Delta Airlines 2009 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

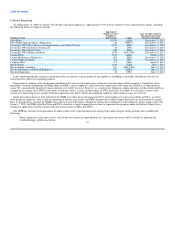

retirees. As of December 31, 2009, the defined benefit pension plans had an estimated benefit obligation of approximately $17.0 billion and were funded

through assets with a value of approximately $7.6 billion. We estimate that our funding requirements for our defined benefit pension plans, which are

governed by ERISA and have been frozen for future accruals, are approximately $720 million in 2010. The significant level of required funding is due

primarily to the decline in the investment markets in 2008, which negatively affected the value of our pension assets. Estimates of pension plan funding

requirements can vary materially from actual funding requirements because the estimates are based on various assumptions concerning factors outside our

control, including, among other things, the market performance of assets; statutory requirements; and demographic data for participants, including the number

of participants and the rate of participant attrition. Results that vary significantly from our assumptions could have a material impact on our future funding

obligations.

Our obligation to post collateral in connection with our fuel hedge contracts may have a substantial impact on our short-term liquidity.

Under fuel hedge contracts that we may enter into from time to time, counterparties to those contracts may require us to fund the margin associated with

any loss position on the contracts. For example, at December 31, 2008, our counterparties required us to fund $1.2 billion of fuel hedge margin. However, at

December 31, 2009, counterparties were required to fund us a net $10 million. If fuel prices fall significantly below the levels at the time we enter into

hedging contracts, we may be required to post a significant amount of collateral, which could have an impact on the level of our unrestricted cash and cash

equivalents and short-term investments.

Our substantial indebtedness may limit our financial and operating activities and may adversely affect our ability to incur additional debt to fund

future needs.

We have substantial indebtedness, which could:

• require us to dedicate a substantial portion of cash flow from operations to the payment of principal and interest on indebtedness, thereby reducing

the funds available for operations and future business opportunities;

• make it more difficult for us to satisfy our payment and other obligations under our indebtedness;

• limit our ability to borrow additional money for working capital, restructurings, capital expenditures, research and development, investments,

acquisitions or other purposes, if needed, and increasing the cost of any of these borrowings;

• make us more vulnerable to economic downturns, adverse industry conditions or catastrophic external events;

• limit our ability to withstand competitive pressures;

• reduce our flexibility in planning for or responding to changing business and economic conditions; and/or

• limit our flexibility in responding to changing business and economic conditions, including increased competition and demand for new services,

placing us at a disadvantage when compared to our competitors that have less debt, and making us more vulnerable than our competitors who have

less debt to a downturn in our business, industry or the economy in general.

In addition, a substantial level of indebtedness, particularly because substantially all of our assets are currently subject to liens, could limit our ability to

obtain additional financing on acceptable terms or at all for working capital, capital expenditures and general corporate purposes. We have historically had

substantial liquidity needs in the operation of our business. These liquidity needs could vary significantly and may be affected by general economic

conditions, industry trends, performance and many other factors not within our control.

14