Delta Airlines 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

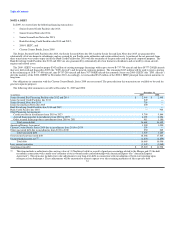

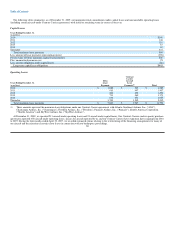

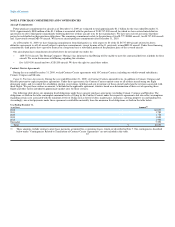

NOTE 6. DEBT

In 2009, we entered into the following financing transactions:

• Senior Secured Credit Facilities due 2013;

• Senior Secured Notes due 2014;

• Senior Second Lien Notes due 2015;

• Bank Revolving Credit Facilities due 2010 and 2012;

• 2009-1 EETC; and

• Clayton County Bonds, Series 2009.

The Senior Secured Credit Facilities due 2013, the Senior Secured Notes due 2014 and the Senior Second Lien Notes due 2015 are guaranteed by

substantially all of our domestic subsidiaries and are secured by our Pacific route authorities and certain related assets. A portion of the net proceeds from

these transactions was used to repay in full the Bank Credit Facility due 2010 with the remainder of the proceeds used for general corporate purposes. The

Bank Revolving Credit Facilities due 2010 and 2012 are also guaranteed by substantially all of our domestic subsidiaries and secured by certain aircraft,

engines and related assets.

The 2009-1 EETC was used to prepay $342 million of existing mortgage financings with respect to two B-737-700 aircraft and three B-777-200LR aircraft

that were delivered and financed in 2009 (the "2009 Aircraft") and for general corporate purposes. The remaining $347 million will be used to repay a portion

of the refinancing of 10 B-737-800 aircraft, nine B-757-200 aircraft and three 767-300ER aircraft that currently secure our 2000-1 EETC (the "2001 Aircraft")

after the maturity of the 2000-1 EETC in November 2010. Accordingly, we reclassified $347 million of the 2000-1 EETC principal from current maturities to

long-term.

Our obligations in connection with the Clayton County Bonds, Series 2009 are not secured. The proceeds from this transaction are available to be used for

general corporate purposes.

