Delta Airlines 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

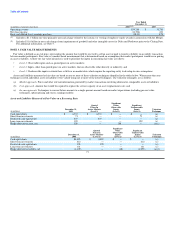

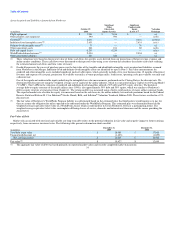

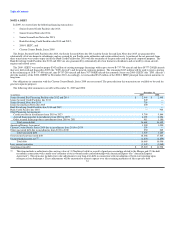

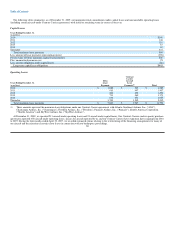

Aircraft Fuel Price Risk

Hedge Position

Our results of operations are materially impacted by changes in aircraft fuel prices. In an effort to manage our exposure to this risk, we periodically enter

into derivative instruments comprised of crude oil, heating oil and jet fuel swap, collar and call option contracts to hedge a portion of our projected aircraft

fuel requirements, including those of our Contract Carriers under capacity purchase agreements. As of December 31, 2009, our open fuel hedge contracts had

an estimated fair value asset position of $179 million, which is recorded in prepaid expenses and other on our Consolidated Balance Sheet. As of

December 31, 2009, we have hedged approximately 20% of our projected fuel consumption for 2010.

In the Merger, we assumed all of Northwest's outstanding fuel hedge contracts. On the Closing Date, we designated certain of Northwest's derivative

instruments, comprised of crude oil collar and swap contracts, as hedges. All Northwest fuel hedge contracts settled as of June 30, 2009.

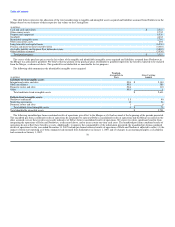

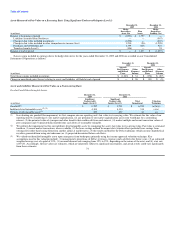

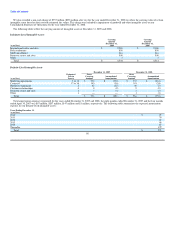

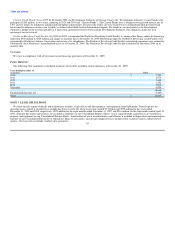

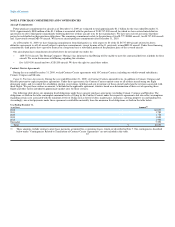

Hedge Gains (Losses)

Gains (losses) recorded on our Consolidated Financial Statements related to our fuel hedge contracts are as follows:

Effective Portion Reclassified from Accumulated Other

Effective Portion Recognized in Other Comprehensive Income (Loss) Comprehensive Loss to Earnings

Successor Predecessor Successor Predecessor

Eight Months Eight Months

Year Ended Ended Four Months Year Ended Ended Four Months

December 31, December 31, Ended April 30, December 31, December 31, Ended April 30,

(in millions) 2009 2008 2007 2007 2009 2008(4) 2007 2007

Designated as hedges

Fuel hedge swaps, collars and call options(1) $ 1,268 $ (1,268) $ 27 $ 69 $ (1,344) $26 $ 59 $ (8)

Interest rate swaps and call options designated as cash flow

hedges(2) 51 (94) — — — — — —

Foreign currency exchange forwards and collars(3) 11 (33) — — (6) — — —

Total designated $ 1,330 $ (1,395) $ 27 $ 69 $ (1,350) $26 $ 59 $ (8)

(1) Gains and losses on fuel hedge contracts reclassified from accumulated other comprehensive loss are recorded in aircraft fuel and related taxes.

(2) Losses on interest rate swaps and call options reclassified from accumulated other comprehensive loss are recorded in interest expense.

(3) Losses on foreign currency exchange contracts reclassified from accumulated other comprehensive loss are recorded in passenger and cargo revenue.

(4) We recorded a mark-to-market adjustment of $91 million related to Northwest derivative contracts settling in 2009 that were not designated as hedges

for the year ended December 31, 2008.

Ineffectiveness gains (losses) recognized on our fuel hedge contracts in other (expense) income on our Consolidated Statements of Operations was

$57 million and $(20) million for the years ended December 31, 2009 and 2008, respectively, $(13) million for the eight months ended December 31, 2007

and $14 million for the four months ended April 30, 2007.

We recorded a loss of $15 million to aircraft fuel and related taxes on our Consolidated Statements of Operations for the year ended December 31, 2009

related to Northwest derivative contracts that were not designated as hedges. As of December 31, 2009, we recorded in other comprehensive loss on our

Consolidated Balance Sheet $15 million of net gains on our hedge contracts scheduled to settle in the next 12 months.

77