Delta Airlines 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

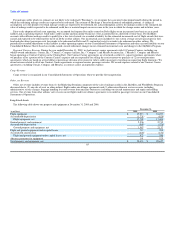

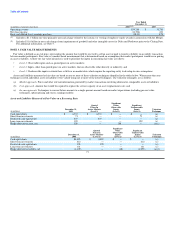

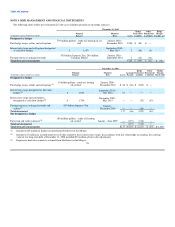

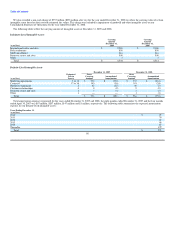

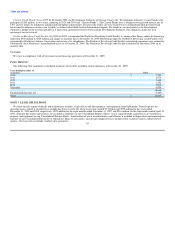

Assets Acquired and Liabilities Assumed from Northwest

Significant Significant

Other Unobservable

October 29, Observable Inputs Valuation

(in millions) 2008 Inputs (Level 2) (Level 3)(1) Technique

Flight equipment $ 7,946 $ 7,946 $ — (a)

Other property and equipment 590 590 — (a)(b)

Goodwill(2) 4,632 — 4,632 (a)(b)(c)

Indefinite-lived intangible assets(2) 2,631 — 2,631 (a)(c)

Definite-lived intangible assets(2) 70 — 70 (c)

Other noncurrent assets 261 181 80 (a)(b)

Debt and capital leases 6,239 6,239 — (a)(c)

WorldPerks deferred revenue(3) 2,034 — 2,034 (a)

Other noncurrent liabilities 224 224 — (a)

(1) These valuations were based on the present value of future cash flows for specific assets derived from our projections of future revenue, expense and

airline market conditions. These cash flows were discounted to their present value using a rate of return that considers the relative risk of not realizing

the estimated annual cash flows and time value of money.

(2) Goodwill represents the excess of purchase price over the fair value of the tangible and identifiable intangible assets acquired and liabilities assumed

from Northwest in the Merger. Indefinite-lived and definite-lived intangible assets are identified by type in Note 5. Fair value measurements for

goodwill and other intangible assets included significant unobservable inputs, which generally include a five-year business plan, 12 months of historical

revenues and expenses by city pair, projections of available seat miles, revenue passenger miles, load factors, operating costs per available seat mile and

a discount rate.

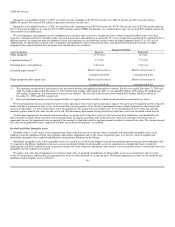

One of the significant unobservable inputs underlying the intangible fair value measurements performed on the Closing Date is the discount rate. We

determined the discount rate using the weighted average cost of capital of the airline industry, which was measured using a Capital Asset Pricing Model

("CAPM"). The CAPM in the valuation of goodwill and indefinite-lived intangibles utilized a 50% debt and 50% equity structure. The historical

average debt-to-equity structure of the major airlines since 1990 is also approximately 50% debt and 50% equity, which was similar to Northwest's

debt-to-equity structure at emergence from Chapter 11. The return on debt was measured using a bid-to-yield analysis of major airline corporate bonds.

The expected market rate of return for equity was measured based on the risk free rate, the airline industry beta and risk premiums based on the Federal

Reserve Statistical Release H. 15 or Ibbotson® Stocks, Bonds, Bills, and Inflation® Valuation Yearbook, Edition 2008. These factors resulted in a 13%

discount rate.

(3) The fair value of Northwest's WorldPerks Program liability was determined based on the estimated price that third parties would require us to pay for

them to assume the obligation for miles expected to be redeemed under the WorldPerks Program. This estimated price was determined based on the

weighted-average equivalent ticket value of a WorldPerks award, which is redeemed for travel on Northwest, Delta or a participating airline. The

weighted-average equivalent ticket value contemplates differing classes of service, domestic and international itineraries and the carrier providing the

award travel.

