Delta Airlines 2009 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

As of December 31, 2009, we have financing commitments from third parties or, with respect to 20 of the 22 B-737-800 aircraft referred to above,

definitive agreements to sell, all aircraft subject to purchase commitments, except for nine of the 11 previously owned MD-90 aircraft. Under these financing

commitments, third parties have agreed to finance on a long-term basis a substantial portion of the purchase price of the covered aircraft.

Our aircraft purchase commitments described above do not include our orders for:

• 18 B-787-8 aircraft. The Boeing Company ("Boeing") has informed us that Boeing will be unable to meet the contractual delivery schedule for these

aircraft. We are in discussions with Boeing regarding this situation.

• five A319-100 aircraft and two A320-200 aircraft. We have the right to cancel these orders.

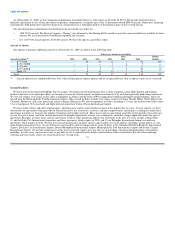

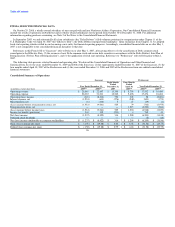

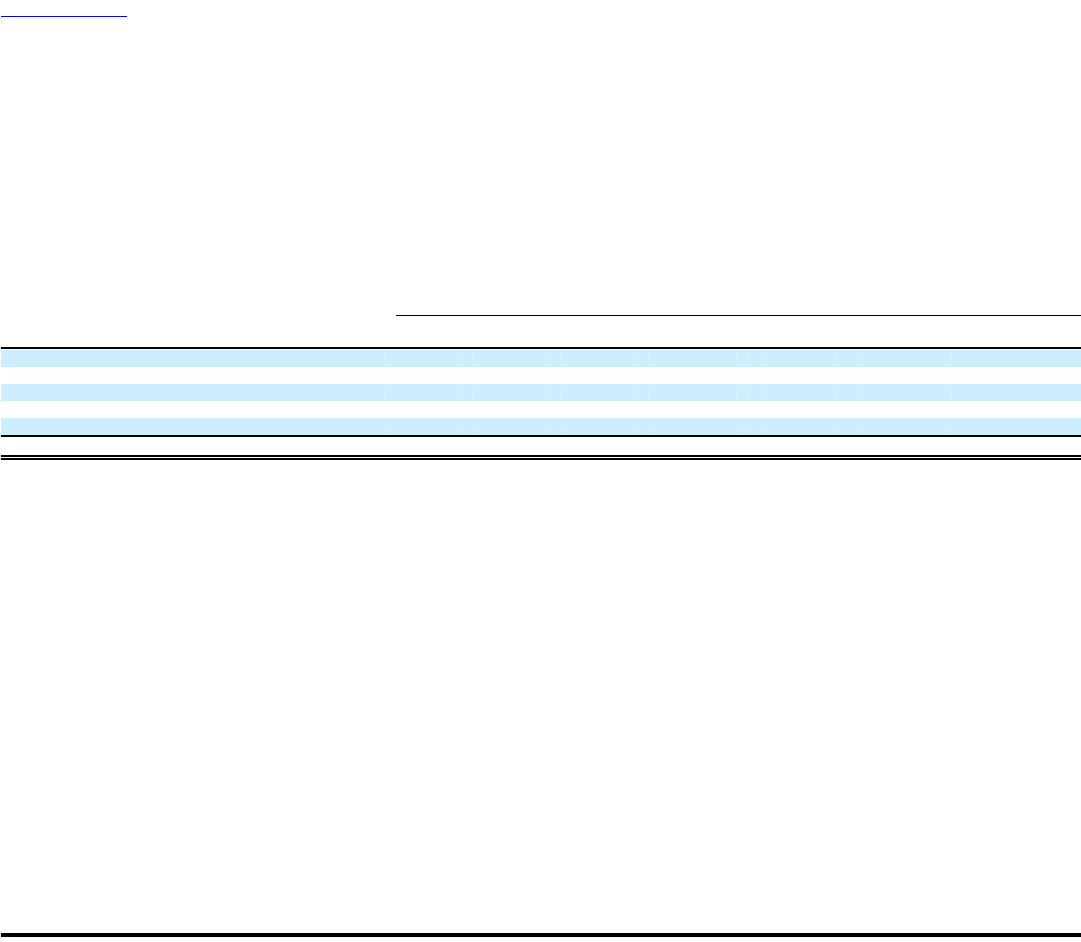

Aircraft on Option

Our options to purchase additional aircraft as of December 31, 2009 are shown in the following table:

Delivery in Calendar Years Ending

After Rolling

Aircraft on Option(1) 2010 2011 2012 2013 2013 Total Options

B-737-800 — 20 24 16 — 60 102

B-767-300ER — — — 1 4 5 —

B-767-400 — 1 1 2 7 11 —

B-777-200LR — 2 6 4 8 20 10

EMB 175 — 4 18 14 — 36 —

Total — 27 49 37 19 132 112

(1) Aircraft options have scheduled delivery slots, while rolling options replace options and are assigned delivery slots as options expire or are exercised.

Ground Facilities

We lease most of the land and buildings that we occupy. Our largest aircraft maintenance base, various computer, cargo, flight kitchen and training

facilities and most of our principal offices are located at or near the Atlanta airport, on land leased from the City of Atlanta generally under long-term leases.

We own our Atlanta reservations center, other real property in Atlanta and the former NWA headquarters building and flight training buildings, which are

located near the Minneapolis/St. Paul International Airport. Other owned facilities include reservations centers in Tampa, Florida, Minot, North Dakota and

Chisholm, Minnesota, and a data processing center in Eagan, Minnesota. We also own property in Tokyo, including a 1.3-acre site in downtown Tokyo and a

33-acre land parcel, 512-room hotel and flight kitchen located near Tokyo's Narita International Airport.

We lease ticket counter and other terminal space, operating areas and air cargo facilities in most of the airports that we serve. At most airports, we have

entered into use agreements which provide for the non-exclusive use of runways, taxiways, and other improvements and facilities; landing fees under these

agreements normally are based on the number of landings and weight of aircraft. These leases and use agreements generally run for periods of less than one

year to 30 years or more, and often contain provisions for periodic adjustments of lease rates, landing fees and other charges applicable under that type of

agreement. Examples of major leases and use agreements at hub or other significant airports that will expire in the next few years include, among others:

(1) our Salt Lake City International Airport use and lease agreement, which expires in 2010; and (2) our Memphis International Airport use and lease

agreement, which expires in 2010. We also lease aircraft maintenance facilities and air cargo facilities at certain airports, including, among others: (1) our

main Atlanta maintenance base; (2) our Atlanta air cargo facilities and our hangar and air cargo facilities at the Cincinnati/Northern Kentucky International

Airport, Salt Lake City International Airport, Detroit Metropolitan International Airport, Minneapolis/St. Paul International Airport and Seattle-Tacoma

International Airport. Our aircraft maintenance facility leases generally require us to pay the cost of providing, operating and maintaining such facilities,

including, in some cases, amounts necessary to pay debt service on special facility bonds issued to finance their construction. We also lease marketing,

ticketing and reservations offices in certain locations for varying terms. 21