Asus 2010 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211

|

|

185

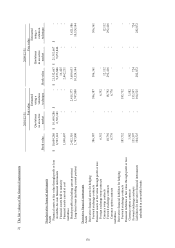

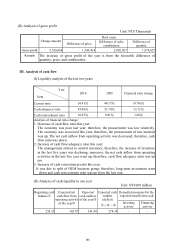

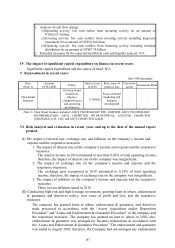

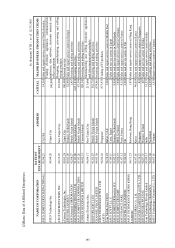

Item 2010 2009 Amount change Ratio change (%)

(Minus) add: Realized

(unrealized) gross profit of the

affiliates

(89,344) (906,321) 816,977 (90.14)

Realized gross profit 17,402,516 11,059,471 6,343,045 57.35

Operating expense (8,066,169) (7,513,776) (552,393) 7.35

Operating income 9,336,347 3,545,695 5,790,652 163.32

Non-operating income and gain

Interest income 91,168 71,798 19,370 26.98

Investment income (Equity

Method) 8,541,113 7,572,667 968,446 12.79

Dividend income 338,950 235,002 103,948 44.23

Gain from exchange - 823,503 (823,503) (100.00)

Gain from financial asset

valuation 466,044 143,601 322,443 224.54

Gain from financial liability

valuation - 192,378 (192,378) (100.00)

Other income 794,371 725,316 69,055 9.52

Total non-operating income

and gain 10,231,646 9,764,265 467,381 4.79

Non-operating expense and loss

Interest expense 81,045 101,497 (20,452) (20.15)

Foreign currency exchange

gain, loss 400,516 - 400,516 100.00

Impairment loss 7,842 301,617 (293,775) (97.40)

Gain on valuation of

financial liabilities, loss 44,971 - 44,971 100,00

Other loss 124,749 86,076 38,673 44.93

Total Non-operating

expense and loss 659,123 489,190 169,933 34.74

Net income before tax 18,908,870 12,820,770 6,088,100 47.49

Minus: Estimated income tax (2,420,513) (341,704) (2,078,809) 608.37

Net income $16,488,357 $12,479,066 4,009,291 32.13

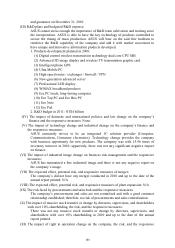

Analysis of financial ratio change:

1. Operating income and operating cost: It was due to the economic recovery of the year with growing

demand of the emerging markets; therefore, sales revenue went up.

2. Operating expense: Expenses went up due to the increase of sales revenue this year.

3. Non-operating income and gain: Investment earnings with equity method had gone up from the year

before.

4. Estimated income tax expense: The higher tax expense this year was due to the increase of taxable

income this year.