Delta Airlines 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

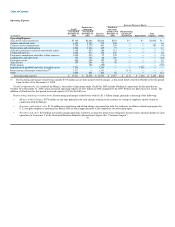

Purchase Accounting Measurements. On the Closing Date, Northwest revalued its assets and liabilities at fair value. This revaluation did not impact

earnings; it did impact the calculation of goodwill related to the excess of purchase price over the fair value of the tangible and identifiable intangible assets

acquired and liabilities assumed from Northwest in the Merger. Additional changes in the fair values of these assets and liabilities from the current estimated

values, as well as changes in other assumptions, could significantly impact earnings.

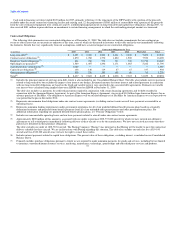

The fair value of Northwest's debt and capital lease obligations was determined by estimating the present value of amounts to be paid at appropriate

interest rates as of the Closing Date. These rates were determined with swap rates, LIBOR rates and market spreads as of the Closing Date. The market

spreads, which were determined with the assistance of third party financial institutions, considered the credit risk and the structure of the debt and capital lease

obligations as well as the underlying collateral supporting the obligations.

Fair value measurements for goodwill and other intangible assets included significant unobservable inputs, which generally include a five-year business

plan, 12 months of historical revenues and expenses by city pair, projections of available seat miles, revenue passenger miles, load factors, operating costs per

available seat mile and a discount rate.

One of the significant unobservable inputs underlying the intangible fair value measurements performed on the Closing Date is the discount rate. We

determined the discount rate using the weighted average cost of capital of the airline industry, which was measured using a Capital Asset Pricing Model

("CAPM"). The CAPM in the valuation of goodwill and indefinite-lived intangibles utilized a 50% debt and 50% equity structure. The historical average

debt-to-equity structure of the major airlines since 1990 is also approximately 50% debt and 50% equity, which was similar to Northwest's debt-to-equity

structure at emergence from Chapter 11. The return on debt was measured using a bid-to-yield analysis of major airline corporate bonds. The expected market

rate of return for equity was measured based on the risk free rate, the airline industry beta and risk premiums based on the Federal Reserve Statistical Release

H. 15 or Ibbotson® Stocks, Bonds, Bills, and Inflation® Valuation Yearbook, Edition 2008. These factors resulted in a 13% discount rate.

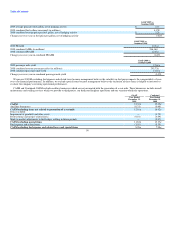

The fair value of Northwest's pension and postretirement plans was determined by measuring the plans' funded status as of the Closing Date. Any excess

projected benefit obligation over the fair value of plan assets was recognized as a liability. One of the significant assumptions in determining our projected

benefit obligation is the discount rate. We determined the discount rate primarily by reference to annualized rates earned on high quality fixed income

investments and yield-to-maturity analysis specific to estimated future benefit payments, which resulted in a weighted average discount rate of 7.8%. Other

significant assumptions include the healthcare cost trend rate, retirement age, and mortality assumptions.

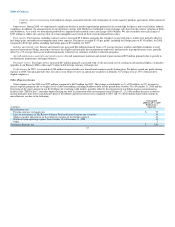

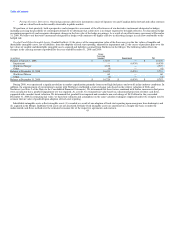

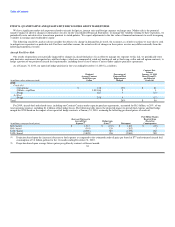

Derivative Instruments. Our results of operations are significantly impacted by changes in aircraft fuel prices, interest rates and foreign currency exchange

rates. In an effort to manage our exposure to these risks, we periodically enter into derivative instruments, including fuel, interest rate and foreign currency

hedges. These derivative instruments are comprised of contracts that are privately negotiated with counterparties without going through a public exchange.

Accordingly, our fair value assessments give consideration to the risk of counterparty default (as well as our own credit risk).

• Aircraft Fuel Derivatives. Our fuel derivative instruments consist of crude oil, heating oil and jet fuel swap, collar and call option contracts. Swap

contracts are valued under the income approach using a discounted cash flow model based on data either readily observable or derived from public

markets. Option contracts are valued under the income approach using option pricing models. We have based our valuation assessments for our

option contracts on data either readily observable in public markets, derived from public markets or provided by counterparties who regularly trade

in public markets.

• Interest Rate Derivatives. Our interest rate derivative instruments consist of swap and call option contracts and are valued based on data readily

observable in public markets. 44