IBM 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

113

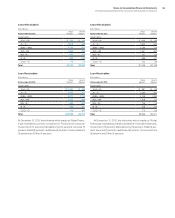

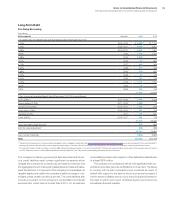

Long-Term Debt

Pre-Swap Borrowing

($ in millions)

At December 31: Maturities 2013 2012

U.S. dollar notes and debentures (average interest rate at December 31, 2013):

0.70% 2014 – 2015 $ 6,456** $ 7,131

3.05% 2016 – 2017 8,465 5,807

3.99% 2018 –2021 6,206 7,457

1.88% 2022 1,000 1,000

3.38% 2023 1,500 —

7.00% 2025 600 600

6.22% 2027 469 469

6.50% 2028 313 313

5.88% 2032 600 600

8.00% 2038 83 83

5.60% 2039 745 745

4.00% 2042 1,107 1,107

7.00% 2045 27 27

7.13% 2096 316 316

27,887 25,656

Other currencies (average interest rate at December 31, 2013, in parentheses):

Euros (2.8%) 2014 – 2025 5,894 2,338

Pound sterling (2.75%) 2017 – 2020 1,254 12

Japanese yen (0.6%) 2014 – 2017 1,057 878

Swiss francs (3.8%) 2015 – 2020 181 178

Canadian (2.2%) 2017 471 502

Other (8.81%) 2015 – 2017 291 95

37,036 29,660

Less: net unamortized discount 872 865

Add: fair value adjustment* 546 886

36,710 29,680

Less: current maturities 3,854 5,593

To t a l $32,856 $24,088

* The portion of the company’s fixed-rate debt obligations that is hedged is reflected in the Consolidated Statement of Financial Position as an amount equal to the sum of the debt’s

carrying value plus a fair value adjustment representing changes in the fair value of the hedged debt obligations attributable to movements in benchmark interest rates.

** Includes $17 million of debt securities issued by IBM International Group Capital, LLC, which is an indirect, 100 percent owned finance subsidiary of the company and will mature

in 2014. Debt securities issued by IBM International Group Capital LLC are fully and unconditionally guaranteed by the company.

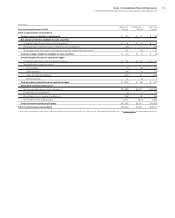

The company’s indenture governing its debt securities and its vari-

ous credit facilities each contain significant covenants which

obligate the company to promptly pay principal and interest, limit

the aggregate amount of secured indebtedness and sale and lease-

back transactions to 10 percent of the company’s consolidated net

tangible assets, and restrict the company’s ability to merge or con-

solidate unless certain conditions are met. The credit facilities also

include a covenant on the company’s consolidated net interest

expense ratio, which cannot be less than 2.20 to 1.0, as well as a

cross default provision with respect to other defaulted indebtedness

of at least $500 million.

The company is in compliance with all of its significant debt cov-

enants and provides periodic certifications to its lenders. The failure

to comply with its debt covenants could constitute an event of

default with respect to the debt to which such provisions apply. If

certain events of default were to occur, the principal and interest on

the debt to which such event of default applied would become

immediately due and payable.