Delta Airlines 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

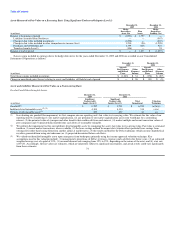

Cash Equivalents and Restricted Cash Equivalents. Short-term, highly liquid investments with maturities of three months or less when purchased, which

primarily consist of money market funds, treasury bills and time deposits, are classified as cash equivalents. These investments are recorded at cost, which

approximates fair value.

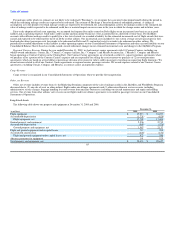

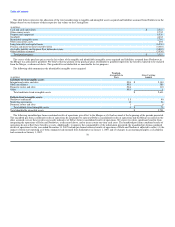

Short-Term Investments. At December 31, 2009 and 2008, our short-term investments were comprised of an investment in the Primary Fund, a money

market fund that is undergoing an orderly liquidation. We record these investments as available-for-sale securities at fair value.

At December 31, 2009 and 2008, the fair value of our investment in the Primary Fund was $71 million and $212 million, respectively. At December 31,

2009, the cost of our remaining investment was $84 million. In mid-September 2008, the net asset value of the Primary Fund decreased below $1 per share

because the Primary Fund valued at zero its holdings of debt securities issued by Lehman Brothers Holdings, Inc. ("Lehman Brothers"), which filed for

bankruptcy on September 15, 2008. Accordingly, we recorded an other than temporary impairment of $13 million as an unrealized loss to the cost basis of our

pro rata share of the estimated loss in this investment.

During 2008, due to uncertainty regarding the timing of the distribution of our holdings in the Primary Fund and the amount expected to be received from

the distribution, we changed our valuation technique for the Primary Fund to an income approach using a discounted cash flow model. Accordingly, our short-

term investments at December 31, 2008, comprised of these securities, changed from Level 1 to Level 3 since initial valuation upon acquisition.

On January 29, 2010, we received $73 million in principal from the Primary Fund under a court approved plan of distribution. Combined with previous

distributions from the Primary Fund, we have now received 99% of our original investment.

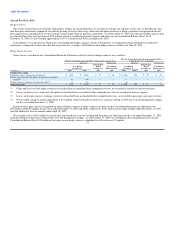

Long-Term Investments. We record our investments in student loan backed auction rate securities as available-for-sale securities at fair value. At

December 31, 2009 and 2008, the fair value of our student loan backed auction rate securities was $45 million and $38 million, respectively. The cost of these

investments was $45 million.

We record our investments in insured auction rate securities as trading securities at fair value. At December 31, 2009 and 2008, the fair value of our

insured auction rate securities was $83 million. The cost of these investments was $110 million.

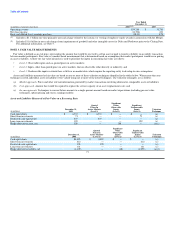

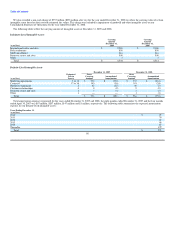

Due to the protracted failure in the auction process and contractual maturities averaging 31 years for our student loan backed auction rate securities and

26 years for our insured auction rate securities, we have classified our auction rate securities as long-term within other noncurrent assets on our Consolidated

Balance Sheets.

Because auction rate securities are not actively traded, fair values were estimated by discounting the cash flows expected to be received over the remaining

maturities of the underlying securities. We based the valuations on our assessment of observable yields on instruments bearing comparable risks and consider

the creditworthiness of the underlying debt issuer. Changes in market conditions could result in further adjustments to the fair value of these securities.

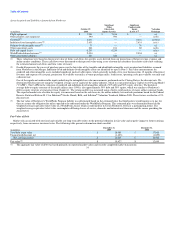

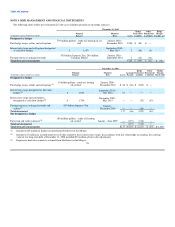

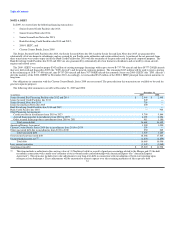

Hedge Derivatives. Our results of operations are significantly impacted by changes in aircraft fuel prices, interest rates and foreign currency exchange

rates. In an effort to manage our exposure to these risks, we periodically enter into derivative instruments, including fuel, interest rate and foreign currency

hedges. These derivative instruments are comprised of contracts that are privately negotiated with counterparties without going through a public exchange.

Accordingly, our fair value assessments give consideration to the risk of counterparty default (as well as our own credit risk).

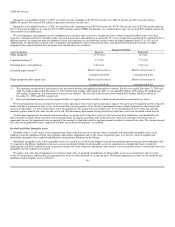

• Aircraft Fuel Derivatives. Our aircraft fuel derivative instruments consist of crude oil, heating oil and jet fuel swap, collar, and call option contracts.

Swap contracts are valued under the income approach using a discounted cash flow model based on data either readily observable or derived from

public markets. Accordingly, we have classified these contracts in Level 2.

Option contracts are valued under the income approach using option pricing models. Historically, we have based our valuation assessments for our

option contracts on data either readily observable in public markets, derived from public markets or provided by counterparties who regularly trade

in public markets. During 2008, we reevaluated certain valuation inputs used for our option contracts. As a result, we reclassified these contracts

from Level 2 to Level 3 since valuation at December 31, 2007. During 2009, we implemented systems that better provide for the evaluation of these

inputs against market data and we no longer rely on data provided by counterparties as a source for our valuation assessments. Accordingly, we

believe a reclassification of our option contracts to Level 2 is appropriate.

• Interest Rate Derivatives. Our interest rate derivative instruments consist of swap and call option contracts and are valued primarily based on data

readily observable in public markets. 72