Delta Airlines 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

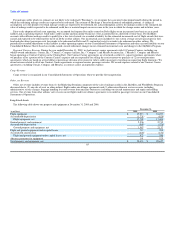

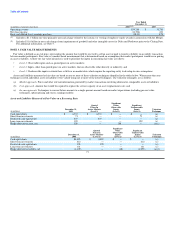

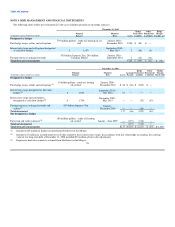

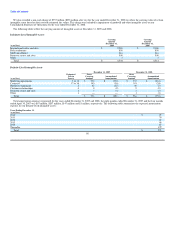

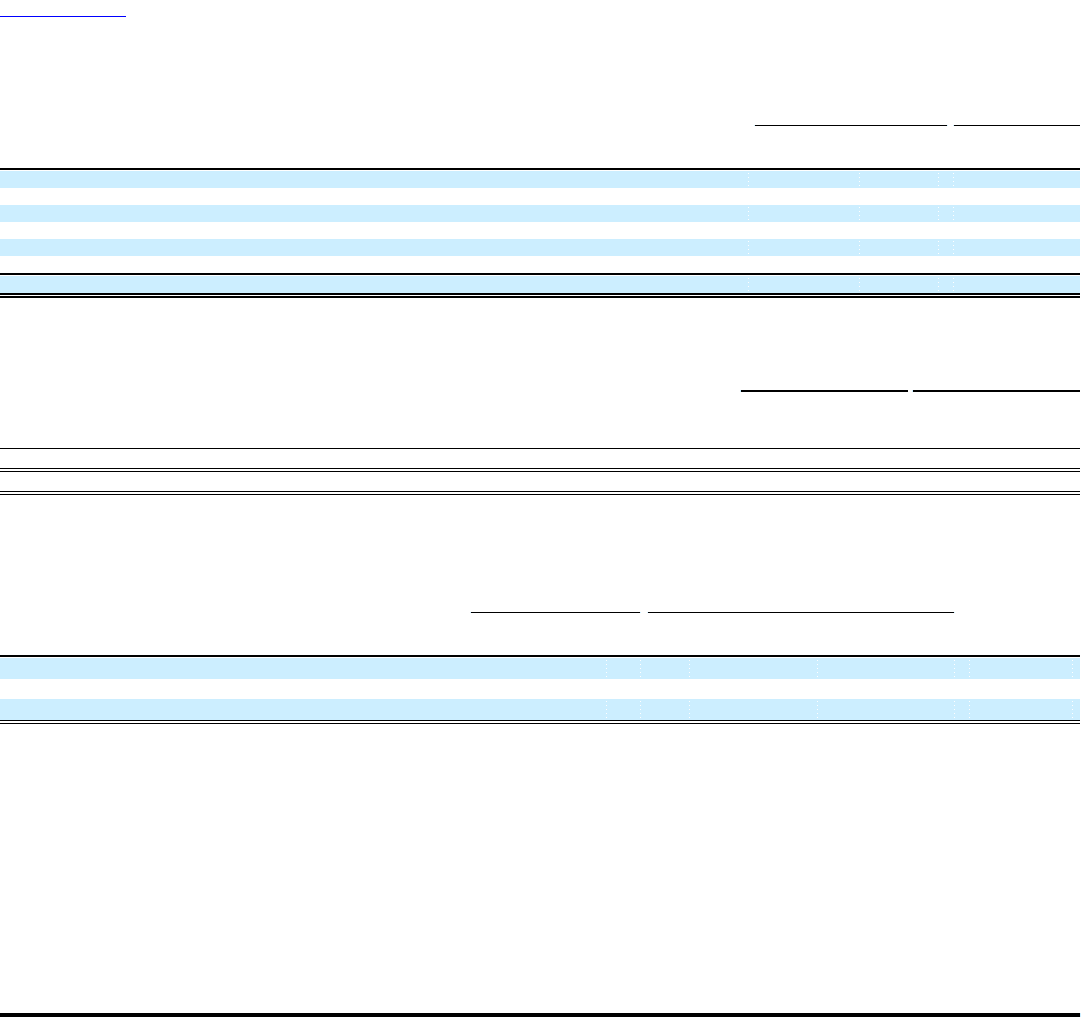

Assets Measured at Fair Value on a Recurring Basis Using Significant Unobservable Inputs (Level 3)

