Asus 2010 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211

|

|

162

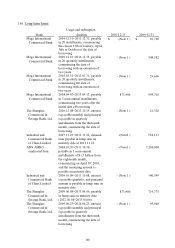

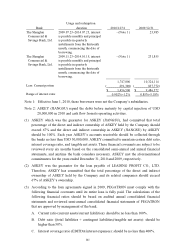

D. Tangible net assets (stockholders equity (including minority interset) – intangible

assets): should be no less than $90,000,000.

(4) The Group provided assets for secured bank loans. Please refer to Note 6 for details of

property, plant and equipment pledged as collateral.

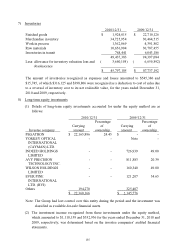

17) Pension

(1) Because of the spin-off, except for a few foreign employees, the Company had settled its

financial obligation to employees under the pension plan accounted for based on SFAS

No. 18 as of December 31, 2007. Thereafter, the Company is subject to the Labor

Pension Act.

(2) The Company obtained permission from the Labor Affairs Bureau, Taipei, to suspend the

appropriation of pension funds for those foreign employees subject to the Labor

Standards Laws in 2010.

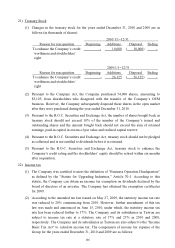

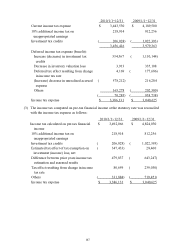

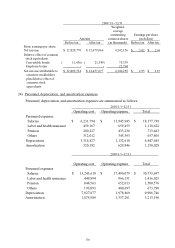

(3) The pension cost for the years ended December 31, 2010 and 2009, consisted of the

following:

2010/1/1~2010/12/31 2009/1/1~2009/12/31

Net pension cost

Defined benefit pension plan $ 5,029 $ 9,923

Defined contribution pension plan $ 708,434 $ ,1,490,923

(including annuity)

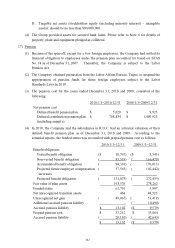

(4) In 2010, the Company and the subsidiaries in R.O.C. had an actuarial valuation of their

defined benefit pension plan as of December 31, 2010 and 2009. According to the

actuarial reports, the funded status was reconciled with prepaid pension cost as follows:

2010/1/1~12/31 2009/1/1~12/31

Benefit obligation:

Vested benefit obligation ($ 10,791) ($ 3,543)

Non-vested benefit obligation ( 83,519) ( 166,470)

Accumulated benefit obligation ( 94,310) ( 170,013)

Projected future employee compensation

increases

( 37,565) ( 102,442)

Projected benefit obligation ( 131,875) ( 272,455)

Fair value of plan assets 193,576 278,262

Funded status 61,701 5,807

Net unrecognized transition assets 468 48,523

Unrecognized net gain ( 49,067) ( 53,419)

Additional accrued pension liability - ( 10,490)

Accrued pension liability $13,102 ($ 9,579)

Prepaid pension cost $ 33,212 $ 33,064

Accrued pension liability ( 20,110) ( 42,643)

$ 13,102 ($ 9,579)