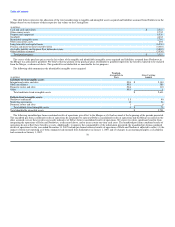

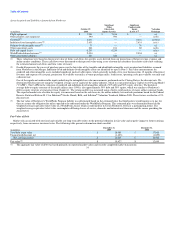

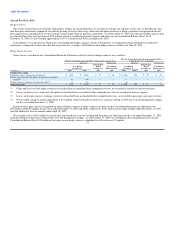

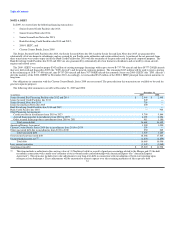

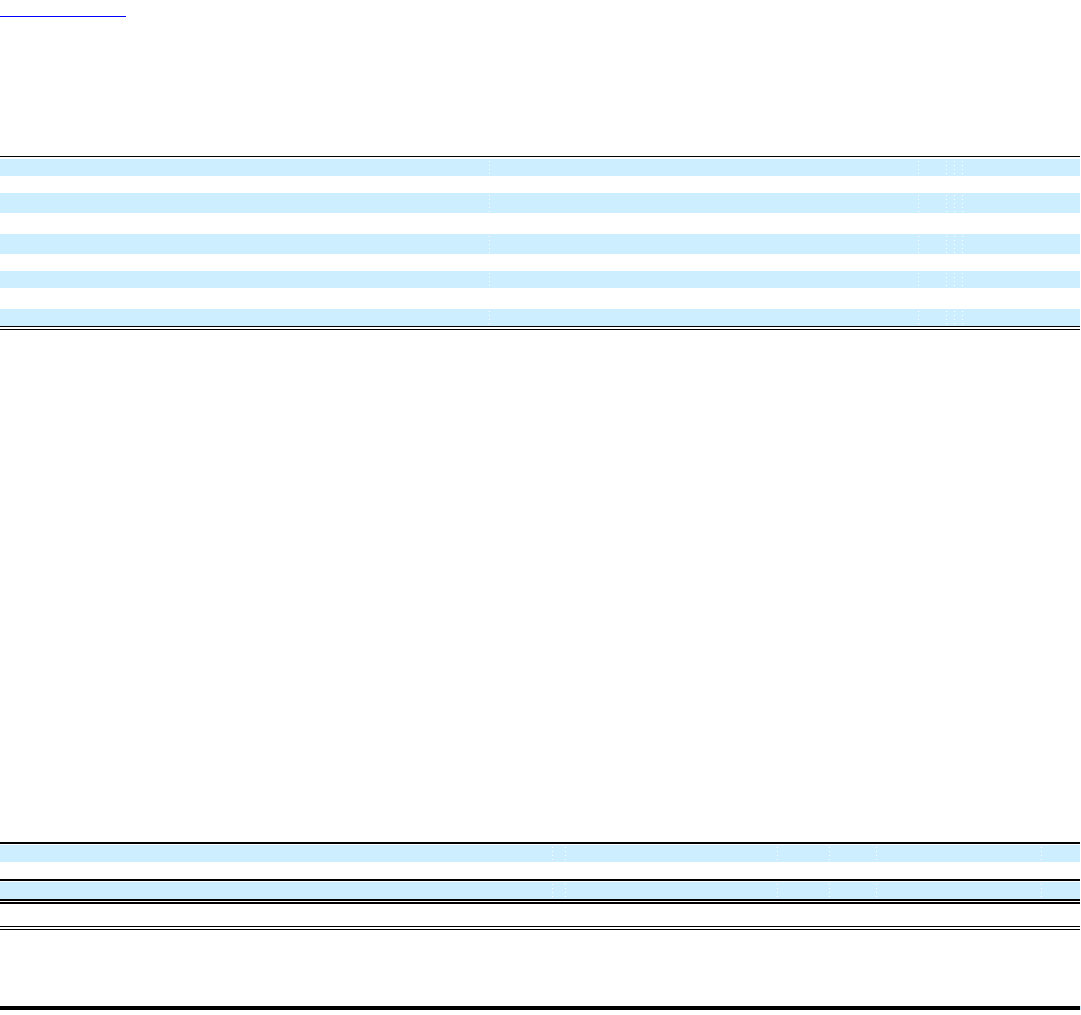

Fair Value of Debt

Market risk associated with our fixed and variable rate long-term debt relates to the potential reduction in fair value and negative impact to future earnings,

respectively, from an increase in interest rates. The following table presents information about our debt:

December 31, December 31,

(in millions) 2009 2008

Total debt at par value $ 18,068 $ 17,865

Unamortized discount, net (1,403) (1,859)

Net carrying amount $ 16,665 $ 16,006

Fair value(1) $ 15,427 $ 12,695

(1) The aggregate fair value of debt was based primarily on reported market values and recently completed market transactions.

75