Asus 2010 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

148

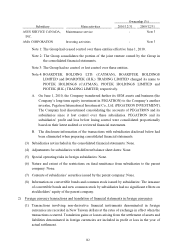

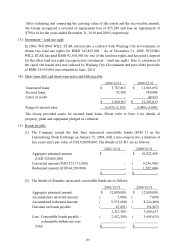

B. Convertible bonds bearing a clause on conversion price adjustment based on stock

market price do not include the equity component. For the liability components, the

fair value of the conversion right and call/put option is determined first, and then the

book value of main debt component is determined based on the net amount of the

issuance price after deducting the fair value of the call/put option and conversion

right with a clause on price adjustment.

C. Convertible bonds are subsequently measured at amortized cost. Derivatives with

call/put options and conversion rights with a clause on price adjustment are

recognized as “financial liabilities at fair value through profit or loss” and are

subsequently measured at fair value. Movements in the fair value of the derivatives

are recognized as “gain/(loss) on valuation of financial liabilities”.

D. If the bondholder exercises the right to convert the bonds ahead of the maturity date

of the bond, the book value of the liability component is adjusted to the value on the

conversion date, which serves as the basis for the recording of the issuance of

common stock so that no conversion gain and loss is recognized thereon.

E. If the bondholder is eligible to exercise the put option within one year, the bonds

payable are reclassified as current liability. When the put option expires, those bonds

payable are reclassified as long-term liability if the liability meets the definition of

long-term liability.

14) Accrued product warranty liability

When the sales of the products attached with a warranty clause are recognized, warranty

liabilities are accrued and current expense are recorded according to historical return rates and

repair costs, failure rates and warranty periods.

15) Pension

(1) Under the defined benefit pension plan, net periodic pension costs are recognized in

accordance with the actuarial calculations. Net periodic pension costs include service cost,

interest cost, expected return on plan assets, and amortization of unrecognized net

transition obligation and gains or losses on plan assets. Unrecognized net transition

obligation is amortized on a straight-line basis over the employees’ remaining service

period.

(2) Under the defined contribution pension plan, net periodic pension costs are recognized as

incurred.

16) Income tax

(1) Income tax is calculated on the basis of accounting income. The differences between the

tax bases and the book values of assets and liabilities are recorded as deferred tax using

the enacted tax rates for the periods in which the deferred tax is expected to be reversed.

The tax effects from taxable temporary differences are recognized as deferred tax

liabilities, while the deductible temporary differences and investment tax credits are

accounted for as deferred tax assets, which are assessed for a valuation allowance based

on further realization.