Delta Airlines 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

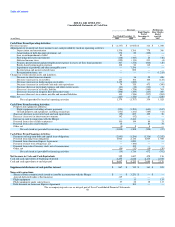

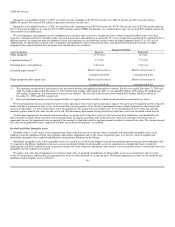

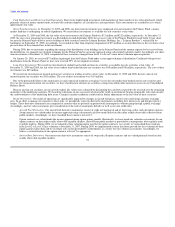

Cash flow hedges

For derivative instruments that are designated as cash flow hedges, the effective portion of the gain or loss on the derivative is reported as a component of

accumulated other comprehensive loss and reclassified into earnings in the same period during which the hedged transaction affects earnings. The effective

portion of the derivative represents the change in fair value of the hedge that offsets the change in fair value of the hedged item. To the extent the change in

the fair value of the hedge does not perfectly offset the change in the fair value of the hedged item, the ineffective portion of the hedge is immediately

recognized in other (expense) income on our Consolidated Statements of Operations. The following table summarizes the accounting treatment and

classification of our cash flow hedges on our Consolidated Financial Statements:

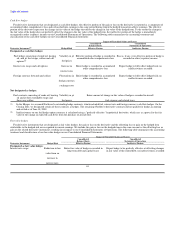

Impact of Unrealized Gains and Losses

Consolidated Consolidated

Balance Sheets Statements of Operations

Derivative Instrument(1) Hedged Risk Effective Portion Ineffective Portion

Designated as cash flow hedges:

Fuel hedges consisting of crude oil, heating

oil, and jet fuel swaps, collars and call

options(2)

Volatility in jet

fuel prices

Effective portion of hedge is recorded in

accumulated other comprehensive loss

Excess, if any, over effective portion of hedge is

recorded in other (expense) income

Interest rate swaps and call options

Increase in

interest rates

Entire hedge is recorded in accumulated

other comprehensive loss

Expect hedge to fully offset hedged risk; no

ineffectiveness recorded

Foreign currency forwards and collars

Fluctuations in

foreign currency

exchange rates

Entire hedge is recorded in accumulated

other comprehensive loss

Expect hedge to fully offset hedged risk; no

ineffectiveness recorded

Not designated as hedges:

Fuel contracts consisting of crude oil, heating

oil and jet fuel extendable swaps and

three-way collars

Volatility in jet

fuel prices

Entire amount of change in fair value of hedge is recorded in aircraft

fuel expense and related taxes

(1) In the Merger, we assumed Northwest's outstanding hedge contracts, which included fuel, interest rate and foreign currency cash flow hedges. On the

Closing Date, we designated certain of these contracts as hedges. The remaining Northwest derivative contracts did not qualify for hedge accounting

and settled as of June 30, 2009.

(2) Ineffectiveness on our fuel hedge option contracts is calculated using a "perfectly effective" hypothetical derivative, which acts as a proxy for the fair

value of the change in expected cash flows from the purchase of aircraft fuel.

