Delta Airlines 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

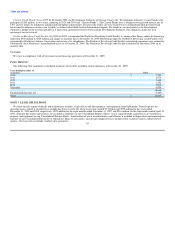

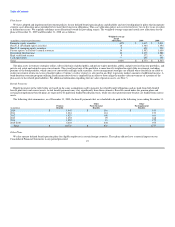

Deferred Taxes

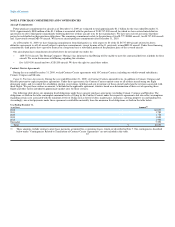

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amounts of assets and liabilities for financial reporting and

income tax purposes. The following table shows significant components of our deferred tax assets and liabilities at December 31, 2009 and 2008:

(in millions) 2009 2008

Deferred tax assets:

Net operating loss carryforwards $6,419 $5,450

Pension, postretirement and other benefits 4,661 4,491

AMT credit carryforward 452 505

Deferred revenue 2,282 2,339

Rent expense 272 291

Reorganization items, net 1,033 1,375

Fuel hedge derivatives 30 663

Other temporary differences 413 565

Valuation allowance (9,897) (9,830)

Total deferred tax assets $5,665 $5,849

Deferred tax liabilities:

Depreciation $4,858 $4,856

Debt valuation 431 627

Intangible assets 1,757 1,795

Other 179 151

Total deferred tax liabilities $7,225 $7,429

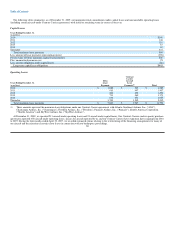

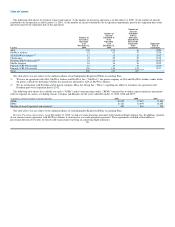

The following table shows the current and noncurrent deferred tax assets (liabilities), recorded on our Consolidated Balance Sheets at December 31, 2009

and 2008:

(in millions) 2009 2008

Current deferred tax assets, net $ 107 $ 401

Noncurrent deferred tax liabilities, net (1,667) (1,981)

Total deferred tax liabilities, net $ (1,560) $ (1,580)

The current and noncurrent components of our deferred tax balances are generally based on the balance sheet classification of the asset or liability creating

the temporary difference. If the deferred tax asset or liability is not based on a component of our balance sheet, such as our net operating loss ("NOL")

carryforwards, the classification is presented based on the expected reversal date of the temporary difference. Our valuation allowance has been classified as

current or noncurrent based on the percentages of current and noncurrent deferred tax assets to total deferred tax assets.

At December 31, 2009, we had (1) $452 million of federal alternative minimum tax ("AMT") credit carryforwards, which do not expire and (2)

$17.3 billion of federal and state pretax NOL carryforwards, substantially all of which will not begin to expire until 2022.

Both Delta and Northwest experienced an ownership change in 2007 as a result of their respective plans of reorganization under Chapter 11 of the U.S.

Bankruptcy Code. As a result of the Merger, Northwest experienced a subsequent ownership change. Delta also experienced a subsequent ownership change

on December 17, 2008 as a result of the Merger, the issuance of equity to employees in connection with the Merger and other transactions involving the sale

of common stock within the testing period. We currently expect these ownership changes will not significantly limit our ability to utilize our AMT credit or

NOLs in the carryforward period.

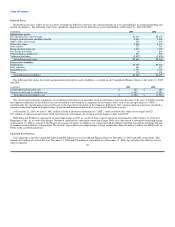

Uncertain Tax Positions

Unrecognized tax benefits totaled $66 million and $29 million on our Consolidated Balance Sheets at December 31, 2009 and 2008, respectively. This

includes $47 million of tax benefits as of December 31, 2009 and $10 million of tax benefits as of December 31, 2008, that will affect the effective tax rate

when recognized. 92