Delta Airlines 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

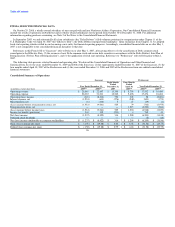

At December 31, 2009, we had $4.7 billion in cash, cash equivalents and short-term investments, and $685 million in undrawn revolving credit facilities.

In 2009, we completed $3.2 billion in financing transactions. For additional information regarding these financing transactions, see Note 6 of the Notes to the

Consolidated Financial Statements.

Business Overview

Recent Initiatives. We believe that our global network, hub structure and alliances with other airlines enables us to offer customers a service which results

in a competitive advantage over other domestic and international airlines. In 2009, we implemented a joint venture with Air France-KLM that further

strengthens our transatlantic network, expanded our alliance agreement with Alaska Airlines and Horizon Air to enhance our West coast presence, and

received U.S. Department of Transportation approval for a codesharing agreement with Virgin Blue, which will expand our network between the U.S. and

Australia and the South Pacific.

Expanding our presence in New York City through increased corporate sales, improved facilities and increased and new service from New York is a key

component of our network strategy. For example, we continue to make investments in our international operation at New York-JFK and explore long-term

options to upgrade the facility. In addition, in August 2009, we announced our intention to make New York's LaGuardia Airport a domestic hub through a slot

transaction with US Airways. The agreement calls for US Airways to transfer 125 operating slot pairs to us at LaGuardia and for us to transfer 42 operating

slot pairs to US Airways at Reagan National Airport in Washington, D.C. We also plan to swap gates at LaGuardia to consolidate all of our operations

(including the Delta Shuttle) into an expanded main terminal facility with 11 additional gates. The U.S. Department of Transportation has issued a tentative

order on the transaction that would require the divestiture of 20 slot pairs at LaGuardia and 14 slot pairs at Reagan National. We and US Airways are

reviewing the tentative order to determine our next steps.

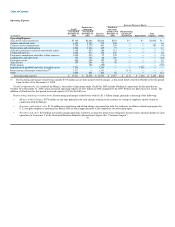

We also plan to invest $1 billion through mid-2013 to improve the customer experience and the efficiency of our aircraft fleet. Planned enhancements

include installing full flat-bed seats in BusinessElite on 90 trans-oceanic aircraft, adding in-seat audio and video throughout Economy Class on 68 widebody

aircraft, adding First Class cabins to 66 CRJ-700 aircraft and installing winglets on more than 170 aircraft to extend aircraft range and increase fuel efficiency.

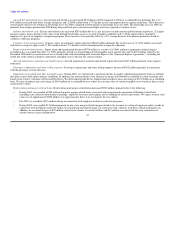

Merger Synergies. As a result of our integration efforts, we achieved more than $700 million in Merger synergy benefits in 2009, and we are targeting an

additional $600 million in Merger synergy benefits in 2010. In 2009, we completed a significant portion of our Merger integration, including combining

frequent flyer programs, consolidating and rebranding all airport facilities and achieving a single operating certificate from the Federal Aviation

Administration. Our ability to fully realize targeted annual synergies of $2 billion by 2012 is dependent on various factors, including the integration of

technologies of the two pre-Merger airlines, which we expect to occur in the first half of 2010. In January 2010, we completed the integration of the

Northwest reservations system, including the transition of Northwest flights and passenger reservations into the Delta system.

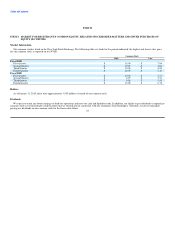

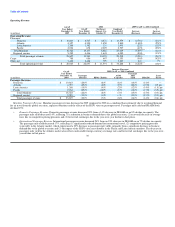

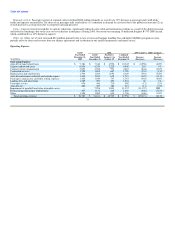

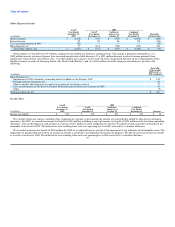

Results of Operations — 2009 GAAP Compared to 2008 Combined

In this section, we compare Delta's results of operations under GAAP for the year ended December 31, 2009 with Delta's results on a combined basis for

the year ended December 31, 2008.

As discussed in "General Information" above, Delta's results of operations for 2008 on a combined basis add (1) Delta's results of operations under GAAP

for 2008, which includes Northwest's results from October 30 to December 31, 2008; and (2) Northwest's results from January 1 to October 29, 2008. We

believe this presentation of the 2008 financial results provides a more meaningful basis for comparing Delta's financial performance in 2009 and 2008.

29