Delta Airlines 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

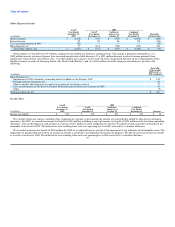

Financial Condition and Liquidity

We expect to meet our cash needs for 2010 from cash flows from operations, cash and cash equivalents, short-term investments and financing

arrangements. Our cash and cash equivalents and short-term investments were $4.7 billion at December 31, 2009. We also have $685 million of additional

cash available from undrawn credit facilities. As of December 31, 2009, we have financing commitments from third parties, or definitive agreements to sell,

all aircraft subject to purchase commitments, except for nine previously owned MD-90 aircraft. Under these financing commitments third parties have agreed

to finance on a long-term basis a substantial portion of the purchase price of the covered aircraft. For additional information regarding our aircraft purchase

commitments, see Note 8 of the Notes to the Consolidated Financial Statements.

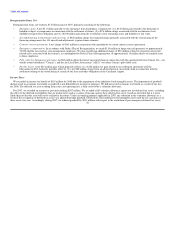

The global economic recession weakened demand for air travel, decreasing our revenue and negatively impacting our liquidity. In an effort to lessen the

impact of the global recession, we implemented initiatives to reduce costs, increase revenues and preserve liquidity, primarily through reducing capacity to

align with demand, workforce reduction programs and the acceleration of Merger synergy benefits.

Our ability to obtain additional financing, if needed, on acceptable terms could be affected by the fact that substantially all of our assets are subject to liens.

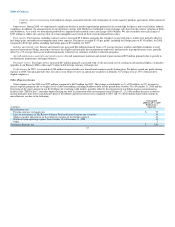

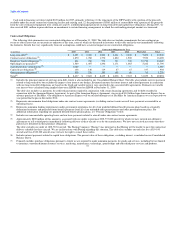

Significant Liquidity Events

Significant liquidity events during 2009 were as follows:

• In September 2009, we borrowed a total of $2.1 billion under three new financings, consisting of: (1) $750 million of senior secured credit facilities,

which include a $500 million first-lien revolving credit facility (the "Revolving Facility") and a $250 million first-lien term loan facility; (2)

$750 million of senior secured notes; and (3) $600 million of senior second lien notes. A portion of the net proceeds was used to repay in full the

Bank Credit Facility due in 2010 with the remainder of the proceeds available for general corporate purposes.

• In November 2009, we issued $689 million of Pass Through Certificates, Series 2009-1 through two separate trusts (the "2009-1 EETC"). We used

$342 million of the net proceeds of the 2009-1 EETC offering to prepay existing mortgage financings for five aircraft that were delivered and

financed earlier in 2009 and for general corporate purposes. We intend to use the remaining $347 million of the net proceeds of the 2009-1 EETC,

which are currently held in escrow, to repay a portion of the refinancing of 22 aircraft that currently secure our 2000-1 EETC.

• In 2009, we entered into two revolving credit facilities for a total of $250 million. We also received the proceeds from the issuance of $150 million

in unsecured tax exempt bonds. In addition, a $300 million revolving credit facility terminated on its maturity date.

For additional information regarding these matters and other liquidity events, see Note 6 of the Notes to the Consolidated Financial Statements.

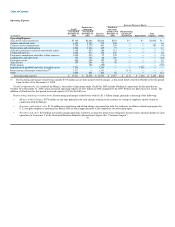

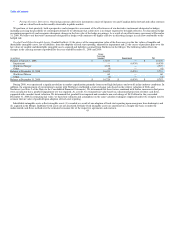

Sources and Uses of Cash

In this section, we review the sources and uses of cash for the years ended December 31, 2009 and 2008 under GAAP. For 2007, we added Delta's sources

and uses of cash for the four months ended April 30, 2007 of the Predecessor with the eight months ended December 31, 2007 of the Successor. We believe

the 2007 Predecessor plus Successor sources and uses of cash provides a more meaningful perspective on Delta's cash flows for 2007 than if we did not

present this information in this manner.

Cash flows from operating activities

Cash provided by operating activities totaled $1.4 billion for 2009, primarily reflecting (1) the return from counterparties of $1.1 billion of hedge margin

primarily used to settle hedge losses recognized during the period and (2) $690 million in net income after adjusting for non-cash items such as depreciation

and amortization. 39