December 31, December 31,

2009 2008

Hedge Hedge

Derivatives Plan Derivatives

(in millions) Asset, Net Assets Liability, Net

Balance at beginning of period $ (1,091) $ 1,797 $ —

Liabilities assumed from Northwest — — (567)

Change in fair value included in earnings (1,232) — (203)

Change in fair value included in other comprehensive income (loss) 1,230 (56) (1,298)

Purchases and settlements, net 1,199 (108) 924

Transfers from/to Level 3 (106) — 53

Balance at end of period $ — $ 1,633 $ (1,091)

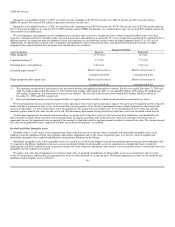

(Losses) gains included in earnings above for hedge derivatives for the years ended December 31, 2009 and 2008 are recorded on our Consolidated

Statements of Operations as follows:

December 31, December 31,

2009 2008

Aircraft Aircraft

Fuel Expense Other Fuel Expense Other

and Related (Expense) and Related (Expense)

(in millions) Taxes Income Taxes Income

Total (losses) gains included in earnings $ (1,263) $ 31 $ (176) $ (27)

Change in unrealized gains (losses) relating to assets and liabilities still held at end of period $ — $ 26 $ (91) $ (5)

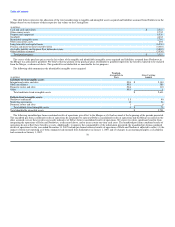

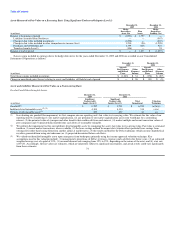

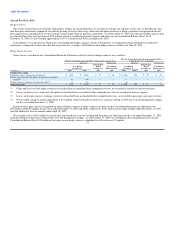

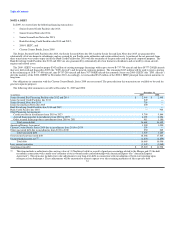

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

Goodwill and Other Intangible Assets

December 31, December 31,

2009 2008

Significant Significant

Unobservable Unobservable Total Valuation

(in millions) Inputs (Level 3) Inputs (Level 3) Impairment Technique

Goodwill(1) $ 9,787 $ 9,731 $ 6,939 (a)(b)(c)

Indefinite-lived intangible assets(2) (3) 4,304 4,314 314 (a)(c)

Definite-lived intangible assets(3) 525 630 43 (c)

(1) In evaluating our goodwill for impairment, we first compare our one reporting unit's fair value to its carrying value. We estimate the fair value of our

reporting unit by considering (1) our market capitalization, (2) any premium to our market capitalization an investor would pay for a controlling

interest, (3) the potential value of synergies and other benefits that could result from such interest, (4) market multiple and recent transaction values of

peer companies and (5) projected discounted future cash flows, if reasonably estimable.

(2) We perform the impairment test for our indefinite-lived intangible assets by comparing the asset's fair value to its carrying value. Fair value is estimated

based on (1) recent market transactions, where available, (2) the lease savings method for airport slots (which reflects potential lease savings from

owning slots rather than leasing them from another airline at market rates), (3) the royalty method for the Delta tradename (which assumes hypothetical

royalties generated from using our tradename) or (4) projected discounted future cash flows.

(3) We valued our identified intangible assets upon emergence from bankruptcy primarily using the income approach valuation technique. Key

assumptions used in this valuation include: (1) management's projections of Delta's revenues, expenses and cash flows for future years; (2) an estimated

weighted average cost of capital of 10%; (3) assumed discount rates ranging from 12% to 15%, depending on the nature of the asset; and (4) a tax rate

of 39.2%. Accordingly, the fair values are estimates, which are inherently subject to significant uncertainties, and actual results could vary significantly

from these estimates. 74