Delta Airlines 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

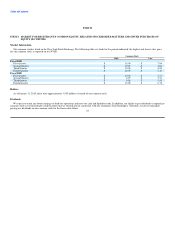

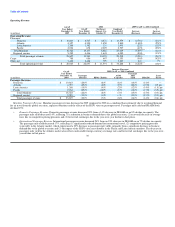

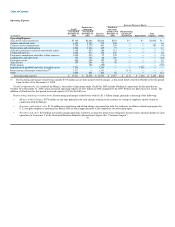

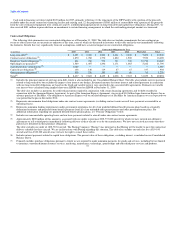

Other (Expense) Income

2008

GAAP

Year Ended GAAP Northwest Combined

December 31, Year Ended January 1 to Year Ended Favorable

(in millions) 2009 December 31 October 29 December 31 (Unfavorable)

Interest expense $ (1,278) $ (705) $ (373) $ (1,078) $ (200)

Interest income 27 92 86 178 (151)

Loss on extinguishment of debt (83) — — — (83)

Miscellaneous, net 77 (114) (230) (344) 421

Total other expense, net $ (1,257) $ (727) $ (517) $ (1,244) $ (13)

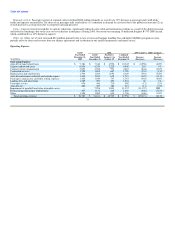

Other expense, net for 2009 was $1.3 billion, compared to $1.2 billion for 2008 on a combined basis. This change is primarily attributable to (1) a

$200 million increase in interest expense from increased amortization of debt discount, (2) a $151 million decrease in interest income primarily from

significantly reduced short-term interest rates, (3) an $83 million non-cash loss for the write-off of the unamortized discount on the extinguishment of the

Northwest senior secured exit financing facility (the "Bank Credit Facility") and (4) a $421 million favorable change in miscellaneous, net due to the

following:

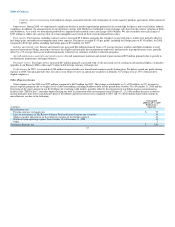

Favorable

(Unfavorable)

2009 GAAP vs.

(in millions) 2008 Combined

Miscellaneous, net

Impairment in 2008 of minority ownership interest in Midwest Air Partners, LLC $ 213

Foreign currency exchange rates 99

Mark-to-market adjustments on the ineffective portion of fuel hedge contracts 77

Loss on investments in The Reserve Primary Fund and insured auction rate securities in 2008 41

Other (9)

Total miscellaneous, net $ 421

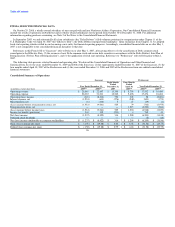

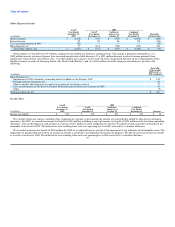

Income Taxes

2008

GAAP

Year Ended GAAP Northwest Combined

December 31, Year Ended January 1 to Year Ended

(in millions) 2009 December 31 October 29 December 31 Increase

Income tax benefit $ 344 $ 119 $ 211 $ 330 $ 14

We consider all income sources, including other comprehensive income, in determining the amount of tax benefit that should be allocated to continuing

operations. For 2009, we recorded an income tax benefit of $344 million, including a non-cash income tax benefit of $321 million on the loss from continuing

operations, with an offsetting non-cash income tax expense of $321 million on other comprehensive income. We did not record an income tax benefit for the

remainder of our loss for 2009. The deferred tax asset resulting from such a net operating loss was fully reserved by a valuation allowance.

We recorded an income tax benefit of $330 million for 2008 on a combined basis as a result of the impairment of our indefinite-lived intangible assets. The

impairment of goodwill did not result in an income tax benefit as goodwill is not deductible for income tax purposes. We did not record an income tax benefit

as a result of our loss for 2008. The deferred tax asset resulting from such a net operating loss is fully reserved by a valuation allowance.

33