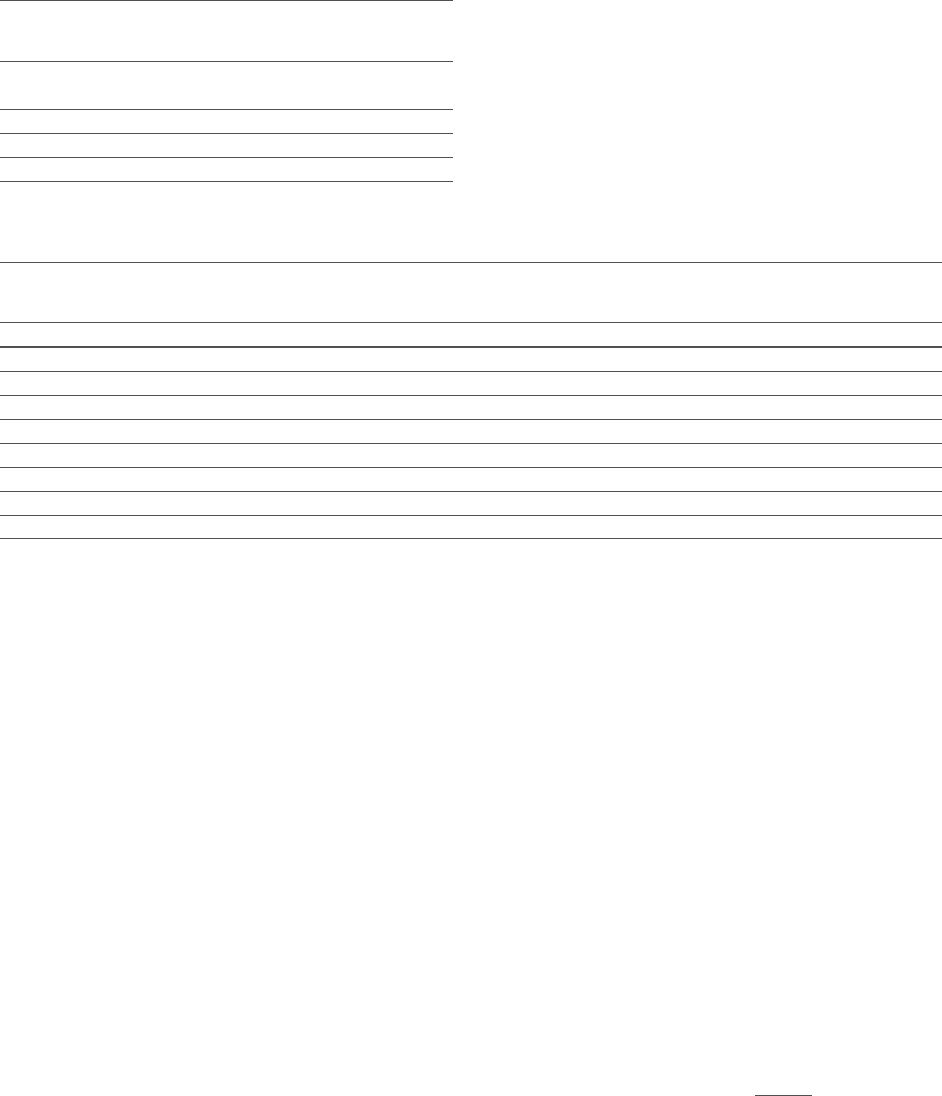

($ in millions)

For the year ended December 31: 2012 2011

Yr.-to-Yr.

Percent/

Margin

Change

Software

External gross profit $22,569 $22,065 2.3%

External gross profit margin 88.7% 88.5% 0.2 pts.

Pre-tax income $10,810 $ 9,970 8.4%

Pre-tax margin 37.6% 35.3% 2.3 pts.

Software gross profit increased 2.3 percent to $22,569 million in 2012,

with a gross profit margin of 88.7 percent, up 0.2 points year to year.

