Delta Airlines 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Clayton County Bonds, Series 2009. In December 2009, the Development Authority of Clayton County (the "Development Authority") issued bonds with

principal of $150 million, in two series, maturing in 2029 and 2035 (the "Clayton Bonds"). The Clayton Bonds have a weighted average fixed interest rate of

8.9% and are subject to mandatory sinking fund redemption requirements. The proceeds of this sale were loaned to us to refund bonds that previously had

been issued to refinance certain of our facilities at Atlanta's Hartsfield-Jackson International Airport. The bonds are secured solely by the Development

Authority's pledge of the revenues payable to it under loan agreements between Delta and the Development Authority. Our obligations under the loan

agreements are not secured.

Northwest Revolving Credit Facility due 2009. In 2009, we amended the Northwest Revolving Credit Facility to, among other things, reduce its borrowing

limit from $500 million to $300 million and change its maturity date to December 30, 2009. Borrowings under the Northwest Revolving Credit Facility were

guaranteed by Northwest Airlines Corporation and certain of its subsidiaries. The Northwest Revolving Credit Facility and related guarantees were secured by

substantially all of Northwest's unencumbered assets as of October 29, 2008. The Northwest Revolving Credit Facility terminated in December 2009 on its

maturity date.

Covenants

We were in compliance with all covenants in our financing agreements at December 31, 2009.

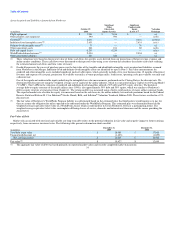

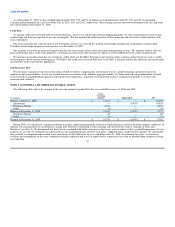

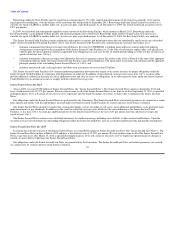

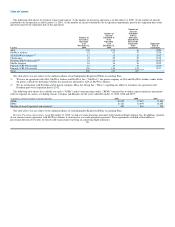

Future Maturities

The following table summarizes scheduled maturities of our debt, including current maturities, at December 31, 2009:

Years Ending December 31,

(in millions) Total

2010 $ 1,709

2011 2,573

2012 3,440

2013 1,382

2014 2,865

Thereafter 6,099

18,068

Unamortized discount, net (1,403)

Total $ 16,665

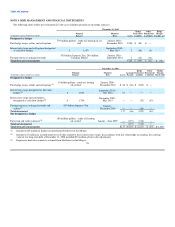

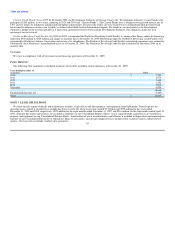

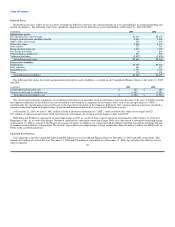

NOTE 7. LEASE OBLIGATIONS

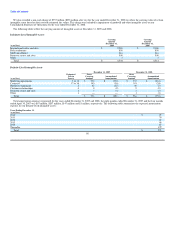

We lease aircraft, airport terminals and maintenance facilities, ticket offices and other property and equipment from third parties. Rental expense for

operating leases, which is recorded on a straight-line basis over the life of the lease term, totaled $1.3 billion and $798 million for the years ended

December 31, 2009 and 2008, respectively, $470 million for the eight months ended December 31, 2007 and $261 million for the four months ended April 30,

2007. Amounts due under capital leases are recorded as liabilities on our Consolidated Balance Sheets. Assets acquired under capital leases are recorded as

property and equipment on our Consolidated Balance Sheets. Amortization of assets recorded under capital leases is included in depreciation and amortization

expense on our Consolidated Statements of Operations. Many of our facility, aircraft and equipment leases include rental escalation clauses and/or renewal

options. Our leases do not include residual value guarantees. 85