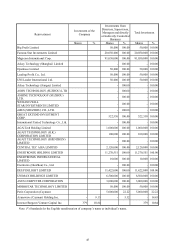

Asus 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

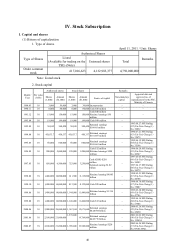

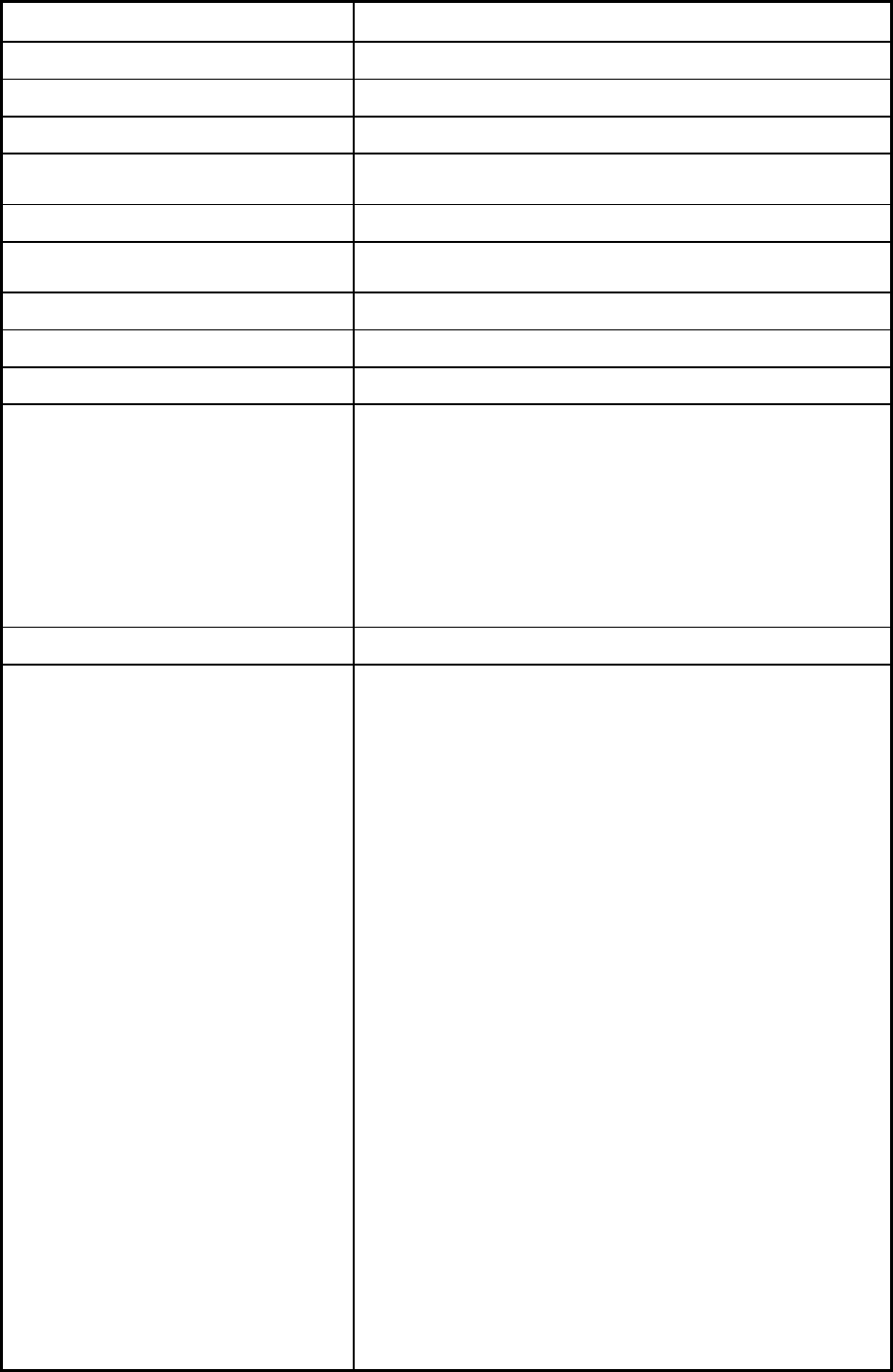

53

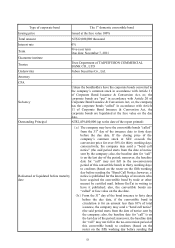

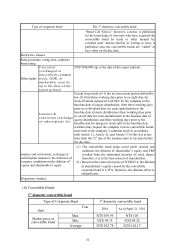

Type of corporate bond The 1st domestic convertible bond

Issuing price Issued at the face value 100%

Total amount NT$12,000,000 thousand

Interest rate 0%

Term Five-year term

Due date: November 7, 2011

Guarantee institute -

Trustee Trust Department of TAIPEIFUBON COMMERCIAL

BANK CO., LTD

Underwriter Fubon Securities Co., Ltd.

Attorney -

CPA -

Solvency

Unless the bondholders have the corporate bonds converted to

the company’s common stock in accordance with Article 11

of Corporate Bond Issuance & Conversion Act, or, the

corporate bonds are “put” in accordance with Article 20 o

f

Corporate Bond Issuance & Conversion Act, or, the company

has the corporate bonds “called” in accordance with Article

11 of Corporate Bond Issuance & Conversion Act, the

corporate bonds are liquidated at the face value on the due

date.

Outstanding Principal NT$2,459,400,000 (up to the date of the report printed)

Redeemed or liquidated before maturity

date

(a)The company may have the convertible bonds “called”

from the 31st day of the issuance date to forty days

b

efore the due date. If the closing price of the

company’s common stock at SEC exceeds the

conversion price for over 50% for thirty working days

consecutively, the company may send a “

b

ond call

notice” (the said period starts from the date of notice

sent by the company; also, the baseline date for “call”

is on the last day of the period; moreover, the baseline

date for “call” may not fall in the no-conversion

period of this convertible bond) in thirty working days

to creditors (based on the roster on the fifth working

day before sending the “Bond Call Notice; however, a

notice is published for the knowledge of investors who

have acquired the convertible bond by trade or other

means) by certified mail. Inform GreTai in writing to

have it published; also, the convertible bonds are

“called” at face value on the due date.

(b)From the 31st day of the bond issuance to forty days

before the due date, if the convertible bond in

circulation is for an amount less than 10% of total

issuance, the company may send a “bond call notice”

(the said period starts from the date of notice sent by

the company; also, the baseline date for “call” is on

the last day of the period; moreover, the baseline date

for “call” may not fall in the no-conversion period o

f

this convertible bond) to creditors (based on the

roster on the fifth working day before sending the