Delta Airlines 2009 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Our credit card processors have the ability to take significant holdbacks in certain circumstances. The initiation of such holdbacks likely would have a

material adverse effect on our liquidity.

Most of the tickets we sell are paid for by customers who use credit cards. Our credit card processing agreements provide that no holdback of receivables

or reserve is required except in certain circumstances, including if we do not maintain a required level of unrestricted cash. If circumstances were to occur that

would allow American Express or our Visa/MasterCard processor to initiate a holdback, the negative impact on our liquidity likely would be material.

We are at risk of losses and adverse publicity stemming from any accident involving our aircraft.

An aircraft crash or other accident could expose us to significant tort liability. The insurance we carry to cover damages arising from any future accidents

may be inadequate. In the event that the insurance is not adequate, we may be forced to bear substantial losses from an accident. In addition, any accident

involving an aircraft that we operate or an aircraft that is operated by an airline that is one of our codeshare partners could create a public perception that our

aircraft are not safe or reliable, which could harm our reputation, result in air travelers being reluctant to fly on our aircraft and harm our business.

Our ability to use net operating loss carryforwards to offset future taxable income for U.S. federal income tax purposes is subject to limitation.

In general, under Section 382 of the Internal Revenue Code of 1986, as amended, a corporation that undergoes an "ownership change" is subject to

limitations on its ability to utilize its pre-change net operating losses ("NOLs"), to offset future taxable income. In general, an ownership change occurs if the

aggregate stock ownership of certain stockholders (generally 5% shareholders, applying certain look-through rules) increases by more than 50 percentage

points over such stockholders' lowest percentage ownership during the testing period (generally three years).

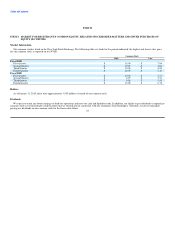

As of December 31, 2009, Delta reported a consolidated federal and state NOL carryforward of approximately $17.3 billion. Both Delta and Northwest

experienced an ownership change in 2007 as a result of their respective plans of reorganization under Chapter 11 of the U.S. Bankruptcy Code. As a result of

the merger, Northwest experienced a subsequent ownership change. Delta also experienced a subsequent ownership change on December 17, 2008 as a result

of the merger, the issuance of equity to employees in connection with the merger and other transactions involving the sale of our common stock within the

testing period.

The Delta and Northwest ownership changes resulting from the merger could limit the ability to utilize pre-change NOLs that were not subject to

limitation, and could further limit the ability to utilize NOLs that were already subject to limitation. Limitations imposed on the ability to use NOLs to offset

future taxable income could cause U.S. federal income taxes to be paid earlier than otherwise would be paid if such limitations were not in effect and could

cause such NOLs to expire unused, in each case reducing or eliminating the benefit of such NOLs. Similar rules and limitations may apply for state income

tax purposes. NOLs generated subsequent to December 17, 2008 are not limited.

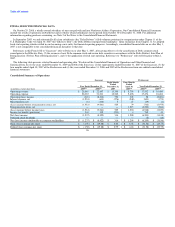

Our merger with Northwest affects the comparability of our historical financial results.

On October 29, 2008, a subsidiary of Delta merged with and into Northwest. Our historical financial results under GAAP include the results of Northwest

for periods after October 29, 2008, but not for periods before October 29, 2008. Accordingly, while our financial results for the year ended December 31,

2009 include the results of Northwest for the entire period, our financial results for the year ended December 31, 2008 include the results of Northwest only

for the period from October 30 to December 31, 2008. This complicates your ability to compare our results of operations and financial condition for periods

that include Northwest's results with periods that do not. 17