Delta Airlines 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We accrue interest and penalties related to unrecognized tax benefits in interest expense and operating expense, respectively. The impact related to interest

and penalties on our Consolidated Statements of Operations for the years ended December 31, 2009 and 2008 was not material.

We are currently under audit by the IRS for the 2008 and 2009 tax years.

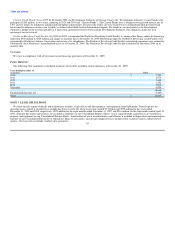

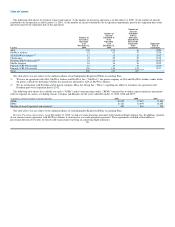

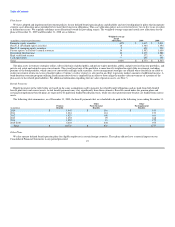

The following table summarizes the changes to the amount of unrecognized tax benefits for the years ended December 31, 2008 and 2009:

(in millions)

Unrecognized tax benefits at January 1, 2008 $ 143

Gross increases-tax positions in prior period 2

Gross decreases-tax positions in prior period (91)

Settlements (25)

Unrecognized tax benefits at December 31, 2008 29

Gross increases-tax positions in prior period 3

Gross decreases-tax positions in prior period (1)

Gross increases-tax positions in current period 38

Settlements (3)

Unrecognized tax benefits at December 31, 2009 $ 66

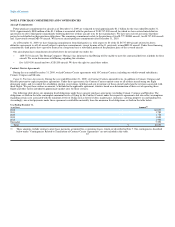

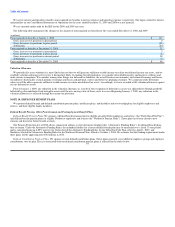

Valuation Allowance

We periodically assess whether it is more likely than not that we will generate sufficient taxable income to realize our deferred income tax assets, and we

establish valuation allowances if recovery is deemed not likely. In making this determination, we consider all available positive and negative evidence and

make certain assumptions. We consider, among other things, our deferred tax liabilities, the overall business environment, our historical earnings and losses,

our industry's historically cyclical periods of earnings and losses and potential, current and future tax planning strategies. We cannot presently determine

when we will be able to generate sufficient taxable income to realize our deferred tax assets. Accordingly, we have recorded a full valuation allowance against

our net deferred tax assets.

Prior to January 1, 2009, any reduction in the valuation allowance as a result of the recognition of deferred tax assets was adjusted first through goodwill

followed by other indefinite-lived intangible assets until the net carrying value of those assets was zero. Beginning January 1, 2009, any reduction in the

valuation allowance is reflected through the income tax provision.

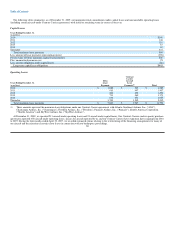

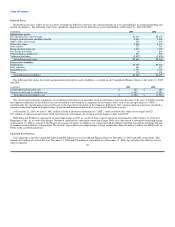

NOTE 10. EMPLOYEE BENEFIT PLANS

We sponsor defined benefit and defined contribution pension plans, healthcare plans, and disability and survivorship plans for eligible employees and

retirees, and their eligible family members.

Defined Benefit Pension, Other Postretirement and Postemployment Benefit Plans

Defined Benefit Pension Plans. We sponsor a defined benefit pension plan for eligible non-pilot Delta employees and retirees (the "Delta Non-Pilot Plan")

and defined benefit pension plans for eligible Northwest employees and retirees (the "Northwest Pension Plans"). These plans have been closed to new

entrants and frozen for future benefit accruals.

The Pension Protection Act of 2006 allows commercial airlines to elect alternative funding rules ("Alternative Funding Rules") for defined benefit plans

that are frozen. Under the Alternative Funding Rules, the unfunded liability for a frozen defined benefit plan may be amortized over a fixed 17-year period

and is calculated using an 8.85% interest rate. Delta elected the Alternative Funding Rules for the Delta Non-Pilot Plan, effective April 1, 2007, and

Northwest elected the Alternative Funding Rules for the Northwest Pension Plans, effective October 1, 2006. We estimate that the funding requirements under

these plans will be approximately $720 million in 2010.

Defined Contribution Pension Plans. We sponsor several defined contribution plans. These plans generally cover different employee groups and employer

contributions vary by plan. The cost associated with our defined contribution pension plans is reflected in the tables below.

93