Delta Airlines 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Cash used in financing activities totaled $120 million for 2007, primarily reflecting (1) the repayment of the DIP Facility with a portion of the proceeds

available under the senior secured exit financing facility and existing cash, (2) the prepayment of $863 million of secured debt with a portion of the proceeds

from the sale of enhanced equipment trust certificates and (3) scheduled principal payments on long-term debt and capital lease obligations. During 2007, we

also received $181 million in proceeds from an amendment to certain financing arrangements in which the outstanding principal amount was increased.

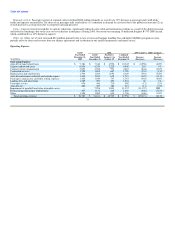

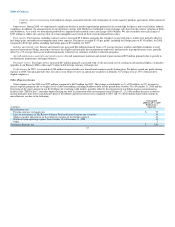

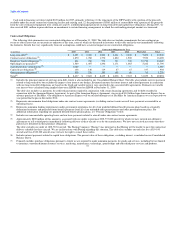

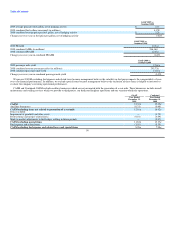

Contractual Obligations

The following table summarizes our contractual obligations as of December 31, 2009. The table does not include commitments that are contingent on

events or other factors that are uncertain or unknown at this time, some of which are discussed in footnotes to this table and in the text immediately following

the footnotes. Results that vary significantly from our assumptions could have a material impact on our contractual obligations.

Contractual Obligations by Year

(in millions) 2010 2011 2012 2013 2014 Thereafter Total

Long-term debt(1) $ 2,690 $ 3,460 $ 4,200 $ 2,060 $ 3,440 $ 7,690 $ 23,540

Contract carrier obligations(2) 1,870 1,780 1,770 1,820 1,900 7,550 16,690

Employee benefit obligations(3) 860 740 790 740 740 10,750 14,620

Operating lease payments(4) 1,589 1,407 1,296 1,171 1,085 5,242 11,790

Aircraft purchase commitments(5) 1,080 — — — — — 1,080

Capital lease obligations(6) 148 146 119 87 67 337 904

Other purchase obligations(7) 400 270 260 160 90 90 1,270

Total(8) $ 8,637 $ 7,803 $ 8,435 $ 6,038 $ 7,322 $ 31,659 $ 69,894

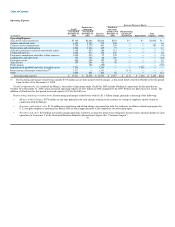

(1) Includes the principal amount of our long-term debt, which is also included in our Consolidated Balance Sheet. The table also includes interest payments

related to long-term debt, but excludes the impact of our interest rate hedges. Estimated amounts for future interest and related payments in connection

with our long-term debt obligations are based on the fixed and variable interest rates specified in the associated debt agreements. Estimates on variable

rate interest were calculated using implied short-term LIBOR based on LIBOR at December 31, 2009.

The table also includes (a) payments for credit enhancements required in conjunction with certain financing agreements and (b) debt recorded in

connection with the American Express Agreement. As part of the American Express Agreement, we received $1.0 billion from American Express for an

advance purchase of SkyMiles. Our obligation to American Express will be satisfied through use of SkyMiles by American Express over an expected two

year period that begins in December 2010.

(2) Represents our minimum fixed obligations under our contract carrier agreements (excluding contract carrier aircraft lease payments accounted for as

operating leases).

(3) Represents minimum funding requirements under government regulations for all of our qualified defined benefit pension plans based on actuarially

determined estimates and projected future benefit payments from all of our unfunded other postretirement and other postemployment plans. For

additional information regarding our qualified defined benefit pension plans, see "Pension Obligations" below.

(4) Includes our noncancelable operating leases and our lease payments related to aircraft under our contract carrier agreements.

(5) Approximately $800 million of this amount is associated with our orders to purchase 20 B-737-800 aircraft for which we have entered into definitive

agreements to sell to third parties immediately following delivery of these aircraft to us by the manufacturer. We have not received any notice that these

parties have defaulted on their purchase obligations.

The table excludes our order of 18 B-787-8 aircraft. The Boeing Company ("Boeing") has informed us that Boeing will be unable to meet the contractual

delivery schedule for these aircraft. We are in discussions with Boeing regarding this situation. The table also excludes our order for five A319-100

aircraft and two A320-200 aircraft since we have the right to cancel these orders.

(6) Includes interest payments related to capital lease obligations. The present value of these obligations, excluding interest, is included on our Consolidated

Balance Sheets.

(7) Primarily includes purchase obligations pursuant to which we are required to make minimum payments for goods and services, including but not limited

to insurance, outsourced human resource services, marketing, maintenance, technology, sponsorships and other third party services and products.

41