Delta Airlines 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We have significant market risk exposure related to aircraft fuel prices, interest rates and foreign currency exchange rates. Market risk is the potential

negative impact of adverse changes in these prices or rates on our Consolidated Financial Statements. To manage the volatility relating to these exposures, we

periodically enter into derivative transactions pursuant to stated policies. We expect adjustments to the fair value of financial instruments to result in ongoing

volatility in earnings and stockholders' equity.

The following sensitivity analyses do not consider the effects of a change in demand for air travel, the economy as a whole or actions we may take to seek

to mitigate our exposure to a particular risk. For these and other reasons, the actual results of changes in these prices or rates may differ materially from the

following hypothetical results.

Aircraft Fuel Price Risk

Our results of operations are materially impacted by changes in aircraft fuel prices. In an effort to manage our exposure to this risk, we periodically enter

into derivative instruments designated as cash flow hedges, which are comprised of crude oil, heating oil and jet fuel swap, collar and call option contracts, to

hedge a portion of our projected aircraft fuel requirements, including those of our Contract Carriers under capacity purchase agreements.

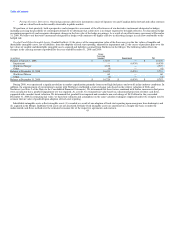

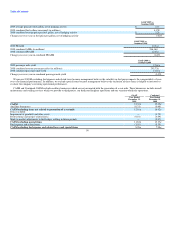

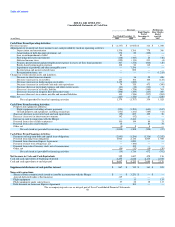

As of January 31, 2010, our open fuel hedge position for the year ending December 31, 2010 is as follows:

Contract Fair

Value at

Weighted Percentage of January 31, 2010

Average Contract Projected Fuel Based Upon $73

Strike Price per Requirements per Barrel of

(in millions, unless otherwise stated) Gallon Hedged Crude Oil

2010

Crude Oil

Call options $ 1.78 12% $ 81

Collars—cap/floor 1.90/1.66 5 1

Swaps 1.87 3 (13)

Jet Fuel

Swaps 2.08 4 (13)

Total 24% $ 56

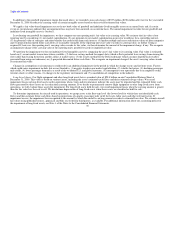

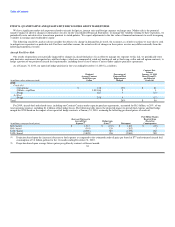

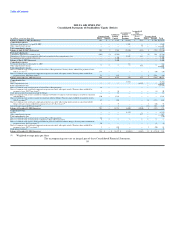

For 2009, aircraft fuel and related taxes, including our Contract Carriers under capacity purchase agreements, accounted for $8.3 billion, or 29%, of our

total operating expense, including $1.4 billion of fuel hedge losses. The following table shows the projected impact to aircraft fuel expense and fuel hedge

margin for 2010 based on the impact of our open fuel hedge contracts at January 31, 2010, assuming the following per barrel prices of crude oil:

Fuel Hedge Margin

(Increase) Decrease to Received from

Aircraft Fuel Hedge Gain (Posted to)

(in millions, except per barrel prices) Expense(1) (Loss)(2) Net impact Counterparties

$60 / barrel $ 1,315 $ (135) $ 1,180 $ (25)

$80 / barrel (391) 129 (262) 2

$100 / barrel (2,098) 519 (1,579) 230

$120 / barrel (3,805) 936 (2,869) 589

(1) Projection based upon the (increase) decrease to fuel expense as compared to the estimated crude oil price per barrel of $77 and estimated aircraft fuel

consumption of 3.6 billion gallons for the 11 months ending December 31, 2010.

(2) Projection based upon average futures prices per gallon by contract settlement month.

52