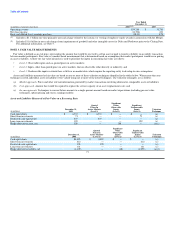

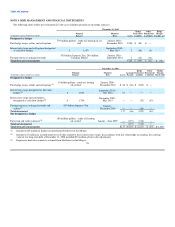

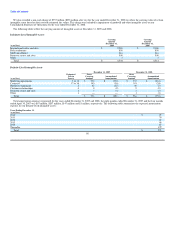

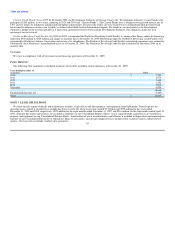

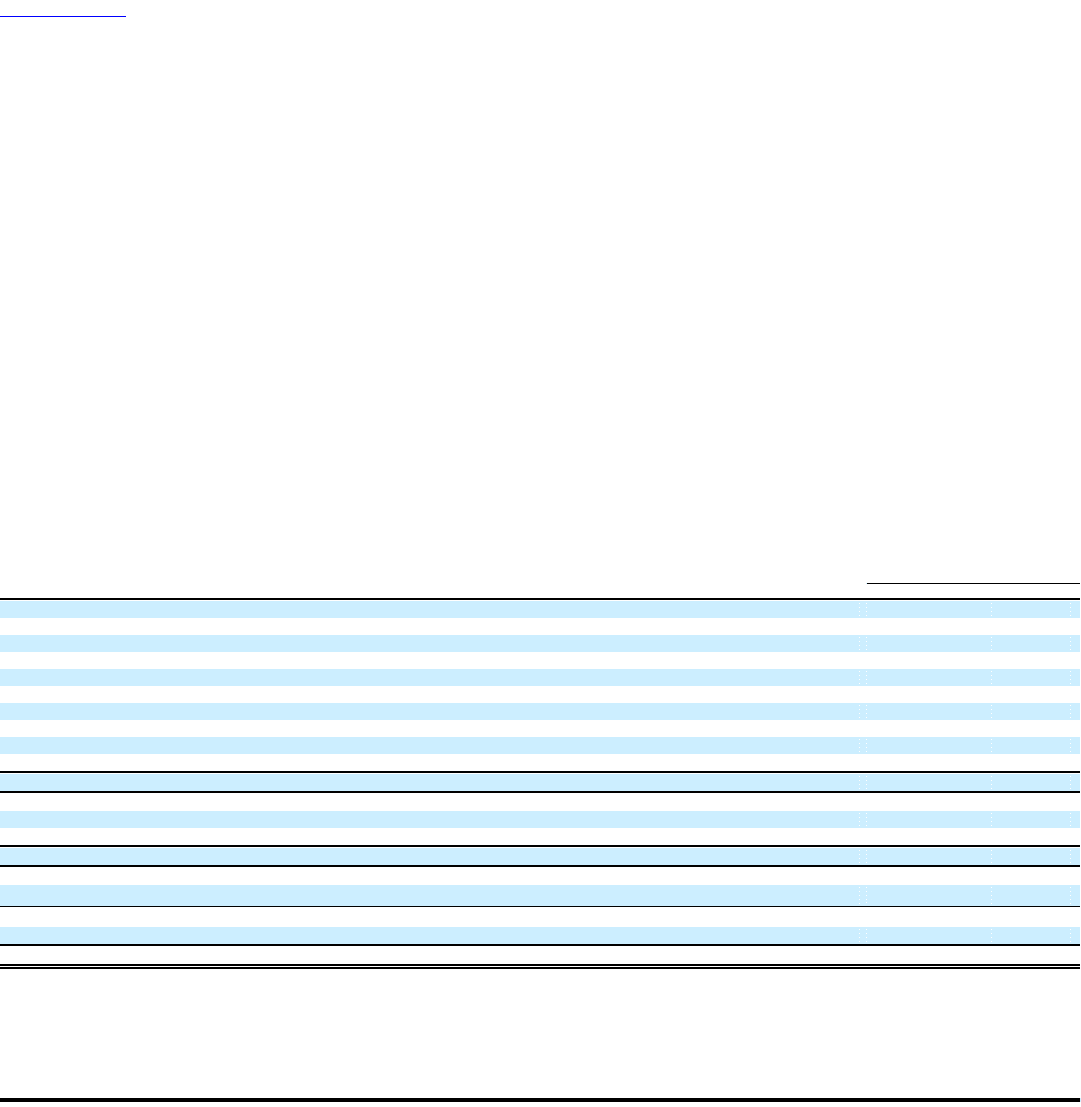

The following table summarizes our debt at December 31, 2009 and 2008:

December 31,

(in millions) 2009 2008

Senior Secured Exit Financing Facilities due 2012 and 2014 $ 2,444 $ 2,448

Senior Secured Credit Facilities due 2013 249 —

Senior Secured Notes due 2014 750 —

Senior Second Lien Notes due 2015 600 —

Bank Revolving Credit Facilities due 2010 and 2012 — —

Bank Credit Facility due 2010 — 904

Other Financing Arrangements

Certificates due in installments from 2010 to 2023 5,709 5,844

Aircraft financings due in installments from 2010 to 2025 6,005 6,224

Other secured financings due in installments from 2010 to 2031 911 1,180

Total secured debt 16,668 16,600

American Express Agreement 1,000 1,000

Clayton County Bonds, Series 2009 due in installments from 2014 to 2035 150 —

Other unsecured debt due in installments from 2010 to 2030 250 265

Total unsecured debt 1,400 1,265

Total secured and unsecured debt 18,068 17,865

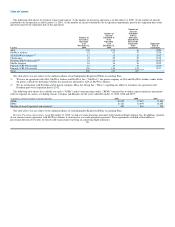

Unamortized discount, net(1) (1,403) (1,859)

Total debt 16,665 16,006

Less: current maturities (1,445) (1,068)

Total long-term debt $ 15,220 $ 14,938

(1) This item includes a reduction in the carrying value of (1) Northwest's debt as a result of purchase accounting related to the Merger and (2) the debt

recorded in connection with a multi-year extension of our co-brand credit card relationship with American Express (the "American Express

Agreement"). This item also includes fair value adjustments to our long-term debt in connection with our adoption of fresh start reporting upon

emergence from bankruptcy. These adjustments will be amortized to interest expense over the remaining maturities of the respective debt.

81