Delta Airlines 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Income Tax Valuation Allowance and Contingencies. We periodically assess whether it is more likely than not that we will generate sufficient taxable

income to realize our deferred income tax assets, and we establish valuation allowances if recovery is deemed not likely. In making this determination, we

consider all available positive and negative evidence and make certain assumptions. We consider, among other things, our deferred tax liabilities, the overall

business environment, our historical earnings and losses, our industry's historically cyclical periods of earnings and losses and potential, current and future tax

planning strategies. We cannot presently determine when we will be able to generate sufficient taxable income to realize our deferred tax assets. Accordingly,

we have recorded a full valuation allowance against our net deferred tax assets.

Our income tax provisions are based on calculations and assumptions that are subject to examination by the IRS and other taxing authorities. Although we

believe that the positions taken on previously filed tax returns are reasonable, we have established tax and interest reserves in recognition that taxing

authorities may challenge the positions we have taken, which could result in additional liabilities for taxes and interest. We review the reserves as

circumstances warrant and adjust the reserves as events occur that affect our potential liability, such as lapsing of applicable statutes of limitations, conclusion

of tax audits, a change in exposure based on current calculations, identification of new issues, release of administrative guidance or the rendering of a court

decision affecting a particular issue. We would adjust the income tax provision in the period in which the facts that give rise to the revision become known.

Prior to January 1, 2009, in the event that an adjustment to the income tax provision related to a pre-emergence tax position or Northwest Merger-related

tax position, we adjusted goodwill followed by other indefinite-lived intangible assets until the net carrying value of those assets was zero. Beginning

January 1, 2009, any adjustments to the income tax provision in regard to pre-emergence tax positions are made through the income tax provision.

For additional information about income taxes, see Notes 1 and 9 of the Notes to the Consolidated Financial Statements.

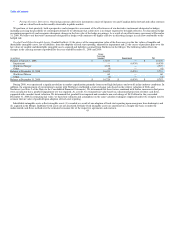

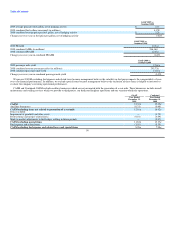

Pension Plans. We sponsor defined benefit pension plans ("DB Plans") for our eligible employees and retirees. We currently estimate that expense for our

DB Plans in 2010 will be approximately $400 million. The effect of our DB Plans on our Consolidated Financial Statements is subject to many assumptions.

We believe the most critical assumptions are (1) the weighted average discount rate and (2) the expected long-term rate of return on the assets of our DB

Plans.

We determine our weighted average discount rate on our measurement date primarily by reference to annualized rates earned on high quality fixed income

investments and yield-to-maturity analysis specific to our estimated future benefit payments. We used a weighted average discount rate of 5.93% and 6.49%

at December 31, 2009 and 2008, respectively. Additionally, our weighted average discount rate for net periodic benefit cost in each of the past three years has

varied from the rate selected on our measurement date, ranging from 5.99% to 7.19% between 2007 and 2009, due to remeasurements throughout the year.

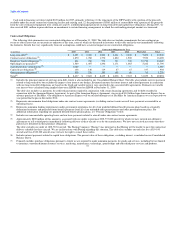

The impact of a 0.50% change in our weighted average discount rate is shown in the table below.

47