Delta Airlines 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

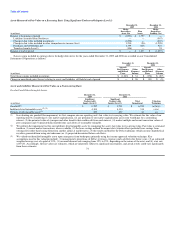

• Foreign Currency Derivatives. Our foreign currency derivative instruments consist of Japanese yen and Canadian dollar forward and collar contracts

and are valued based on data readily observable in public markets.

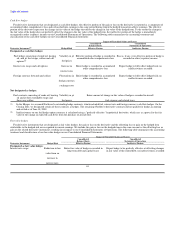

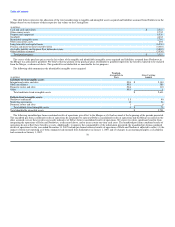

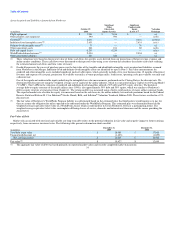

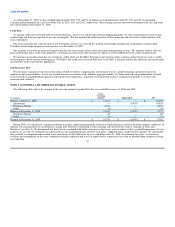

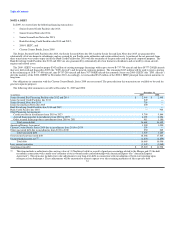

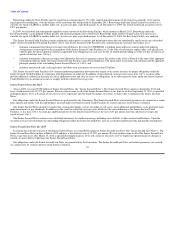

Plan Assets

Significant

Quoted Other Significant

Prices In Observable Unobservable

December 31, Active Markets Inputs Inputs Valuation

(in millions) 2009 (Level 1) (Level 2) (Level 3) Technique

Common stock

U.S. $ 1,661 $ 1,661 $ — $ — (a)

Non-U.S. 842 842 — — (a)

Mutual funds

U.S. 851 2 849 — (a)

Non-U.S. 251 — 251 — (a)

Non-U.S. emerging markets 335 55 280 — (a)

Diversified fixed income 310 — 310 — (a)

High yield 317 — 271 46 (a)(c)

Commingled funds

U.S. 891 — 891 — (a)

Non-U.S. 187 — 187 — (a)

Non-U.S. emerging markets 86 — 86 — (a)

Diversified fixed income 346 — 346 — (a)

High yield 50 — 50 — (a)

Alternative investments

Limited partnerships 1,251 — — 1,251 (a)(c)

Real estate and natural resources 336 — — 336 (a)(c)

Fixed income 389 — 389 — (a)(c)

Cash equivalents and other 649 43 606 — (a)

Total plan assets $ 8,752 $ 2,603 $ 4,516 $ 1,633

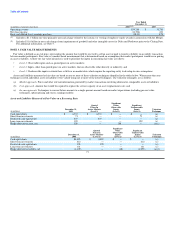

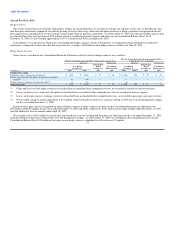

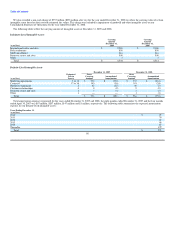

Common Stock. Common stock is valued at the closing price reported on the active market on which the individual securities are traded.

Mutual and Commingled Funds. These funds are valued using the net asset value, which is based on quoted market prices of the underlying assets owned

by the fund minus its liabilities and then divided by the number of shares outstanding.

Alternative Investments. The valuation of alternative investments requires significant judgment due to the absence of quoted market prices, the inherent

lack of liquidity and the long-term nature of such assets; therefore these assets are generally classified in Level 3. Alternative investments include limited

partnerships, real estate, oil and gas and timberland. Investments are valued based upon recommendations of our investment managers. The investment

managers' values are from valuation models where one or more of the significant inputs into the model cannot be observed and which require the development

of relevant assumptions. We also assess the potential for adjustment to the fair value of these investments due to the lag in the availability of data. In these

cases, we solicit preliminary valuation updates at year-end from the investment managers and use that information and corroborating data from public markets

to determine any needed adjustments to fair value.

Fixed Income. Investments include corporate bonds, government bonds, collateralized mortgage obligations, and other asset backed securities. These

investments are generally valued at the bid price or the average of the bid and asked price. Prices are obtained from independent pricing services and are based

on pricing models, quoted prices of securities with similar characteristics, or broker quotes.

Cash Equivalents and Other. These investments primarily consist of short term investment funds, which are valued using the net asset value based on the

value of the underlying assets minus the liabilities and then divided by the number of shares outstanding. Cash is not included in the table above.

73