Delta Airlines 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

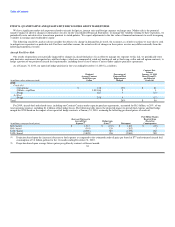

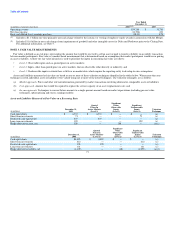

Short-Term Investments

Investments with maturities of less than one year when purchased are classified as short-term investments. At December 31, 2009 and 2008, our short-term

investments were comprised of an investment in The Reserve Primary Fund (the "Primary Fund"), a money market fund that is undergoing an orderly

liquidation. We record these investments as available-for-sale securities at fair value on our Consolidated Balance Sheets. For additional information

regarding the Primary Fund, see Note 3.

Restricted Cash and Cash Equivalents

Restricted cash and cash equivalents, which primarily consist of money market funds and time deposits, included in current assets on our Consolidated

Balance Sheets totaled $423 million and $429 million at December 31, 2009 and 2008, respectively. Restricted cash recorded in other noncurrent assets on

our Consolidated Balance Sheets totaled $16 million and $24 million at December 31, 2009 and 2008, respectively. Restricted cash and cash equivalents are

recorded at cost, which approximates fair value.

At December 31, 2009 and 2008, our restricted cash and cash equivalents primarily related to cash held to meet certain projected self-insurance

obligations.

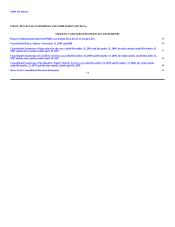

Accounts Receivable

Accounts receivable primarily consist of amounts due from credit card companies, customers of our aircraft maintenance and cargo transportation services

and other airlines associated with frequent flyer programs. We provide an allowance for uncollectible accounts equal to the estimated losses expected to be

incurred based on historical chargebacks, write-offs, bankruptcies and other specific analyses. Bad debt expense and write-offs were not material for the years

ended December 31, 2009 and 2008, the eight months ended December 31, 2007 and the four months ended April 30, 2007.

Derivative Financial Instruments

Our results of operations are significantly impacted by changes in aircraft fuel prices, interest rates and foreign currency exchange rates. In an effort to

manage our exposure to these risks, we periodically enter into derivative instruments, including fuel, interest rate and foreign currency hedges. We recognize

all derivative instruments as either assets or liabilities at fair value on our Consolidated Balance Sheets and recognize certain changes in the fair value of

derivative instruments on our Consolidated Statements of Operations.

We perform, at least quarterly, both a prospective and retrospective assessment of the effectiveness of our derivative instruments designated as hedges,

including assessing the possibility of counterparty default. If we determine that a derivative is no longer expected to be highly effective, we discontinue hedge

accounting prospectively and recognize subsequent changes in the fair value of the hedge in earnings. As a result of our effectiveness assessment at December

31, 2009, we believe our derivative instruments designated as hedges will continue to be highly effective in offsetting changes in cash flow or fair value

attributable to the hedged risk. 62