Delta Airlines 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

• Foreign Currency Derivatives. Our foreign currency derivative instruments consist of Japanese yen and Canadian dollar forward and collar contracts

and are valued based on data readily observable in public markets.

We perform, at least quarterly, both a prospective and retrospective assessment of the effectiveness of our derivative instruments designated as hedges,

including assessing the possibility of counterparty default. If we determine that a derivative is no longer expected to be highly effective, we discontinue hedge

accounting prospectively and recognize subsequent changes in the fair value of the hedge in earnings. As a result of our effectiveness assessment at December

31, 2009, we believe our derivative instruments designated as hedges will continue to be highly effective in offsetting changes in cash flow attributable to the

hedged risk.

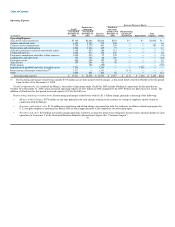

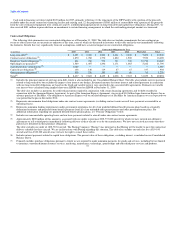

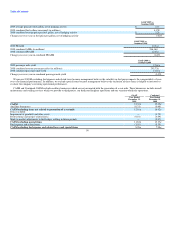

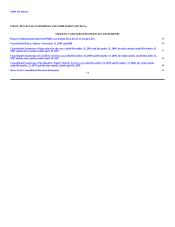

Goodwill and Other Intangible Assets. Goodwill reflects (1) the excess of the reorganization value of the Successor over the fair values of tangible and

identifiable intangible assets, net of liabilities, from the adoption of fresh start reporting, adjusted for impairment and (2) the excess of purchase price over the

fair values of tangible and identifiable intangible assets acquired and liabilities assumed from Northwest in the Merger. The following table reflects the

changes in the carrying amount of goodwill for the years ended December 31, 2008 and 2009:

Gross

Carrying

(in millions) Amount Impairment Net

Balance at January 1, 2008 $ 12,104 $ — $ 12,104

Impairment — (6,939) (6,939)

Northwest Merger 4,572 — 4,572

Other (6) — (6)

Balance at December 31, 2008 16,670 (6,939) 9,731

Northwest Merger 60 — 60

Other (4) — (4)

Balance at December 31, 2009 $ 16,726 $ (6,939) $ 9,787

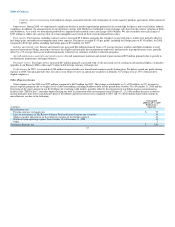

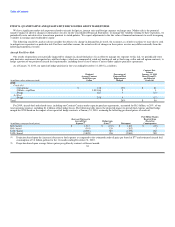

During 2008, we experienced a significant decline in market capitalization primarily from record high fuel prices and overall airline industry conditions. In

addition, the announcement of our intention to merge with Northwest established a stock exchange ratio based on the relative valuation of Delta and

Northwest (see Note 2 of the Notes to the Consolidated Financial Statements). We determined that these factors combined with further increases in fuel prices

were an indicator that a goodwill impairment test was required. As a result, we estimated fair value based on a discounted projection of future cash flows,

supported with a market-based valuation. We determined that goodwill was impaired and recorded a non-cash charge of $6.9 billion for the year ended

December 31, 2008. In estimating fair value, we based our estimates and assumptions on the same valuation techniques employed and levels of inputs used to

estimate the fair value of goodwill upon adoption of fresh start reporting.

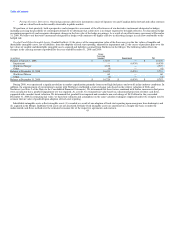

Identifiable intangible assets reflect intangible assets (1) recorded as a result of our adoption of fresh start reporting upon emergence from bankruptcy and

(2) acquired in the Merger. Indefinite-lived assets are not amortized. Definite-lived intangible assets are amortized on a straight-line basis or under the

undiscounted cash flows method over the estimated economic life of the respective agreements and contracts.

45