Delta Airlines 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

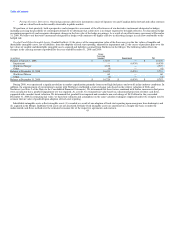

Table of Contents

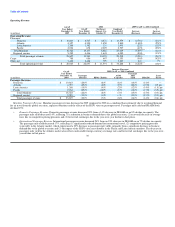

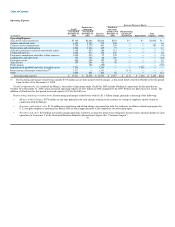

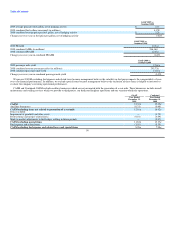

Cash used in operating activities totaled $1.7 billion for 2008, primarily reflecting (1) an increase in aircraft fuel payments due to record high fuel prices

for most of the year, (2) the posting of $680 million in margin with counterparties primarily from our estimated fair value loss position on our fuel hedge

contracts at December 31, 2008, (3) the payment of $438 million in premiums for fuel hedge derivatives entered into during 2008, (4) a $374 million decrease

in advance ticket sales due to the slowing economy and (5) the payment of $158 million in 2008 under our broad-based employee profit sharing plan related

to 2007. Cash used in operating activities was partially offset by cash flows driven by a $3.5 billion increase in operating revenue, $2.0 billion of which is

directly attributable to Northwest's operations since the Closing Date.

Cash provided by operating activities totaled $1.4 billion for 2007, primarily reflecting $875 million in cash used under Delta's Plan of Reorganization to

satisfy bankruptcy-related obligations under our comprehensive agreement with ALPA and settlement agreement with the Pension Benefit Guaranty

Corporation. Cash flows from operating activities during 2007 also reflect (1) the release of $804 million from restricted cash pursuant to an amendment to

our Visa/Mastercard credit card processing agreement, (2) revenue and network productivity improvements, including right-sizing capacity to better meet

customer demand and the continued restructuring of our route network to reduce less productive short haul domestic flights and reallocate widebody aircraft

to international routes and (3) a $476 million decrease in short-term investments primarily from sales of auction rate securities.

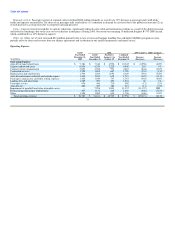

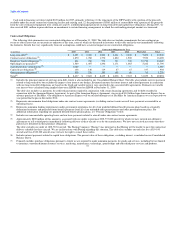

Cash flows from investing activities

Cash used in investing activities totaled $1.0 billion for 2009, primarily reflecting net investments of $951 million for flight equipment and $251 million

for ground property and equipment. Cash used in investing activities was partially offset by (1) a $142 million distribution of our investment in The Reserve

Primary Fund and (2) $100 million of proceeds from the sale of flight equipment.

Cash provided by investing activities totaled $1.6 billion for 2008, primarily reflecting (1) the inclusion of $2.4 billion in cash and cash equivalents from

Northwest in the Merger and (2) $609 million in restricted cash and cash equivalents, primarily related to $500 million of cash from a Northwest borrowing

that was released from escrow. These inflows were partially offset by investments of $1.3 billion for flight equipment and $241 million for ground property

and equipment.

Cash used in investing activities totaled $625 million for 2007, primarily reflecting investments of $810 million for flight equipment and advanced

payments for aircraft commitments and $226 million for ground property and equipment. During 2007, restricted cash decreased by $185 million. In addition,

we received $34 million and $83 million from the sale of our investments in priceline.com Incorporated and ARINC Incorporated, respectively.

Cash flows from financing activities

Cash used in financing activities totaled $19 million for 2009, primarily reflecting $3.0 billion in proceeds from long-term debt and aircraft financing,

largely associated with the issuance of (1) $2.1 billion under three new financings (as discussed above), (2) $342 million from the 2009-1 EETC offering

(with the remaining proceeds held in escrow) and (3) $150 million of tax exempt bonds, mostly offset by the repayment of $2.9 billion in long-term debt and

capital lease obligations, including the Bank Credit Facility and the Revolving Facility.

Cash provided by financing activities totaled $1.7 billion for 2008, primarily reflecting (1) $1.0 billion in borrowings under a revolving credit facility, (2)

$1.0 billion received under the American Express Agreement for an advance purchase of SkyMiles, and (3) $1.0 billion from aircraft financing. Cash

provided by financing activities was partially offset by the repayment of $1.6 billion of long-term debt and capital lease obligations.

40