Delta Airlines 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

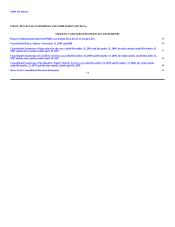

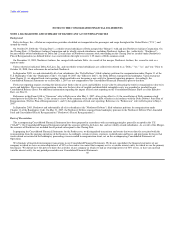

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1. BACKGROUND AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Background

Delta Air Lines, Inc., a Delaware corporation, provides scheduled air transportation for passengers and cargo throughout the United States ("U.S.") and

around the world.

On October 29, 2008 (the "Closing Date"), a wholly-owned subsidiary of Delta merged (the "Merger") with and into Northwest Airlines Corporation. On

the Closing Date, (1) Northwest Airlines Corporation and its wholly-owned subsidiaries, including Northwest Airlines, Inc. (collectively, "Northwest"),

became wholly-owned subsidiaries of Delta and (2) each share of Northwest common stock outstanding on the Closing Date or issuable under Northwest's

Plan of Reorganization (as defined below) was converted into the right to receive 1.25 shares of Delta common stock.

On December 31, 2009, Northwest Airlines, Inc. merged with and into Delta. As a result of this merger, Northwest Airlines, Inc. ceased to exist as a

separate entity.

Unless otherwise indicated, Delta Air Lines, Inc. and our wholly-owned subsidiaries are collectively referred to as "Delta," "we," "us," and "our." Prior to

October 30, 2008, these references do not include Northwest.

In September 2005, we and substantially all of our subsidiaries (the "Delta Debtors") filed voluntary petitions for reorganization under Chapter 11 of the

U.S. Bankruptcy Code (the "Bankruptcy Code"). On April 30, 2007 (the "Effective Date"), the Delta Debtors emerged from bankruptcy. Upon emergence

from Chapter 11, we adopted fresh start reporting, which resulted in our becoming a new entity for financial reporting purposes. Accordingly, the

Consolidated Financial Statements on or after May 1, 2007 are not comparable to the Consolidated Financial Statements prior to that date.

Fresh start reporting requires resetting the historical net book value of assets and liabilities to fair value by allocating the entity's reorganization value to its

assets and liabilities. The excess reorganization value over the fair value of tangible and identifiable intangible assets was recorded as goodwill on our

Consolidated Balance Sheet. For additional information regarding the impact of fresh start reporting on the Consolidated Balance Sheet as of the Effective

Date, see Note 11.

References in this Form 10-K to "Successor" refer to Delta on or after May 1, 2007, after giving effect to (1) the cancellation of Delta common stock

issued prior to the Effective Date, (2) the issuance of new Delta common stock and certain debt securities in accordance with the Delta Debtors' Joint Plan of

Reorganization ("Delta's Plan of Reorganization"), and (3) the application of fresh start reporting. References to "Predecessor" refer to Delta prior to May 1,

2007.

In September 2005, Northwest and substantially all of its subsidiaries (the "Northwest Debtors") filed voluntary petitions for reorganization under

Chapter 11 of the Bankruptcy Code. On May 31, 2007, the Northwest Debtors emerged from bankruptcy pursuant to the Northwest Debtors' First Amended

Joint and Consolidated Plan of Reorganization ("Northwest's Plan of Reorganization").

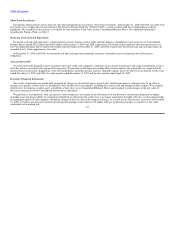

Basis of Presentation

The accompanying Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the U.S.

("GAAP"). Our Consolidated Financial Statements include the accounts of Delta Air Lines, Inc. and our wholly-owned subsidiaries. As a result of the Merger,

the accounts of Northwest are included for all periods subsequent to the Closing Date.

In preparing the Consolidated Financial Statements for the Predecessor, we distinguished transactions and events that were directly associated with the

reorganization from the ongoing operations of the business. Accordingly, certain revenues, expenses, realized gains and losses and provisions for losses that

were realized or incurred in the bankruptcy proceedings were recorded in reorganization items, net on the accompanying Consolidated Statements of

Operations.

We eliminate all material intercompany transactions in our Consolidated Financial Statements. We do not consolidate the financial statements of any

company in which we have an ownership interest of 50% or less unless we control that company or it is a variable interest entity for which we are the primary

beneficiary. We did not have the power to direct the activities of any company in which we had an ownership interest of 50% or less, or have any material

variable interest entity, for any period presented in our Consolidated Financial Statements.

60