Delta Airlines 2009 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We believe that our insurance would cover most of our exposure to such liabilities and related indemnities associated with the types of lease and financing

agreements described above, including real estate leases. However, our insurance does not typically cover environmental liabilities, although we have certain

policies in place to meet the requirements of applicable environmental laws.

Certain of our aircraft and other financing transactions include provisions which require us to make payments to preserve an expected economic return to

the lenders if that economic return is diminished due to certain changes in law or regulations. In certain of these financing transactions, we also bear the risk

of certain changes in tax laws that would subject payments to non-U.S. lenders to withholding taxes.

We cannot reasonably estimate our potential future payments under the indemnities and related provisions described above because we cannot predict

(1) when and under what circumstances these provisions may be triggered and (2) the amount that would be payable if the provisions were triggered because

the amounts would be based on facts and circumstances existing at such time.

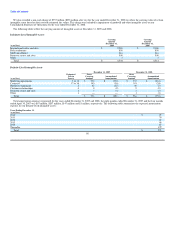

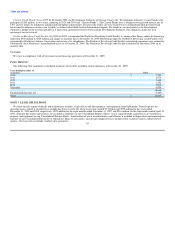

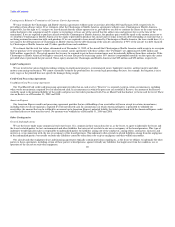

Employees Under Collective Bargaining Agreements

At December 31, 2009, we had 81,106 full-time equivalent employees. Approximately 39% of these employees were represented by unions, including the

following domestic employee groups.

Approximate

Number of

Active Date on which Collective

Employees Bargaining Agreement

Employee Group Represented Union Becomes Amendable

Delta Pilots 10,790 ALPA December 31, 2012

Delta Flight Superintendents (Dispatchers) 318 PAFCA December 31, 2013

Pre-merger NWA Fleet Service, Passenger Service, and Office/Clerical 9,407 IAM December 31, 2010

Pre-merger NWA Simulator Technicians 38 IAM December 31, 2010

Pre-merger NWA Stock Clerks 242 IAM December 31, 2010

Pre-merger NWA Flight Attendants 5,970 AFA-CWA December 31, 2011

Comair Pilots 1,314 ALPA March 2, 2011

Comair Maintenance Employees 400 IAM December 31, 2010

Comair Flight Attendants 764 IBT December 31, 2010

Compass Pilots 373 ALPA April 10, 2013

Mesaba Pilots 1,019 ALPA June 1, 2012

Mesaba Flight Attendants 623 AFA-CWA May 31, 2012

Mesaba Mechanics and Related Employees 353 AMFA May 31, 2012

Mesaba Dispatchers 28 TWU May 31, 2012

War-Risk Insurance Contingency

As a result of the terrorist attacks on September 11, 2001, aviation insurers significantly reduced the maximum amount of insurance coverage available to

commercial air carriers for liability to persons (other than employees or passengers) for claims resulting from acts of terrorism, war or similar events. At the

same time, aviation insurers significantly increased the premiums for such coverage and for aviation insurance in general. Since September 24, 2001, the U.S.

government has been providing U.S. airlines with war-risk insurance to cover losses, including those resulting from terrorism, to passengers, third parties

(ground damage) and the aircraft hull. The U.S. Secretary of Transportation has extended coverage through August 31, 2010. The withdrawal of government

support of airline war-risk insurance would require us to obtain war-risk insurance coverage commercially, if available. Such commercial insurance could

have substantially less desirable coverage than currently provided by the U.S. government, may not be adequate to protect our risk of loss from future acts of

terrorism, may result in a material increase to our operating expense or may not be obtainable at all, resulting in an interruption to our operations.

90