Delta Airlines 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

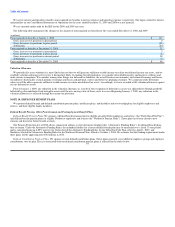

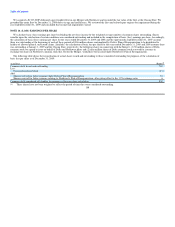

(f) Noncurrent liabilities—other. An adjustment of $1.2 billion primarily related to the tax effect of fresh start valuation adjustments.

(g) Total stockholders' deficit. The adoption of fresh start reporting resulted in a new reporting entity with no beginning retained earnings or

accumulated deficit. All common stock of the Predecessor was eliminated and replaced by the new equity structure of the Successor

based on Delta's Plan of Reorganization. The Fresh Start Consolidated Balance Sheet reflects initial stockholders' equity value of

$9.4 billion, representing the low end in the range of $9.4 billion to $12.0 billion estimated in our financial projections developed in

connection with Delta's Plan of Reorganization. The low end of the range is estimated to reflect market conditions as of the Effective

Date and therefore was used to establish initial stockholders' equity value.

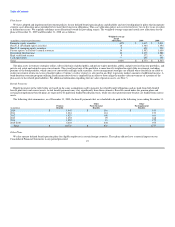

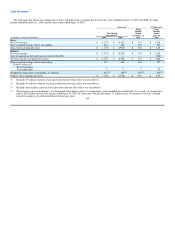

NOTE 12. EQUITY AND EQUITY-BASED COMPENSATION

Equity

Common Stock. On the Effective Date, all common stock issued by the Predecessor was cancelled. We began issuing shares of new common stock at

emergence from bankruptcy pursuant to Delta's Plan of Reorganization. The new common stock is subject to the terms of our Amended and Restated

Certificate of Incorporation (the "New Certificate"), which supersedes the Certificate of Incorporation in effect prior to the Effective Date.

The New Certificate authorizes us to issue a total of 2.0 billion shares of capital stock, of which 1.5 billion may be shares of common stock, par value

$0.0001 per share, and 500 million may be shares of preferred stock. Delta's Plan of Reorganization contemplates the issuance of 400 million shares of

common stock, consisting of 386 million shares to holders of allowed general, unsecured claims and up to 14 million shares to approximately 39,000 non-

contract, non-management employees under the Delta Air Lines, Inc. 2007 Performance Compensation Plan (the "2007 Plan"). Our Plan of Reorganization

also contemplates the issuance of common stock under the 2007 Plan for management employees.

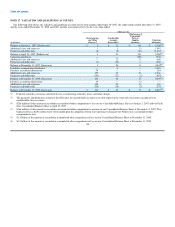

In connection with the Merger, we issued, or expect to issue, a total of 339 million shares of Delta common stock in exchange for the Northwest common

stock outstanding on the Closing Date or issuable under Northwest's Plan of Reorganization. Additionally, in connection with the Merger, we (1) issued

50 million shares of common stock to eligible Delta and Northwest pilots; (2) granted 34 million shares of common stock to substantially all U.S. based non-

pilot employees of Delta and Northwest; and (3) granted 17 million shares of restricted stock and non-qualified stock options to purchase 12 million shares of

common stock to management personnel. The awards to management personnel will fully vest over approximately three years, subject to the participant's

continued employment.

Preferred Stock. The New Certificate permits us to issue preferred stock in one or more series. It authorizes the Board of Directors (1) to fix the

descriptions, powers (including voting powers), preferences, rights, qualifications, limitations and restrictions with respect to any series of preferred stock and

(2) to specify the number of shares of any series of preferred stock. As of December 31, 2009 and 2008, no preferred stock had been issued.

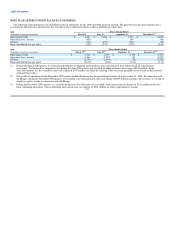

Treasury Stock. We generally withhold shares of Delta common stock to cover employees' portion of required tax withholdings when employee equity

awards are issued or vest. These shares are valued at cost, which equals the market price of the common stock on the date of issuance or vesting. There were

approximately 11 million shares of common stock held in treasury at a weighted average cost of $15.89 per share at December 31, 2009. In December 2008,

we sold from treasury approximately 18 million shares of our common stock that were previously withheld as the employee portion of tax withholdings on the

issuance and vesting of employee equity awards in connection with the Merger. The $192 million of net proceeds from the offering was available for general

corporate purposes. There were approximately eight million shares of common stock held in treasury at a weighted average cost of $20.11 per share at

December 31, 2008. Substantially all of these shares were withheld to cover the employees' portion of required tax withholdings on equity awards.

103