Delta Airlines 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

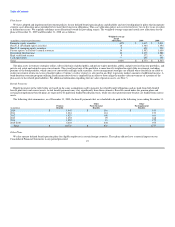

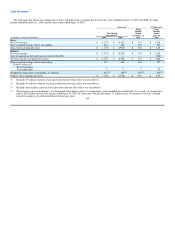

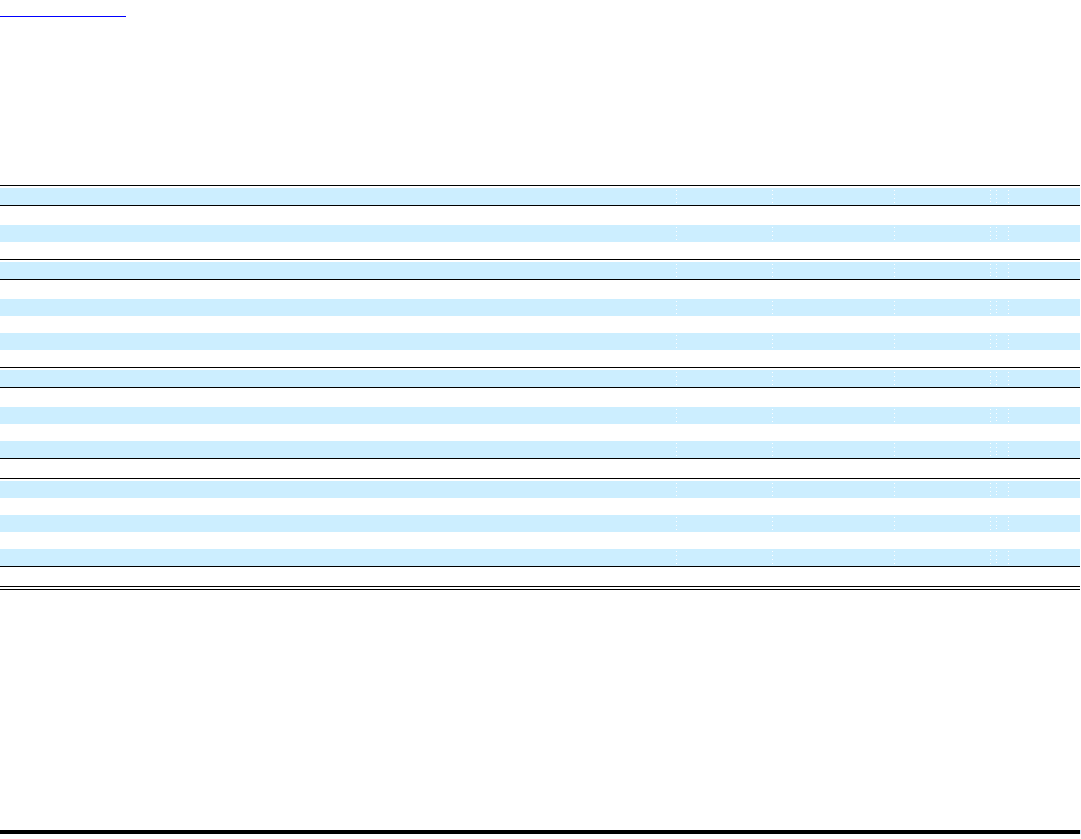

NOTE 13. ACCUMULATED OTHER COMPREHENSIVE (LOSS) INCOME

The following table shows the components of accumulated other comprehensive (loss) income for the four months ended April 30, 2007, the eight months

ended December 31, 2007 and the years ended December 31, 2008 and 2009:

Unrecognized Marketable

Pension Derivative Equity Valuation

(in millions) Liability Instruments Securities Allowance Total

Balance at January 1, 2007 (Predecessor) $ (727) $ (23) $ 2 $ 230 $ (518)

Pension adjustment 6 — — — 6

Changes in fair value — 61 — — 61

Reclassification to earnings — 8 — — 8

Balance at April 30, 2007 (Predecessor) (721) 46 2 230 (443)

Elimination of Predecessor other comprehensive loss 721 (46) (2) (230) 443

Pension adjustment 408 — — — 408

Changes in fair value — 86 — — 86

Reclassification to earnings — (59) — — (59)

Tax effect (155) (11) — 166 —

Balance at December 31, 2007 (Successor) 253 16 — 166 435

Pension adjustment (3,111) — — — (3,111)

Changes in fair value — (1,369) (9) — (1,378)

Reclassification to earnings — (26) — — (26)

Tax effect 1,162 516 3 (1,681) —

Balance at December 31, 2008 (Successor) (1,696) (863) (6) (1,515) (4,080)

Pension adjustment (502) — — — (502)

Changes in fair value — (20) 10 — (10)

Reclassification to earnings — 1,350 — — 1,350

Income Tax Allocation — (321) — — (321)

Tax effect 186 (491) (3) 308 —

Balance at December 31, 2009 (Successor) $ (2,012) $ (345) $ 1 $ (1,207) $ (3,563)

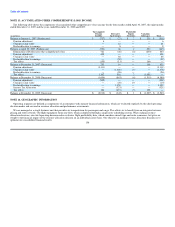

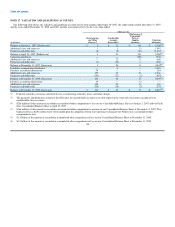

NOTE 14. GEOGRAPHIC INFORMATION

Operating segments are defined as components of an enterprise with separate financial information, which are evaluated regularly by the chief operating

decision maker and are used in resource allocation and performance assessments.

We are managed as a single business unit that provides air transportation for passengers and cargo. This allows us to benefit from an integrated revenue

pricing and route network. Our flight equipment forms one fleet, which is deployed through a single route scheduling system. When making resource

allocation decisions, our chief operating decision maker evaluates flight profitability data, which considers aircraft type and route economics, but gives no

weight to the financial impact of the resource allocation decision on an individual carrier basis. Our objective in making resource allocation decisions is to

optimize our consolidated financial results. 106