Delta Airlines 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

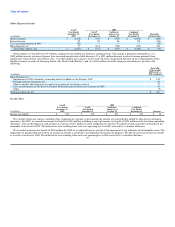

Reorganization Items, Net

Reorganization items, net totaled a $1.2 billion gain for 2007, primarily consisting of the following:

• Emergence gain. A net $2.1 billion gain due to our emergence from bankruptcy, comprised of (1) a $4.4 billion gain related to the discharge of

liabilities subject to compromise in connection with the settlement of claims, (2) a $2.6 billion charge associated with the revaluation of our

SkyMiles frequent flyer obligation and (3) a $238 million gain from the revaluation of our remaining assets and liabilities to fair value.

• Aircraft financing renegotiations and rejections. A $440 million charge for estimated claims primarily associated with the restructuring of the

financing arrangements for 143 aircraft and adjustments to prior claims estimates.

• Contract carrier agreements. A net charge of $163 million in connection with amendments to certain contract carrier agreements.

• Emergence compensation. In accordance with Delta's Plan of Reorganization, we made $130 million in lump-sum cash payments to approximately

39,000 eligible non-contract, non-management employees. We also recorded an additional charge of $32 million related to our portion of payroll

related taxes associated with the issuance, as contemplated by Delta's Plan of Reorganization, of approximately 14 million shares of common stock

to those employees.

• Pilot collective bargaining agreement. An $83 million allowed general, unsecured claim in connection with the agreement between Comair, Inc., our

wholly owned subsidiary ("Comair"), and the Air Line Pilots Association ("ALPA") to reduce Comair's pilot labor costs.

• Facility leases. A net $43 million gain, which primarily reflects (1) a $126 million net gain related to our settlement agreement with the

Massachusetts Port Authority partially offset by (2) a net $80 million charge from an allowed general, unsecured claim in connection with the

settlement relating to the restructuring of certain of our lease and other obligations at the Cincinnati Airport.

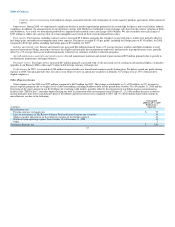

Income Taxes

We recorded an income tax benefit of $119 million for 2008 due to the impairment of our indefinite-lived intangible assets. The impairment of goodwill

did not result in an income tax benefit as goodwill is not deductible for income tax purposes. We did not record an income tax benefit as a result of our loss

for 2008. The deferred tax asset resulting from such a net operating loss is fully reserved by a valuation allowance.

For 2007, we recorded an income tax provision totaling $207 million. We recorded a full valuation allowance against our net deferred tax assets, excluding

the effect of the deferred tax liabilities that are unable to be used as a source of income against these deferred tax assets, based on our belief that it is more

likely than not that the asset will not be realized in the future. Under accounting guidance applicable in 2007, any reduction in the valuation allowance as a

result of the recognition of deferred tax assets was adjusted through goodwill, followed by other indefinite-lived intangible assets until the net carrying cost of

these assets was zero. Accordingly, during 2007, we reduced goodwill by $211 million with respect to the realization of pre-emergence deferred tax assets.

38