Delta Airlines 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

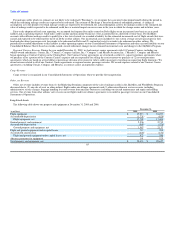

Table of Contents

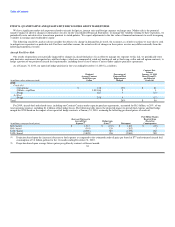

We have marketing alliances with other airlines to enhance our access to domestic and international markets. These arrangements can include codesharing,

reciprocal frequent flyer program benefits, shared or reciprocal access to passenger lounges, joint promotions, common use of airport gates and ticket

counters, ticket office co-location and other marketing agreements. We have received antitrust immunity for certain of our marketing arrangements, which

enables us to offer a more integrated route network and develop common sales, marketing and discount programs for customers. Some of our marketing

arrangements provide for the sharing of revenues and expenses. Revenues and expenses associated with collaborative arrangements are presented on a gross

basis in the applicable line items on our Consolidated Statements of Operations.

We evaluated the financial statements for subsequent events through the date of the filing of this Form 10-K, which is the date the financial statements

were issued.

Use of Estimates

We are required to make estimates and assumptions when preparing our Consolidated Financial Statements in accordance with GAAP. These estimates

and assumptions affect the amounts reported in our Consolidated Financial Statements and the accompanying notes. Actual results could differ materially

from those estimates.

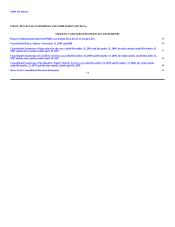

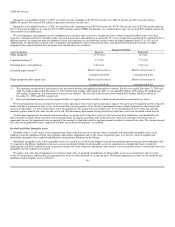

New Accounting Standards

In September 2009, the Financial Accounting Standards Board (the "FASB") issued "Revenue Arrangements with Multiple Deliverables." The standard

revises guidance on (1) the determination of when individual deliverables may be treated as separate units of accounting and (2) the allocation of transaction

consideration among separately identified deliverables. It also expands disclosure requirements regarding an entity's multiple element revenue arrangements.

The standard is effective for fiscal years beginning on or after June 15, 2010, with early adoption permitted. We are currently evaluating the impact the

adoption of this standard will have on our Consolidated Financial Statements.

In April 2009, the FASB issued "Interim Disclosures about Fair Value of Financial Instruments." The standard amends required disclosures about the fair

value of financial instruments in interim and annual financial statements. We adopted this standard on April 1, 2009.

In December 2008, the FASB issued "Employers' Disclosures about Postretirement Benefit Plan Assets." It requires additional annual disclosures about

assets held in an employer's defined benefit pension or other postretirement plan, primarily related to categories and fair value measurements of plan assets.

We adopted this standard on January 1, 2009. For additional information regarding this standard, see

Note 3.

In March 2008, the FASB issued "Disclosures about Derivative Instruments and Hedging Activities." The standard requires enhanced disclosures about

(1) how and why an entity uses derivative instruments, (2) how derivative instruments and related hedged items are accounted for and (3) how derivative

instruments and related hedged items affect an entity's financial position, financial performance and cash flows. This standard is effective for interim and

annual periods. We adopted this standard on January 1, 2009.

In December 2007, the FASB issued "Business Combinations (revised 2007)." The standard provides guidance for recognizing and measuring goodwill

acquired in a business combination and requires disclosure of information regarding the nature and financial effects of a business combination. It also revises

the treatment of valuation allowance adjustments related to income tax benefits in existence prior to a business combination or prior to the adoption of fresh

start reporting. Under the original standard, any reduction in the valuation allowance from the recognition of deferred tax assets is adjusted through goodwill,

followed by other indefinite-lived intangible assets until the net carrying costs of these assets is zero. In contrast, this revised standard requires that any

reduction in this valuation allowance be reflected through the income tax provision. This standard is effective for fiscal years beginning on January 1, 2009.

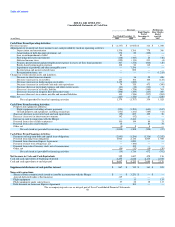

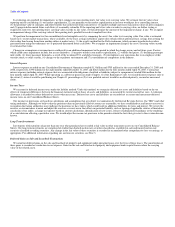

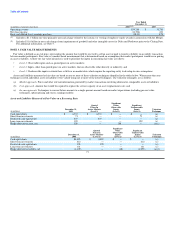

Cash and Cash Equivalents

Short-term, highly liquid investments with maturities of three months or less when purchased, which primarily consist of money market funds and treasury

bills, are classified as cash and cash equivalents. These investments are recorded at cost, which approximates fair value.

61