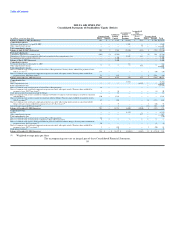

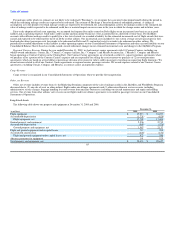

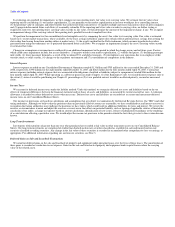

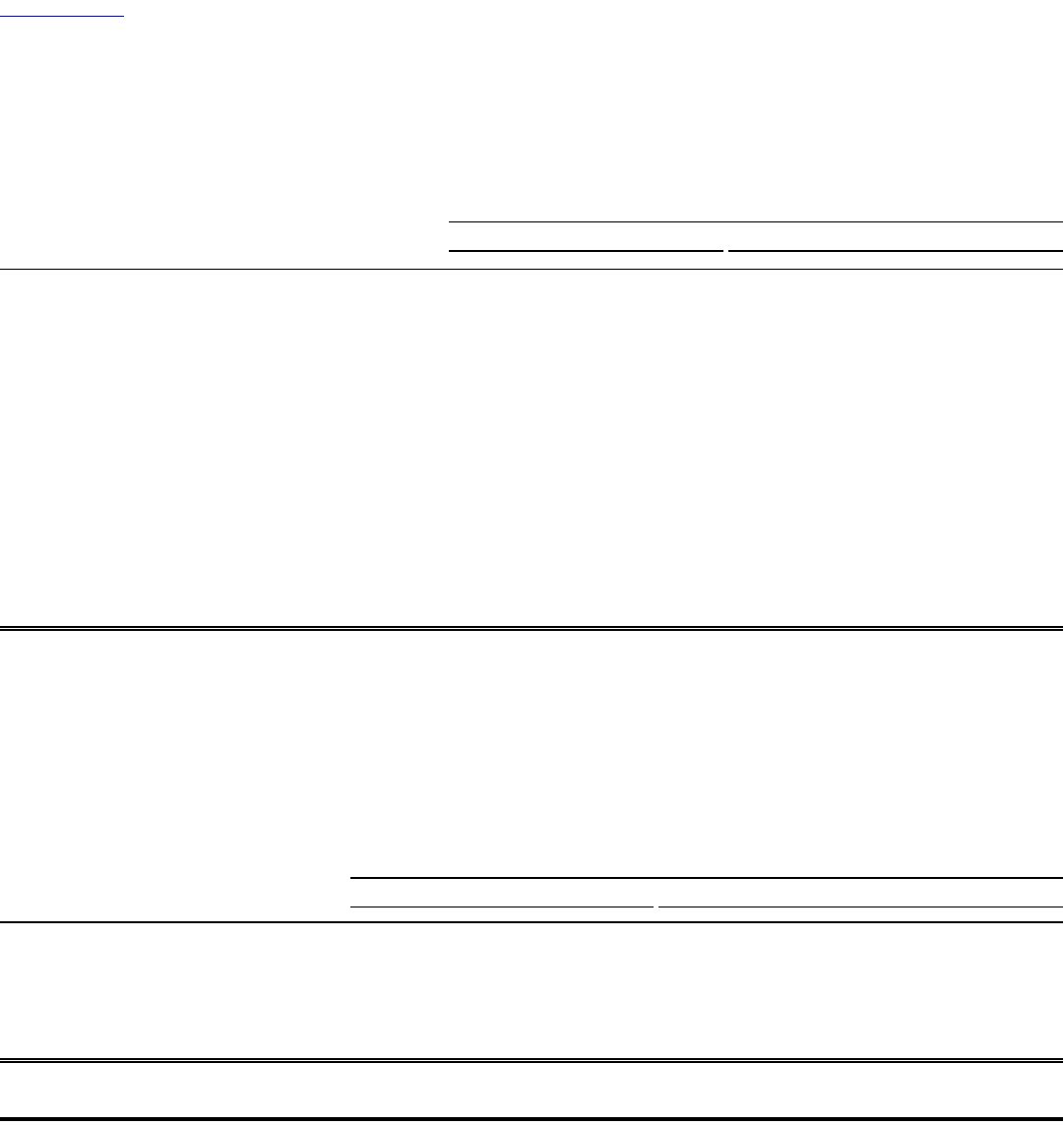

Fair value hedges

For derivative instruments that are designated as fair value hedges, the gain or loss on the derivative and the offsetting loss or gain on the hedged item

attributable to the hedged risk are recognized in current earnings. We include the gain or loss on the hedged item in the same account as the offsetting loss or

gain on the related derivative instrument, resulting in no impact to our Consolidated Statements of Operations. The following table summarizes the accounting

treatment and classification of our fair value hedges on our Consolidated Financial Statements:

Impact of Unrealized Gains and Losses

Consolidated Consolidated

Balance Sheets Statements of Operations

Derivative Instrument Hedged Risk Effective Portion Ineffective Portion

Designated as fair value hedges:

Interest rate swaps

Reduction in fair

value from an

increase in

interest rates

Entire fair value of hedge is recorded in

long-term debt and capital leases

Expect hedge to be perfectly effective at offsetting changes

in fair value of the related debt; no ineffectiveness recorded

63