Delta Airlines 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

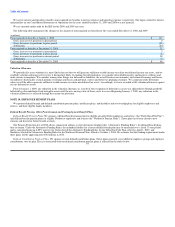

Table of Contents

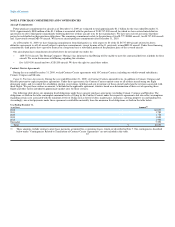

Borrowings under the Term Facility must be repaid in an amount equal to 1% of the original principal amount of the term loans annually (to be paid in

equal quarterly installments), with the balance of the term loans due and payable in September 2013. Borrowings under the Term Facility bear interest at a

variable rate equal to LIBOR or another index rate, in each case plus a specified margin. As of December 31, 2009, the Term Facility had an interest rate of

8.8% per annum.

In 2009, we borrowed and subsequently repaid the entire amount of the Revolving Facility, which matures in March 2013. Borrowings under the

Revolving Facility can be prepaid without penalty and amounts prepaid can be reborrowed. Borrowings under the Revolving Facility bear interest at a

variable rate equal to LIBOR or another index rate, in each case plus a specified margin. As of December 31, 2009, the Revolving Facility was undrawn.

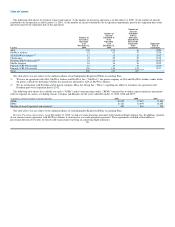

The Senior Secured Credit Facilities contain affirmative and negative covenants and default provisions that are substantially similar to the ones described

under "Senior Secured Exit Financing Facilities" above. The Senior Secured Credit Facilities also contain financial covenants that require us to:

• maintain a minimum fixed charge coverage ratio (defined as the ratio of (1) EBITDAR (excluding gains and losses arising under fuel hedging

arrangements incurred prior to the closing date of the Senior Secured Credit Facilities) to (2) the sum of cash interest expense plus cash aircraft rent

expense plus the interest portion of Delta's capitalized lease obligations) in each case for the 12-month period ending as of the last day of each fiscal

quarter of not less than 1.20 to 1;

• maintain a minimum collateral coverage ratio (defined as the ratio of aggregate current fair market value of the collateral to the sum of the aggregate

outstanding exposure under the Senior Secured Credit Facilities and certain obligations with equal rights to payment and collateral and the aggregate

principal amount of the outstanding Senior Secured Notes) of 1.60:1; and

• maintain unrestricted cash, cash equivalents and short-term investments of not less than $2 billion.

The Senior Secured Credit Facilities also contain mandatory prepayment provisions that require us in certain instances to prepay obligations under the

Senior Secured Credit Facilities in connection with dispositions of collateral. In addition, if the collateral coverage ratio is less than 1.60:1, we must either

provide additional collateral in the form of cash or additional routes and slots to secure our obligations, or we must repay the loans under the Senior Secured

Credit Facilities by an amount necessary to comply with the collateral coverage ratio.

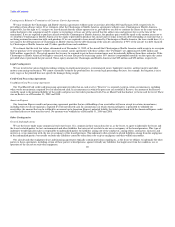

Senior Secured Notes due 2014

Also in 2009, we issued $750 million of Senior Secured Notes (the "Senior Secured Notes"). The Senior Secured Notes mature in September 2014 and

have a fixed interest rate of 9.5% per annum. We may redeem some or all of the Senior Secured Notes at any time on or after September 15, 2011 at specified

redemption prices. If we sell certain of our assets or if we experience specific kinds of changes in control, we must offer to repurchase the Senior Secured

Notes.

Our obligations under the Senior Secured Notes are guaranteed by the Guarantors. The Senior Secured Notes and related guarantees are secured on a senior

basis equally and ratably with the indebtedness incurred under our Senior Secured Credit Facilities by security interests in the Pacific Collateral.

The Senior Secured Notes include covenants that, among other things, restrict our ability to sell assets, incur additional indebtedness, issue preferred stock,

make investments or pay dividends. In addition, in the event the collateral coverage ratio, which has the same definition as the Senior Secured Credit

Facilities, is less than 1.60:1, we must pay additional interest on the Senior Secured Notes at the rate of 2% per annum until the collateral coverage ratio

equals at least 1.60:1.

The Senior Secured Notes contain events of default customary for similar financings, including cross-defaults to other material indebtedness. Upon the

occurrence of an event of default, the outstanding obligations under the Senior Secured Notes may be accelerated and become due and payable immediately.

Senior Second Lien Notes due 2015

In conjunction with the issuance of the Senior Secured Notes, we issued $600 million of Senior Second Lien Notes (the "Senior Second Lien Notes"). The

Senior Second Lien Notes mature in March 2015 and have a fixed interest rate of 12.25% per annum. We may redeem some or all of the Senior Second Lien

Notes at any time on or after March 15, 2012 at specified redemption prices. If we sell certain of our assets or if we experience specific kinds of changes in

control, we must offer to repurchase the Senior Second Lien Notes.

Our obligations under the Senior Second Lien Notes are guaranteed by the Guarantors. The Senior Second Lien Notes and related guarantees are secured

on a junior basis by security interests in the Pacific Collateral. 83