Delta Airlines 2009 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

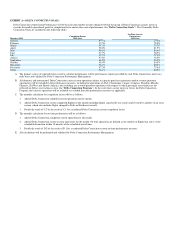

Exhibit 12.1

Delta Air Lines, Inc.

Computation of Ratio of Earnings to Fixed Charges(1)

Successor Predecessor

Eight Months Four

Months

Year Ended Year Ended Ended Ended

December 31, December 31, December 31, April 30, Year Ended December 31,

(in millions, except for ratio data) 2009(2) 2008(3) 2007 2007(4) 2006(5) 2005(6)

(Loss) earnings:

(Loss) earnings before income taxes $ (1,581) $ (9,041) $ 525 $ 1,294 $ (6,968) $ (3,859)

Add (deduct):

Fixed charges from below 1,416 805 432 285 970 1,274

Capitalized interest (12) (23) (8) (3) (8) (9)

(Loss) earnings as adjusted $ (177) $ (8,259) $ 949 $ 1,576 $ (6,006) $ (2,594)

Fixed charges:

Interest expense, including capitalized amounts and amortization of debt costs 1,290 728 398 265 878 1,041

Preference security dividend — — — 2 18

Portion of rental expense representative of the interest factor 126 77 34 20 90 215

Fixed charges $ 1,416 $ 805 $ 432 $ 285 $ 970 $ 1,274

Ratio of earnings to fixed charges(7) (0.13) (10.26) 2.20 5.53 (6.19) (2.04)

(1) References to "Successor" refer to Delta on or after May 1, 2007, after giving effect to (1) the cancellation of Delta common stock issued prior to the

effective date of Delta's emergence from bankruptcy on April 30, 2007; (2) the issuance of new Delta common stock and certain debt securities in

accordance with Delta's Joint Plan of Reorganization; and (3) the application of fresh start reporting. References to "Predecessor" refer to Delta prior to

May 1, 2007.

(2) Includes (a) $407 million in restructuring and merger-related charges associated with (i) integrating the operations of Northwest into Delta, including

costs related to information technology, employee relocation and training, and re-branding of aircraft and stations and (ii) employee workforce

reduction programs and (b) an $83 million non-cash loss for the write-off of the unamortized discount on the extinguishment of the Northwest senior

secured exit financing facility. Additionally, interest expense includes $370 million in net debt discount amortization primarily as a result of adjusting

our debt and capital lease obligations to fair value in purchase accounting upon our merger with Northwest.

(3) Includes a $7.3 billion non-cash charge from an impairment of goodwill and other intangible assets and $1.1 billion in primarily non-cash merger-

related charges relating to the issuance or vesting of employee equity awards in connection with our merger with Northwest.

(4) Includes a $1.2 billion non-cash gain for reorganization items.

(5) Includes a $6.2 billion non-cash charge for reorganization items and a $310 million non-cash charge associated with certain accounting adjustments.

(6) Includes an $888 million charge for restructuring, asset writedowns, pension settlements and related items, net and an $884 million non-cash charge for

reorganization items.

(7) For the years ended December 31, 2009, 2008, 2006 and 2005, earnings were not sufficient to cover fixed charges by $1.6 billion, $9.1 billion,

$7.0 billion and $3.9 billion, respectively.