Delta Airlines 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

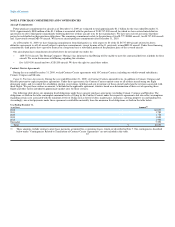

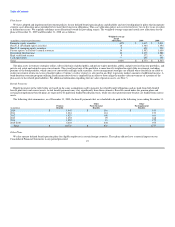

Estimated amounts that will be amortized from accumulated other comprehensive income into net periodic benefit cost in 2010 are $48 million and

$14 million in pension benefits and other postemployment benefits, respectively, and an actuarial gain of $22 million relating to other postretirement benefits.

Amounts are generally amortized into accumulated other comprehensive income over the expected future lifetime of plan participants.

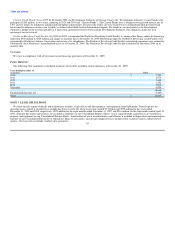

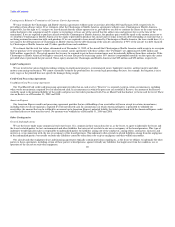

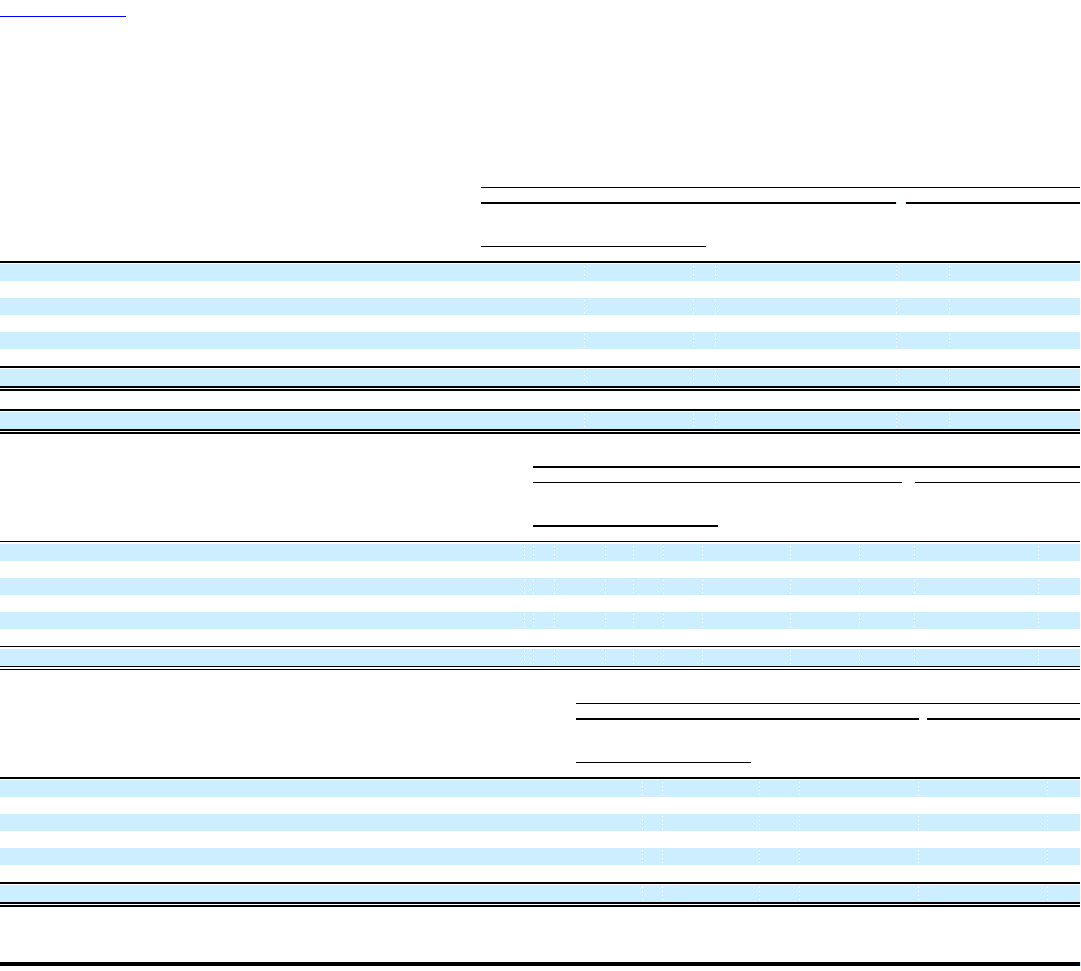

Net periodic cost (benefit) for the years ended December 31, 2009 and 2008, the eight months ended December 31, 2007 and the four months ended

April 30, 2007 included the following components:

Pension Benefits

Successor Predecessor

Eight Months Four Months

Year Ended Ended Ended

December 31, December 31, April 30,

(in millions) 2009 2008 2007 2007

Service cost $ — $ — $ — $ —

Interest cost 1,002 550 296 145

Expected return on plan assets (615) (479) (281) (129)

Recognized net actuarial loss 33 — — 19

Settlement charge (gain), net 9 3 — (30)

Revaluation of liability — — — (143)

Net periodic cost (benefit) $ 429 $ 74 $ 15 $ (138)

Defined contribution plan costs 306 211 128 36

Total cost (benefit) $ 735 $ 285 $ 143 $ (102)

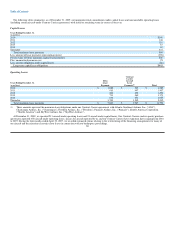

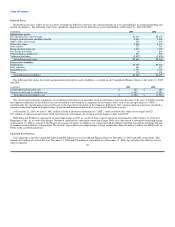

Other Postretirement Benefits

Successor Predecessor

Eight Months Four Months

Year Ended Ended Ended

December 31, December 31, April 30,

(in millions) 2009 2008 2007 2007

Service cost $ 20 $ 10 $ 8 $ 4

Interest cost 82 65 42 21

Amortization of prior service benefit — — — (31)

Recognized net actuarial (gain) loss (18) (6) — 8

Special termination benefits 6 — — —

Revaluation of liability — — — 49

Net periodic cost $ 90 $ 69 $ 50 $ 51

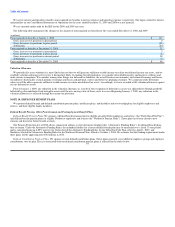

Other Postemployment Benefits

Successor Predecessor

Eight Months Four Months

Year Ended Ended Ended

December 31, December 31, April 30,

(in millions) 2009 2008 2007 2007

Service cost $ 33 $ 28 $ 21 $ 8

Interest cost 125 127 82 41

Expected return on plan assets (79) (151) (104) (51)

Amortization of prior service cost (benefit) 18 — — (2)

Recognized net actuarial loss — — — 5

Revaluation of liability — — — (273)

Net periodic cost (benefit) $ 97 $ 4 $ (1) $ (272)

95