Delta Airlines 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

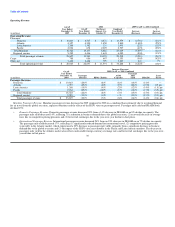

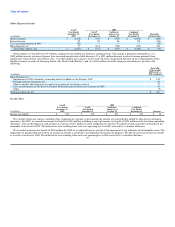

Aircraft fuel and related taxes. Aircraft fuel and related taxes decreased $5.0 billion in 2009 compared to 2008 on a combined basis primarily due to (1)

$4.8 billion associated with lower average fuel prices and (2) $858 million from a 7% decline in fuel consumption due to capacity reductions. These decreases

were partially offset by $1.4 billion in fuel hedge losses for 2009, compared to $666 million in fuel hedge losses for 2008. The fuel hedge losses in 2009 are

primarily from hedges purchased in 2008 during the period fuel prices reached record highs and were expected to continue to rise.

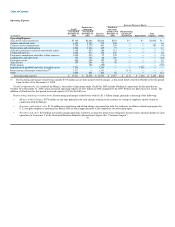

Salaries and related costs. Salaries and related costs increased $289 million due to (1) pay increases for pilot and non-pilot frontline employees, (2) higher

pension expense from a decline in the value of our defined benefit plan assets as a result of market conditions and (3) Delta airline tickets awarded to

employees as part of an employee recognition program. These increases were partially offset by a 5% average decrease in headcount primarily related to

workforce reduction programs.

Contract carrier arrangements. Contract carrier arrangements expense decreased $844 million primarily due to decreases of (1) $714 million associated

with lower average fuel prices and (2) $119 million from a 7% decline in fuel consumption due to capacity reductions.

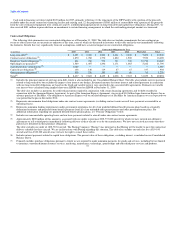

Depreciation and amortization. Depreciation and amortization decreased $784 million as a result of (1) $641 million in impairment related charges

recorded in the year ended December 31, 2008, primarily related to certain definite-lived intangible assets and aircraft, and (2) $125 million related to the

December 2008 multi-year extension of our co-brand credit card relationship with American Express (the "American Express Agreement"), extending the

useful life of the American Express Agreement intangible asset to the date the contract expires.

Aircraft maintenance materials and outside repairs. Aircraft maintenance materials and outside repairs decreased $347 million primarily from capacity

reductions.

Passenger commissions and other selling expenses. Passenger commissions and other selling expenses decreased $362 million primarily in connection

with the passenger revenue decrease.

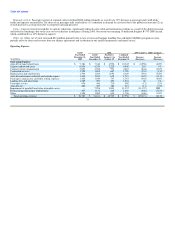

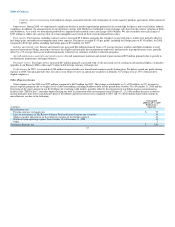

Impairment of goodwill and other intangible assets. During 2008, we experienced a significant decline in market capitalization primarily from record high

fuel prices and overall airline industry conditions. In addition, the announcement of our intention to merge with Northwest established a stock exchange ratio

based on the relative valuation of Delta and Northwest. We determined goodwill was impaired and recorded a non-cash charge of $10.2 billion on a combined

basis. We also recorded a non-cash charge of $955 million on a combined basis to reduce the carrying value of certain intangible assets based on their revised

estimated fair values.

Restructuring and merger-related items. Restructuring and merger-related items decreased $949 million, primarily due to the following:

• During 2009, we recorded a $288 million charge for merger-related items associated with integrating the operations of Northwest into Delta,

including costs related to information technology, employee relocation and training, and re-branding of aircraft and stations. We expect to incur total

cash costs of approximately $500 million over approximately three years to integrate the two airlines.

• For 2009, we recorded a $119 million charge in connection with employee workforce reduction programs.

• During 2008, we recorded $1.2 billion primarily in non-cash, merger-related charges related to the issuance or vesting of employee equity awards in

connection with the Merger and $114 million in restructuring and related charges in connection with voluntary workforce reduction programs. In

addition, we recorded charges of $25 million related to the closure of certain facilities and $14 million associated with the early termination of

certain contract carrier arrangements. 32