Software pre-tax income of $10,810 million increased 8.4 percent and

the pre-tax margin improved 2.3 points to 37.6 percent. Normalized

for workforce rebalancing charges of $94 million and $6 million in the

third quarter of 2012 and 2011, respectively, software pre-tax income

was up 9.3 percent and the pre-tax margin expanded 2.6 points

versus the prior year. The Software business had another successful

year leveraging revenue growth and expense productivity which drove

significant margin expansion and profit growth.

Systems and Technology

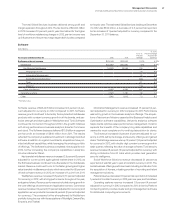

($ in millions)

For the year ended December 31: 2012 2011

Yr.-to-Yr.

Percent

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency

Systems and Technology external revenue $17,667 $18,985 (6.9)% (5.9)%

System z 5.4% 6.3%

Power Systems (8.5) (7.4)

System x (3.7) (2.7)

Storage (5.8) (4.1)

Total Systems excluding Retail Store Solutions (3.7) (2.5)

Microelectronics OEM (14.4) (14.4)

Total Systems and Technology excluding Retail Store Solutions (5.1) (4.0)

Retail Store Solutions (Divested in 2012) (52.6) (51.7)

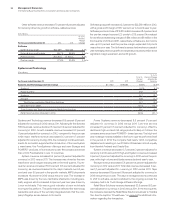

Systems and Technology revenue decreased 6.9 percent (6 percent

adjusted for currency) in 2012 versus 2011. Adjusting for the divested

RSS business, revenue declined 5.1 percent (4 percent adjusted for

currency) in 2012. Growth markets revenue increased 0.3 percent

(1 percent adjusted for currency) in 2012, compared to the prior year

while major markets revenue decreased 8.3 percent (7 percent

adjusted for currency). During 2012, the company’s continued invest-

ments for innovation supported the introduction of the new System

z mainframe, the PureSystems offerings and new Storage and

POWER7+ products. In its introductory year, the company sold more

than 2,300 PureSystems in over 70 countries.

System z revenue increased 5.4 percent (6 percent adjusted for

currency) in 2012 versus 2011. The increase was driven by the new

mainframe which began shipping late in the third quarter. Fourth-

quarter revenue increased 55.6 percent (56 percent adjusted for

currency), as revenue increased in the major markets over 50 per-

cent and over 65 percent in the growth markets. MIPS shipments

increased 19 percent in 2012 versus the prior year. The increase in

MIPS was driven by the new mainframe shipments, including spe-

cialty engines, which increased 44 percent year over year driven by

Linux workloads. This was a good indicator of new workloads

moving to this platform. The performance reflected the technology

leadership and value of the vertically integrated stack that the com

-

pany’s flagship server delivers to its clients.

Power Systems revenue decreased 8.5 percent (7 percent

adjusted for currency) in 2012 versus 2011. Low-end servers

increased 6 percent (7 percent adjusted for currency) offset by

declines in high-end and mid-range products. Early in October, the

company announced new POWER7+ based servers. The high-end

and midrange models available in the fourth quarter performed well

in the period. In 2012, the company had nearly 1,200 competitive

displacements resulting in over $1 billion of business; almost equally

from Hewlett Packard and Oracle/Sun.

System x revenue decreased 3.7 percent (3 percent adjusted for

currency) in 2012 versus 2011. High-end System x revenue increased

5 percent (6 percent adjusted for currency) in 2012 versus the prior

year, while high-volume and blade servers declined year to year.

Storage revenue decreased 5.8 percent (4 percent adjusted for

currency) in 2012 versus 2011. Total disk revenue decreased 3 per-

cent (1 percent adjusted for currency) in 2012 versus 2011. Tape

revenue decreased 16 percent (14 percent adjusted for currency) in

2012 versus the prior year. The value in storage solutions continued

to shift to software, as demonstrated by the ongoing success the

company had in its Tivoli storage software offerings.

Retail Store Solutions revenue decreased 52.6 percent (52 per-

cent adjusted for currency) in 2012 versus 2011. In the third quarter,

the company divested the Retail Store Solutions business to Toshiba

Tec. See the caption, “Divestitures,” on page 98 for additional infor-

mation regarding the transaction.