Asus 2010 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127

5

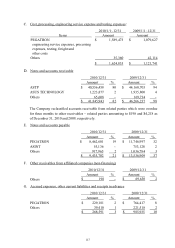

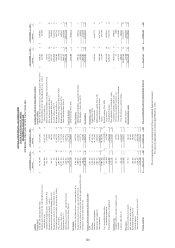

ASUSTek COMPUTER INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

FOR THE YEARS ENDED DECEMBER 31, 2010 AND 2009

(EXPRESSED IN THOUSANDS OF NEW TAIWAN DOLLARS, EXCEPT EARNINGS PER SHARE DATA)

For the years ended December 31

2010 2009

Amount %Amount %

Net sales

revenue (Note 5) $ 429,802,853 100 $ 610,120,403 100

Cost of goods sold

(Notes 4(7), (24) and 5) ( 373,295,560)( 87)( 548,105,350)( 90)

Gross profit

56,507,293 13 62,015,053 10

Operating expenses

(Notes 4(24) and 5)

Selling ( 23,216,036) ( 5) ( 21,306,349) ( 3)

General and administrative ( 6,224,202) ( 1) ( 10,106,984) ( 2)

Research and development (8,418,881)(2)( 14,867,522)(2)

Total operating expenses ( 37,859,119)(8)( 46,280,855)(7)

Operating income

18,648,174 515,734,198 3

Non

-operating income and gains

Interest income 245,222 -286,044 -

Investment income accounted for under the equity method

(Note 4(18))

1,110,159 -332,956 -

Dividends 362,148 -255,108 -

Gain on disposal of investments 540,364 -814,876 -

Gain on valuation of financial assets, net (Note 4(2)) 1,373,218 1 1,339,020 -

Gain on valuation of financial liabilities, net (Notes 4(2) and (15)) - - 192,867 -

Others 1,365,478 -3,476,936 1

Total non-operating income 4,996,589 16,697,807 1

Non

-operating expenses

Interest expense (Note 4(15)) ( 207,620) - ( 334,067) -

Foreign currency exchange loss, net ( 820,950) ( 1) (822,737) -

Impairment loss (Notes 4(3),(4),(10) and (12)) ( 239,361) - ( 958,461) -

Loss on valuation of financial liabilities, net (Note 4(2)) ( 324,249) - - -

Others ( 626,849) - ( 1,020,580) ( 1)

Total non-operating expenses ( 2,219,029)(1)( 3,135,845) ( 1)

Income before income tax

21,425,734 519,296,160 3

Income tax expense (Note 4(22))

(3,386,131)(1)( 3,040,625) -

Consolidated net income

$18,039,603 4$ 16,255,535 3

Attributable to:

Parent company’s shareholders $ 16,488,357 4$12,479,066 2

Minority interest 1,551,246 -3,776,469 1

$ 18,039,603 4$ 16,255,535 3

Before Tax

After Tax

Before Tax

After Tax

Basic earnings per share

(In dollars) (Note 4(23))

Net income

$

8.85

$

7.72

$ 3.02

$

2.94

Diluted earnings per share (In dollars)

Net income

$ 8.67

$

7.56

$ 2.95

$

2.87

Supplementary disclosures for spin-off and capital reduction:

Outstanding shares before the spin-off and capital reduction on June 1, 2010 were

4,246,777,000 shares; outstanding shares after the capital reduction were 637,017,000 shares.

The weighted-average number of shares outstanding for earnings per share calculation is

2,137,012,000 shares.

The accompanying notes are an integral part of these consolidated financial statements.

See report of independent accountants dated March 12, 2011.