Delta Airlines 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

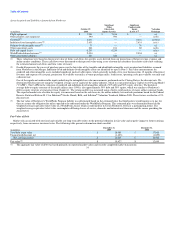

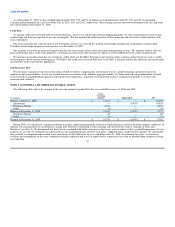

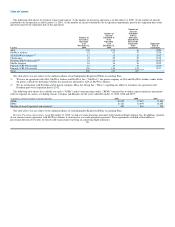

In September 2008, one of our fuel hedge contract counterparties, Lehman Brothers, filed for bankruptcy. As a result, we terminated our fuel hedge

contracts with Lehman Brothers prior to their scheduled settlement dates. Additionally, during the December 2008 quarter, we terminated certain fuel hedge

contracts with other counterparties to reduce our exposure to projected fuel hedge losses due to the decrease in crude oil prices. We recorded an unrealized

loss of $324 million, which represents the effective portion of these terminated contracts at the date of settlement, in accumulated other comprehensive loss on

our Consolidated Balance Sheet. These losses were reclassified in the Consolidated Statements of Operations in accordance with their original contract

settlement dates through December 2009. The ineffective portion of these contracts at the date of settlement resulted in an $11 million charge, which we

recorded to other (expense) income on our Consolidated Statement of Operations for the year ended December 31, 2008.

Prior to the adoption of fresh start reporting, we recorded as a component of stockholders' deficit a $46 million unrealized gain related to our fuel hedging

program. This gain would have been recognized as an offset to aircraft fuel expense and related taxes as the underlying fuel hedge contracts were settled.

However, as required by fresh start reporting, our accumulated stockholders' deficit and accumulated other comprehensive loss were reset to zero.

Accordingly, fresh start reporting adjustments eliminated the unrealized gain and increased aircraft fuel expense and related taxes by $46 million for the eight

months ended December 31, 2007.

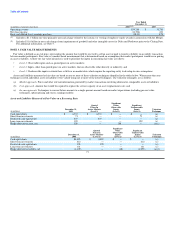

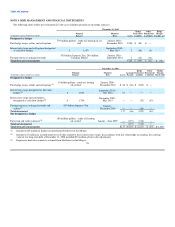

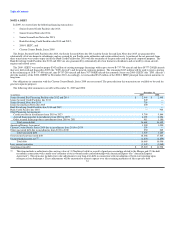

Interest Rate Risk

Our exposure to market risk from adverse changes in interest rates is associated with our long-term debt obligations, cash portfolio, workers' compensation

obligations and pension, postemployment and postretirement benefits. Market risk associated with our fixed and variable rate long-term debt relates to the

potential reduction in fair value and negative impact to future earnings, respectively, from an increase in interest rates.

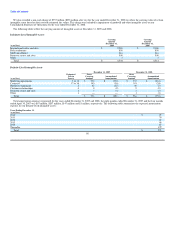

Cash Flow Hedges. In the Merger, we assumed Northwest's outstanding interest rate swap and call option agreements. On the Closing Date, we designated

these derivative instruments as cash flow hedges for purposes of converting our interest rate exposure on a portion of our debt portfolio from a floating rate to

a fixed rate. The floating rates are based on three month LIBOR plus a margin. These interest rate swap and call option agreements had a net fair value loss of

$45 million at December 31, 2009.

Fair Value Hedges. During the June 2008 quarter, we entered into interest rate swap agreements designated as fair value hedges with an aggregate notional

amount of $1.0 billion to convert our interest rate exposure on a portion of our debt portfolio from a fixed rate to a floating rate. These interest rate swap

agreements had a fair value gain of $74 million and a corresponding interest receivable of $17 million, which were recorded in other noncurrent assets and

accounts receivable, respectively, on our Consolidated Balance Sheet at December 31, 2008. In accordance with fair value accounting, the carrying value of

our long-term debt at December 31, 2008 included $74 million of fair value adjustments.

During the June 2009 quarter, we terminated our interest rate swaps designated as fair value hedges, resulting in $65 million in cash proceeds from

counterparties. Due to the fair value gain position of these swaps at the date of termination, we recorded a deferred gain of $44 million. This gain will be

amortized through 2012, the remaining life of the debt, using an effective-interest method and recorded to interest expense. As of December 31, 2009,

$35 million of this gain had yet to be amortized.

Other Matters. Market risk associated with our cash portfolio relates to the potential decline in interest income from a decrease in interest rates. Workers'

compensation obligation risk relates to the potential increase in our future obligations and expenses from a decrease in interest rates used to discount these

obligations. Pension, postemployment and postretirement benefits risk relates to the potential increase in our benefit obligations, funding and expenses from a

decrease in interest rates.

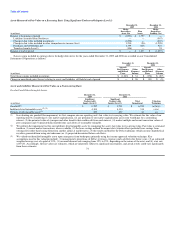

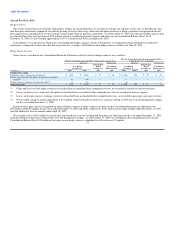

Foreign Currency Exchange Rate Risk

We are subject to foreign currency exchange rate risk because we have revenue and expense denominated in foreign currencies, primarily the Japanese yen

and the Canadian dollar. To manage exchange rate risk, we attempt to execute both our international revenue and expense transactions in the same foreign

currency to the extent practicable. From time to time, we may also enter into foreign currency options and forward contracts.

In the Merger, we assumed Northwest's outstanding foreign currency derivative instruments. On the Closing Date, we designated certain of these

derivative instruments, comprised of Japanese yen forward and collar contracts, as cash flow hedges. All Northwest foreign currency derivative instruments

settled as of December 31, 2009. 78