Asus 2010 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2010 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

179

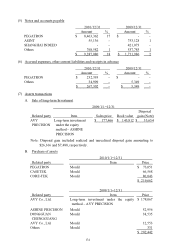

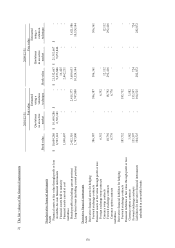

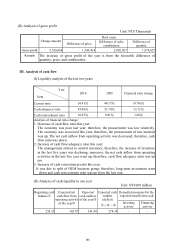

The methods and assumptions used to estimate the fair values of the above financial

instruments are summarized below:

(1) The above financial instruments exclude cash and cash equivalents, accounts/notes

receivable, other receivables, refundable deposits, accounts/notes payable, accrued

expenses, other current liabilities and guarantee deposits received. For such financial

instruments, the fair values were determined based on their carrying values because of the

short maturities of the instruments.

(2) Financial assets at fair value through profit or loss and available-for-sale financial

instruments are regarded as quoted in an active market if quoted prices are readily and

regularly available from an exchange, dealer, broker, industry group, pricing service or

regulatory agency, and those prices represent actual and regularly occurring market

transactions on an arm’s length basis. If the market for a financial instrument is not active,

an entity establishes fair value by using a valuation technique.

(3) The fair value of convertible bonds payable is not available, and a valuation technique is

used. The assumptions used in the said valuation are the same as those used by financial

market traders when quoting their prices. However, the fair value is not expected to

equal future cash outflow.

(4) The fair values of derivative financial instruments which include unrealized gain or loss

on unsettled contracts were determined based on the amounts to be received or paid

assuming that the contracts were settled as of the reporting date.

(5) Financial assets carried at cost and held to maturity are invested in unquoted equity

instruments and mutual fund bond obligations that cannot estimate its fair value in

practice.

(6) The fair value of long-term loans was estimated by the discounted value of expected cash

flow. The discount rate used was based on the interest rate of long-term loans with similar

conditions. Based on the results of the evaluation, the fair value is close to book value.

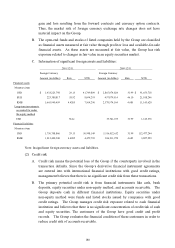

3) Procedure of financial risk control

The Group adopted a comprehensive risk management and control system to identify all

market risks. Therefore, the management can effectively control significant market risks after

appropriately taking into consideration the economic environment, competition, and changes

of market value risk.

4) Information of material financial risk

(1) Market risk

A. The main currency for purchases and sales of the Group is the US dollar. The Group

uses the principle of natural hedge to mitigate the risk and utilizes spot or forward

contracts and currency option contracts to hedge foreign currency risk. The forward

and currency option contracts’ duration corresponds to the Group’s foreign currency

assets’ and liabilities’ due date and future cash flows. The exchange gains and losses

resulting from foreign currency assets and liabilities will be offset by the exchange