Delta Airlines 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

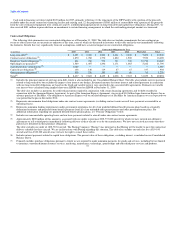

The expected long-term rate of return on the assets of our DB Plans is based primarily on plan-specific investment studies using historical market returns

and volatility data with forward looking estimates based on existing financial market conditions and forecasts. Modest excess return expectations versus some

market indices are incorporated into the return projections based on the actively managed structure of the investment programs and their records of achieving

such returns historically. We review our rate of return on plan asset assumptions annually. These assumptions are largely based on the asset category rate-of-

return assumptions developed annually with our pension investment advisors; however, our annual investment performance for one particular year does not,

by itself, significantly influence our evaluation. The investment strategy for DB Plan assets is to utilize a diversified mix of global public and private equity

portfolios, public and private fixed income portfolios, and private real estate and natural resource investments to earn a long-term investment return that meets

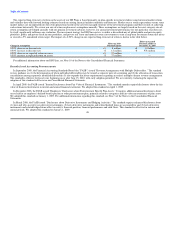

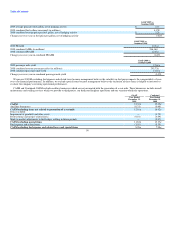

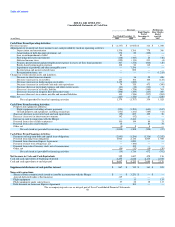

or exceeds a 9% annualized return target. The impact of a 0.50% change in our expected long-term rate of return is shown in the table below.

Effect on Accrued

Effect on 2010 Pension Liability at

Change in Assumption Pension Expense December 31, 2009

0.50% decrease in discount rate +$ 8 million +$ 1.0 billion

0.50% increase in discount rate -$ 12 million -$ 978 million

0.50% decrease in expected return on assets +$ 37 million —

0.50% increase in expected return on assets -$ 37 million —

For additional information about our DB Plans, see Note 10 of the Notes to the Consolidated Financial Statements.

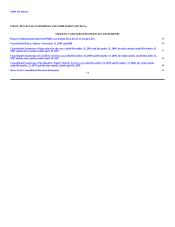

Recently Issued Accounting Pronouncements

In September 2009, the Financial Accounting Standards Board (the "FASB") issued "Revenue Arrangements with Multiple Deliverables." The standard

revises guidance on (1) the determination of when individual deliverables may be treated as separate units of accounting and (2) the allocation of transaction

consideration among separately identified deliverables. It also expands disclosure requirements regarding an entity's multiple element revenue arrangements.

The standard is effective for fiscal years beginning on or after June 15, 2010, with early adoption permitted. We are currently evaluating the impact the

adoption of this standard will have on our Consolidated Financial Statements.

In April 2009, the FASB issued "Interim Disclosures about Fair Value of Financial Instruments." The standard amends required disclosures about the fair

value of financial instruments in interim and annual financial statements. We adopted this standard on April 1, 2009.

In December 2008, the FASB issued "Employers' Disclosures about Postretirement Benefit Plan Assets." It requires additional annual disclosures about

assets held in an employer's defined benefit pension or other postretirement plan, primarily related to categories and fair value measurements of plan assets.

We adopted this standard on January 1, 2009. For additional information regarding this standard, see Note 3 of the Notes to the Consolidated Financial

Statements.

In March 2008, the FASB issued "Disclosures about Derivative Instruments and Hedging Activities." The standard requires enhanced disclosures about

(1) how and why an entity uses derivative instruments, (2) how derivative instruments and related hedged items are accounted for and (3) how derivative

instruments and related hedged items affect an entity's financial position, financial performance and cash flows. This standard is effective for interim and

annual periods. We adopted this standard on January 1, 2009. 48