Delta Airlines 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

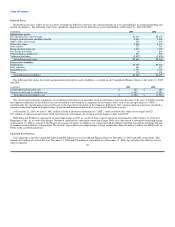

Table of Contents

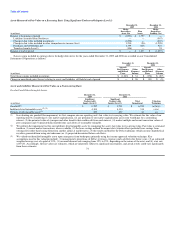

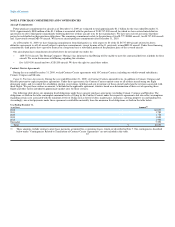

The Senior Second Lien Notes include covenants and default provisions that are substantially similar to the ones described under "Senior Secured Notes

due 2014" above. In addition, in the event (1) the collateral coverage ratio (defined as the ratio of aggregate current market value of the collateral to the sum

of the aggregate outstanding exposure under the Senior Secured Credit Facilities and certain obligations with equal rights to payment and collateral, the

aggregate principal amount of the outstanding Senior Secured Notes, and the aggregate principal amount of the outstanding Senior Second Lien Notes and any

other permitted junior indebtedness that is secured by the collateral) is less than 1.00:1 or (2) we are required to pay additional interest on the Senior Secured

Notes, we must pay additional interest on the Senior Second Lien Notes at the rate of 2% per annum until the later of (a) the collateral coverage ratio equals at

least 1.00:1 or (b) special interest on the Senior Secured Notes ceases to accrue.

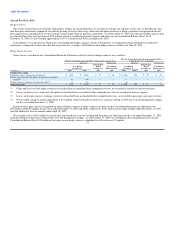

Bank Revolving Credit Facilities due 2010 and 2012

In December 2009, we entered into a $100 million first-lien revolving credit facility, which is guaranteed by the Guarantors and is secured by a first lien on

certain aircraft, engines and related assets owned by Mesaba and us. Borrowings under this facility are due in December 2012, can be repaid and reborrowed

without penalty and bear interest at a variable rate equal to LIBOR or another index rate, in each case plus a specified margin. As of December 31, 2009, the

facility was undrawn.

In December 2009, we also entered into a $150 million first-lien revolving credit facility, which is guaranteed by the Guarantors and is secured by a first

lien on certain aircraft, engines and related assets owned by Delta and Comair. Borrowings under the facility are due in December 2010; however, we may

request additional one-year renewals of the facility thereafter. Borrowings can be repaid and reborrowed without penalty and bear interest at a variable rate

equal to LIBOR or another index rate, in each case plus a specified margin. As of December 31, 2009, the facility was undrawn.

Under both of these facilities, we must maintain a minimum balance of cash, permitted investments and available borrowing capacity under committed

facilities at a specified level. We are also required to maintain a minimum collateral coverage ratio under both facilities. If the collateral coverage ratio is not

maintained, we must either provide additional collateral to secure our obligations or repay the relevant facility by an amount necessary to maintain compliance

with the collateral coverage ratio. Both facilities contain other covenants and events of default, including cross-defaults to other material indebtedness, that are

substantially similar to the ones described under "Senior Secured Exit Financing Facilities due 2012 and 2014" above.

Other Financing Agreements

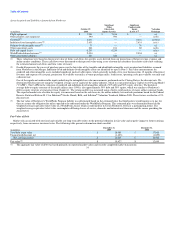

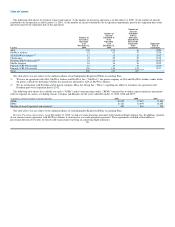

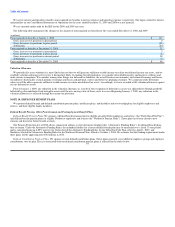

Certificates. Pass-Through Trust Certificates and Enhanced Equipment Trust Certificates (collectively, the "Certificates") are secured by 242 aircraft. As of

December 31, 2009, the Certificates had interest rates ranging from 0.8% to 9.8%. We issued $689 million of Class A and Class B Pass Through Certificates,

Series 2009-1 in November 2009 through two separate pass through trusts (the "2009-1 EETC"). The trusts hold equipment notes for, and are secured by, the

2009 Aircraft and are expected, after the maturity of our 2000-1 EETC in November 2010, to hold equipment notes for, and be secured by, the 2000-1

Aircraft. The equipment notes have a weighted average fixed interest rate of 8.1%.

Aircraft Financing. We have $6.0 billion of loans secured by 300 aircraft, not including aircraft securing the Certificates. These loans had interest rates

ranging from 0.7% to 7.2% at December 31, 2009. During 2008, we entered into agreements to borrow up to $1.6 billion to finance the purchase of 35

aircraft. In 2009, we took delivery of and financed 20 aircraft, five of which were the 2009 Aircraft which were refinanced in connection with the 2009-1

EETC.

Other Secured Financings. Other secured financings primarily include (1) manufacturer term loans, secured by spare parts, spare engines and aircraft and

(2) real estate loans. The financings had annual interest rates ranging from 1.5% to 8.5% at December 31, 2009.

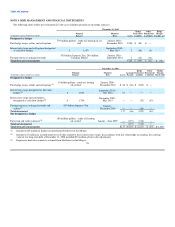

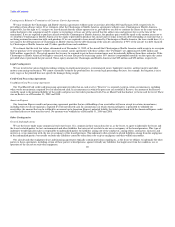

American Express Agreement. In December 2008, we announced a multi-year extension of the American Express Agreement. As part of the American

Express Agreement, we received $1.0 billion from American Express for an advance purchase of SkyMiles, which amount is classified as long-term debt.

This obligation will not be satisfied by cash payments, but through the use of SkyMiles by American Express over an expected two year period beginning in

December 2010. 84