Delta Airlines 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

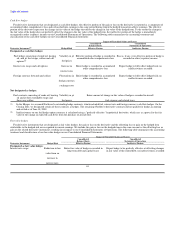

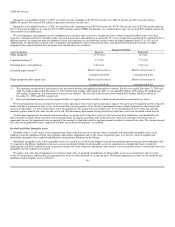

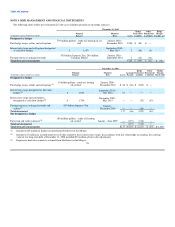

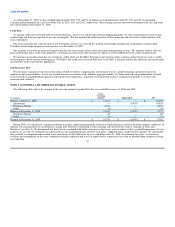

The table below represents the allocation of the total consideration to tangible and intangible assets acquired and liabilities assumed from Northwest in the

Merger based on our estimate of their respective fair values on the Closing Date:

(in millions)

Cash and cash equivalents $ 2,441

Other current assets 2,732

Property and equipment 8,536

Goodwill 4,632

Identifiable intangible assets 2,701

Other noncurrent assets 292

Long-term debt and capital leases (6,239)

Pension and postretirement related benefits (4,010)

Air traffic liability and frequent flyer deferred revenue (3,802)

Other liabilities assumed (3,930)

Total purchase price $ 3,353

The excess of the purchase price over the fair values of the tangible and identifiable intangible assets acquired and liabilities assumed from Northwest in

the Merger was allocated to goodwill. We believe that the portion of the purchase price attributable to goodwill represents the benefits expected to be realized

from the Merger, as discussed above. This goodwill is not deductible or amortizable for tax purposes.

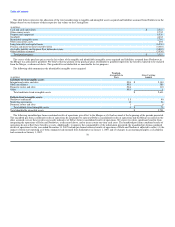

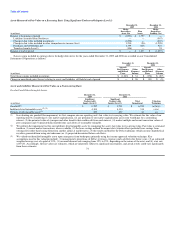

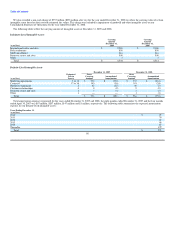

The following table summarizes the identifiable intangible assets acquired:

Weighted-

Average Life in Gross Carrying

(in millions) Years Amount

Indefinite-lived intangible assets:

International routes and slots N/A $ 2,140

SkyTeam alliance N/A 380

Domestic routes and slots N/A 110

Other N/A 1

Total indefinite-lived intangible assets $ 2,631

Definite-lived intangible assets:

Northwest tradename 1.5 40

Marketing agreements 14 26

Domestic routes and slots 1 4

Total definite-lived intangible assets 6 $ 70

Total identifiable intangible assets $ 2,701

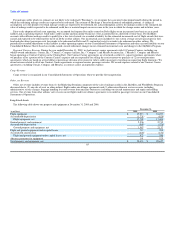

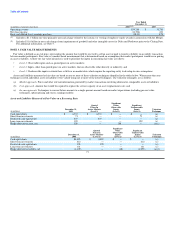

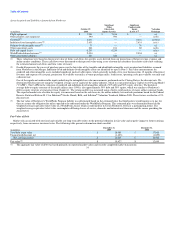

The following unaudited pro forma combined results of operations give effect to the Merger as if it had occurred at the beginning of the periods presented.

The unaudited pro forma combined results of operations do not purport to represent Delta's consolidated results of operations had the Merger occurred on the

dates assumed, nor are these results necessarily indicative of Delta's future consolidated results of operations. We expect to realize significant benefits from

integrating the operations of Delta and Northwest, as discussed above, and to incur certain one-time cash costs. The unaudited pro forma combined results of

operations do not reflect these benefits or costs. Additionally, to improve the comparability of the information presented, the unaudited pro forma combined

results of operations for the year ended December 31, 2007 include pro forma historical results of operations of Delta and Northwest adjusted to reflect (1) the

impact of fresh start reporting as if both companies had emerged from bankruptcy on January 1, 2007 and (2) changes in accounting principles as if adoption

had occurred on January 1, 2007. 70