Delta Airlines 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Other

We have certain contracts for goods and services that require us to pay a penalty, acquire inventory specific to us or purchase contract specific equipment,

as defined by each respective contract, if we terminate the contract without cause prior to its expiration date. Because these obligations are contingent on our

termination of the contract without cause prior to its expiration date, no obligation would exist unless such a termination occurs.

NOTE 9. INCOME TAXES

Income Tax (Benefit) Provision

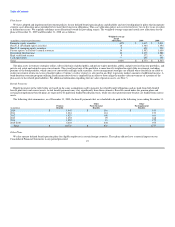

We consider all income sources, including other comprehensive income, in determining the amount of tax benefit allocated to continuing operations (the

"Income Tax Allocation"). Accordingly, for the year ended December 31, 2009, we recorded an income tax benefit of $344 million, including a non-cash

income tax benefit of $321 million on the loss from continuing operations, with an offsetting non-cash income tax expense of $321 million on other

comprehensive income. Our overall tax provision is not impacted by this tax allocation.

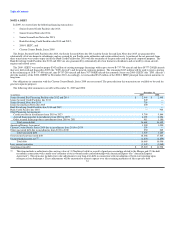

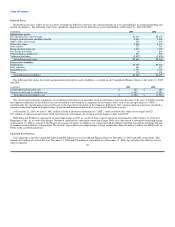

Our income tax benefit (provision) for the years ended December 31, 2009 and 2008, the eight months ended December 31, 2007 and the four months

ended April 30, 2007 consisted of:

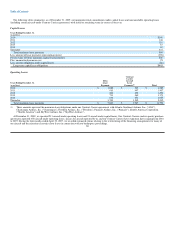

Successor Predecessor

Eight Months Four Months

Year Ended Ended Ended

December 31, December 31, April 30,

(in millions) 2009 2008 2007 2007

Current tax benefit $ 15 $ — $ — $ —

Deferred tax benefit (provision) exclusive of the other components listed below 850 866 (211) (505)

(Increase) decrease in valuation allowance (521) (747) — 509

Income tax benefit (provision) $ 344 $ 119 $ (211) $ 4

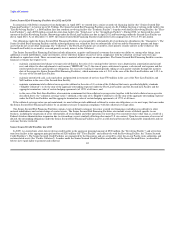

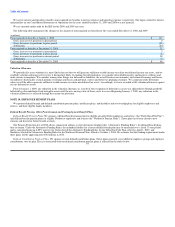

The following table presents the principal reasons for the difference between the effective tax rate and the U.S. federal statutory income tax rate for the

years ended December 31, 2009 and 2008, the eight months ended December 31, 2007 and the four months ended April 30, 2007:

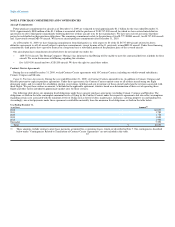

Successor Predecessor

Eight Months Four Months

Year Ended Ended Ended

December 31, December 31, April 30,

2009 2008 2007 2007

U.S. federal statutory income tax rate (35.0)% (35.0)% 35.0% 35.0%

State taxes, net of federal income tax effect (1.8) (0.6) 3.7 3.6

Increase (decrease) in valuation allowance(1) 32.9 8.3 — (39.3)

Income Tax Allocation (20.2) — — —

Goodwill impairment — 26.8 — —

Other, net 2.4 (0.8) 1.5 0.4

Effective income tax rate (21.7)% (1.3)% 40.2% (0.3)%

(1) For the four months ended April 30, 2007, the decrease in the valuation allowance reflects fresh start reporting adjustments.

91